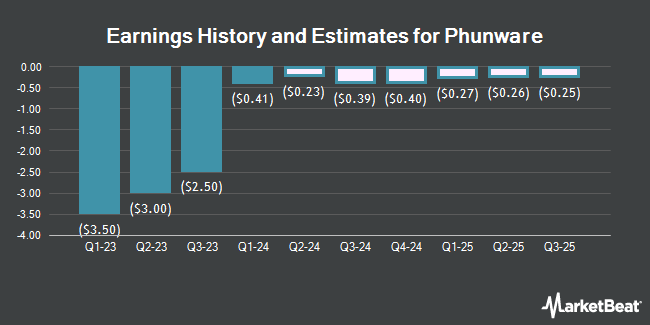

Phunware, Inc. (NASDAQ:PHUN - Free Report) - Taglich Brothers increased their FY2024 earnings estimates for Phunware in a report issued on Tuesday, November 12th. Taglich Brothers analyst H. Halpern now forecasts that the company will post earnings of ($1.01) per share for the year, up from their previous estimate of ($1.17). The consensus estimate for Phunware's current full-year earnings is ($1.15) per share. Taglich Brothers also issued estimates for Phunware's Q4 2024 earnings at ($0.15) EPS, Q1 2025 earnings at ($0.17) EPS, Q2 2025 earnings at ($0.17) EPS, Q3 2025 earnings at ($0.14) EPS, Q4 2025 earnings at ($0.07) EPS and FY2025 earnings at ($0.56) EPS.

Other equities research analysts have also recently issued research reports about the stock. HC Wainwright cut shares of Phunware from a "buy" rating to a "neutral" rating and dropped their price target for the company from $9.00 to $6.00 in a research note on Tuesday. Ascendiant Capital Markets lowered their price target on shares of Phunware from $20.00 to $13.00 and set a "buy" rating on the stock in a research report on Tuesday.

Check Out Our Latest Stock Analysis on Phunware

Phunware Price Performance

Shares of Phunware stock traded down $0.47 during midday trading on Friday, hitting $4.46. The company had a trading volume of 2,251,586 shares, compared to its average volume of 3,358,606. The company has a debt-to-equity ratio of 0.02, a quick ratio of 2.82 and a current ratio of 3.80. The company has a fifty day simple moving average of $5.35 and a 200 day simple moving average of $5.31. Phunware has a 12-month low of $2.85 and a 12-month high of $24.49.

Institutional Investors Weigh In On Phunware

An institutional investor recently bought a new position in Phunware stock. Virtu Financial LLC acquired a new position in shares of Phunware, Inc. (NASDAQ:PHUN - Free Report) in the first quarter, according to the company in its most recent filing with the SEC. The firm acquired 10,196 shares of the company's stock, valued at approximately $91,000. Virtu Financial LLC owned approximately 0.12% of Phunware at the end of the most recent quarter. Institutional investors and hedge funds own 7.57% of the company's stock.

About Phunware

(

Get Free Report)

Phunware, Inc, together with its subsidiaries, provides integrated software platform that equips companies with the products, solutions, and services to engage, manage, and monetize their mobile application portfolios in the United States and internationally. The company's products and services include mobile software and application transaction solutions comprise integration of software development kit (SDK) licenses, which consists of analytics that offers data related to application use and engagement; content management that allows application administrators to create and manage app content in a cloud-based portal; alerts, notifications, and messaging, which enables brands to send messages; marketing automation that enables location-triggered messages and workflow; advertising; and location-based services, such as mapping, navigation, wayfinding, workflow, asset management, and policy enforcement.

Featured Articles

Before you consider Phunware, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Phunware wasn't on the list.

While Phunware currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.