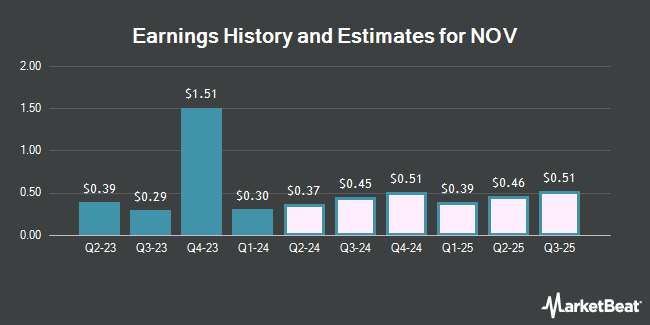

NOV Inc. (NYSE:NOV - Free Report) - Analysts at Zacks Research dropped their Q1 2025 earnings estimates for NOV in a report issued on Thursday, April 3rd. Zacks Research analyst R. Department now expects that the oil and gas exploration company will earn $0.25 per share for the quarter, down from their prior forecast of $0.27. The consensus estimate for NOV's current full-year earnings is $1.40 per share. Zacks Research also issued estimates for NOV's Q1 2025 earnings at $0.25 EPS, Q2 2025 earnings at $0.32 EPS, Q2 2025 earnings at $0.32 EPS, Q3 2025 earnings at $0.35 EPS, Q3 2025 earnings at $0.35 EPS, Q4 2025 earnings at $0.41 EPS, Q4 2025 earnings at $0.41 EPS, FY2025 earnings at $1.33 EPS, FY2025 earnings at $1.33 EPS, Q1 2026 earnings at $0.27 EPS, Q1 2026 earnings at $0.27 EPS, Q1 2027 earnings at $0.48 EPS, Q1 2027 earnings at $0.48 EPS and FY2027 earnings at $1.82 EPS.

Other equities research analysts have also issued reports about the company. Seaport Res Ptn lowered NOV from a "strong-buy" rating to a "hold" rating in a research note on Sunday, January 5th. Royal Bank of Canada raised shares of NOV from a "sector perform" rating to an "outperform" rating and set a $22.00 price target on the stock in a report on Monday, March 24th. Evercore ISI reissued an "in-line" rating and issued a $18.00 price objective (down from $25.00) on shares of NOV in a research note on Wednesday, January 15th. ATB Capital restated a "sector perform" rating and set a $19.00 target price on shares of NOV in a research note on Tuesday, December 10th. Finally, Barclays increased their price target on NOV from $12.00 to $13.00 and gave the stock an "underweight" rating in a research note on Tuesday, February 18th. Two research analysts have rated the stock with a sell rating, eight have issued a hold rating and eight have given a buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus price target of $19.60.

Read Our Latest Stock Analysis on NOV

NOV Stock Performance

Shares of NOV traded up $1.31 on Friday, reaching $12.42. The company's stock had a trading volume of 2,749,200 shares, compared to its average volume of 3,817,071. NOV has a 12-month low of $10.62 and a 12-month high of $21.20. The stock has a market capitalization of $4.73 billion, a P/E ratio of 7.71, a PEG ratio of 1.02 and a beta of 1.35. The company has a debt-to-equity ratio of 0.26, a current ratio of 2.46 and a quick ratio of 1.64. The stock's 50 day simple moving average is $14.72 and its two-hundred day simple moving average is $15.22.

NOV (NYSE:NOV - Get Free Report) last issued its quarterly earnings data on Tuesday, February 4th. The oil and gas exploration company reported $0.41 EPS for the quarter, topping the consensus estimate of $0.35 by $0.06. NOV had a return on equity of 9.88% and a net margin of 7.16%.

NOV Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, March 28th. Stockholders of record on Friday, March 14th were paid a $0.075 dividend. This represents a $0.30 annualized dividend and a dividend yield of 2.42%. The ex-dividend date was Friday, March 14th. NOV's payout ratio is 18.63%.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of the company. Cerity Partners LLC grew its holdings in NOV by 5.4% during the 3rd quarter. Cerity Partners LLC now owns 64,240 shares of the oil and gas exploration company's stock valued at $1,026,000 after purchasing an additional 3,274 shares during the last quarter. Zurcher Kantonalbank Zurich Cantonalbank grew its stake in shares of NOV by 5.9% during the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 84,386 shares of the oil and gas exploration company's stock valued at $1,348,000 after buying an additional 4,721 shares during the last quarter. Verition Fund Management LLC raised its holdings in shares of NOV by 767.1% in the third quarter. Verition Fund Management LLC now owns 163,317 shares of the oil and gas exploration company's stock worth $2,608,000 after buying an additional 144,483 shares during the period. Jacobs Levy Equity Management Inc. bought a new stake in shares of NOV during the 3rd quarter worth approximately $273,000. Finally, Quarry LP purchased a new position in NOV during the 3rd quarter valued at $36,000. 93.27% of the stock is owned by hedge funds and other institutional investors.

About NOV

(

Get Free Report)

NOV Inc designs, constructs, manufactures, and sells systems, components, and products for oil and gas drilling and production, and industrial and renewable energy sectors in the United States and internationally. It operates through two segments, Energy Equipment, and Energy Products and Services. The company provides solids control and waste management equipment and services, managed pressure drilling, drilling fluids, premium drillpipe, wired pipe, drilling optimization services, tubular inspection and coating services, instrumentation, downhole tools, and drill bits.

Read More

Before you consider NOV, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NOV wasn't on the list.

While NOV currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.