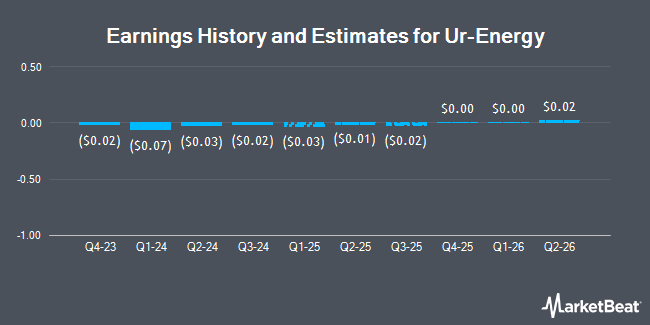

Ur-Energy Inc. (NYSEAMERICAN:URG - Free Report) TSE: URE - Equities researchers at Ventum Cap Mkts decreased their FY2027 earnings estimates for Ur-Energy in a report released on Thursday, November 7th. Ventum Cap Mkts analyst A. Terentiew now expects that the basic materials company will post earnings per share of $0.10 for the year, down from their previous forecast of $0.13. The consensus estimate for Ur-Energy's current full-year earnings is ($0.09) per share.

A number of other research firms have also recently issued reports on URG. Roth Mkm reiterated a "buy" rating and issued a $2.20 target price (up from $1.90) on shares of Ur-Energy in a research note on Wednesday, October 23rd. HC Wainwright reduced their target price on shares of Ur-Energy from $3.20 to $2.70 and set a "buy" rating for the company in a research note on Wednesday, August 14th. Finally, B. Riley decreased their target price on shares of Ur-Energy from $3.00 to $2.00 and set a "buy" rating for the company in a research report on Tuesday, August 20th. One research analyst has rated the stock with a sell rating, three have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $2.30.

Read Our Latest Stock Analysis on Ur-Energy

Ur-Energy Stock Performance

Shares of NYSEAMERICAN:URG traded down $0.02 on Monday, reaching $1.17. 4,075,166 shares of the company's stock were exchanged, compared to its average volume of 3,652,038. Ur-Energy has a fifty-two week low of $0.96 and a fifty-two week high of $2.01. The stock has a market capitalization of $423.86 million, a price-to-earnings ratio of -9.15 and a beta of 1.11.

Ur-Energy (NYSEAMERICAN:URG - Get Free Report) TSE: URE last posted its quarterly earnings results on Wednesday, November 6th. The basic materials company reported ($0.02) EPS for the quarter, hitting analysts' consensus estimates of ($0.02). The firm had revenue of $6.40 million during the quarter, compared to analyst estimates of $9.67 million.

Insider Activity

In other news, CFO Roger L. Smith sold 228,119 shares of the business's stock in a transaction dated Friday, September 20th. The shares were sold at an average price of $1.20, for a total transaction of $273,742.80. Following the transaction, the chief financial officer now owns 613,061 shares in the company, valued at approximately $735,673.20. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. In related news, CFO Roger L. Smith sold 228,119 shares of the business's stock in a transaction on Friday, September 20th. The stock was sold at an average price of $1.20, for a total value of $273,742.80. Following the sale, the chief financial officer now owns 613,061 shares of the company's stock, valued at $735,673.20. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Gary C. Huber sold 97,628 shares of the company's stock in a transaction dated Wednesday, September 25th. The stock was sold at an average price of $1.23, for a total transaction of $120,082.44. Following the sale, the director now directly owns 404,869 shares in the company, valued at $497,988.87. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 605,480 shares of company stock valued at $726,708. 3.29% of the stock is owned by company insiders.

Institutional Trading of Ur-Energy

Several institutional investors and hedge funds have recently made changes to their positions in URG. Xponance Inc. acquired a new stake in shares of Ur-Energy in the 2nd quarter valued at approximately $25,000. Principal Financial Group Inc. acquired a new stake in Ur-Energy in the 2nd quarter valued at approximately $51,000. Tidal Investments LLC bought a new position in shares of Ur-Energy during the 1st quarter worth approximately $65,000. Intech Investment Management LLC acquired a new stake in shares of Ur-Energy in the third quarter valued at approximately $73,000. Finally, Ballentine Partners LLC lifted its position in shares of Ur-Energy by 235.6% in the third quarter. Ballentine Partners LLC now owns 68,266 shares of the basic materials company's stock worth $81,000 after purchasing an additional 47,922 shares in the last quarter. Institutional investors own 57.51% of the company's stock.

Ur-Energy Company Profile

(

Get Free Report)

Ur-Energy Inc engages in the acquisition, exploration, development, and operation of uranium mineral properties. The company holds interests in 12 projects located in the United States. Its flagship property is the Lost Creek project comprising a total of approximately 1,800 unpatented mining claims and three Wyoming mineral leases covering an area of approximately 35,400 acres located in the Great Divide Basin, Wyoming.

Featured Articles

Before you consider Ur-Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ur-Energy wasn't on the list.

While Ur-Energy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.