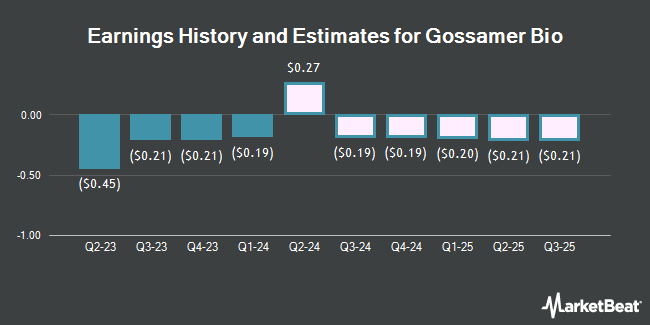

Gossamer Bio, Inc. (NASDAQ:GOSS - Free Report) - Research analysts at HC Wainwright lowered their FY2028 earnings per share (EPS) estimates for Gossamer Bio in a note issued to investors on Tuesday, March 18th. HC Wainwright analyst P. Trucchio now expects that the company will post earnings per share of $0.24 for the year, down from their prior forecast of $0.28. HC Wainwright currently has a "Buy" rating and a $10.00 target price on the stock. The consensus estimate for Gossamer Bio's current full-year earnings is ($0.28) per share. HC Wainwright also issued estimates for Gossamer Bio's FY2029 earnings at $0.55 EPS.

Gossamer Bio (NASDAQ:GOSS - Get Free Report) last issued its quarterly earnings results on Tuesday, March 18th. The company reported ($0.15) earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of ($0.15). The firm had revenue of $9.38 million during the quarter, compared to analyst estimates of $7.02 million.

Separately, Wedbush reissued an "outperform" rating and issued a $4.00 price objective on shares of Gossamer Bio in a research report on Friday, March 14th. Five investment analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, the stock currently has a consensus rating of "Buy" and an average target price of $9.20.

Get Our Latest Report on Gossamer Bio

Gossamer Bio Trading Up 3.0 %

NASDAQ GOSS traded up $0.04 during mid-day trading on Wednesday, reaching $1.39. 1,068,430 shares of the stock were exchanged, compared to its average volume of 1,566,248. The company has a debt-to-equity ratio of 3.64, a current ratio of 6.74 and a quick ratio of 6.74. The stock has a market cap of $315.84 million, a P/E ratio of -4.34 and a beta of 1.86. The stock has a 50 day simple moving average of $1.16 and a 200-day simple moving average of $0.98. Gossamer Bio has a one year low of $0.50 and a one year high of $1.55.

Institutional Investors Weigh In On Gossamer Bio

A number of large investors have recently bought and sold shares of GOSS. Octagon Capital Advisors LP raised its holdings in shares of Gossamer Bio by 99.7% during the fourth quarter. Octagon Capital Advisors LP now owns 18,350,000 shares of the company's stock valued at $16,599,000 after purchasing an additional 9,162,117 shares during the period. Alyeska Investment Group L.P. raised its stake in Gossamer Bio by 52.7% during the 4th quarter. Alyeska Investment Group L.P. now owns 8,808,514 shares of the company's stock worth $7,968,000 after buying an additional 3,041,058 shares during the period. Monaco Asset Management SAM boosted its holdings in Gossamer Bio by 39.5% in the fourth quarter. Monaco Asset Management SAM now owns 5,371,641 shares of the company's stock worth $4,859,000 after acquiring an additional 1,520,721 shares in the last quarter. Allostery Investments LP acquired a new stake in Gossamer Bio in the fourth quarter valued at approximately $555,000. Finally, Silverarc Capital Management LLC increased its holdings in shares of Gossamer Bio by 9.3% during the fourth quarter. Silverarc Capital Management LLC now owns 6,171,847 shares of the company's stock valued at $5,583,000 after acquiring an additional 526,495 shares in the last quarter. 81.23% of the stock is currently owned by institutional investors and hedge funds.

About Gossamer Bio

(

Get Free Report)

Gossamer Bio, Inc, a clinical-stage biopharmaceutical company, focuses on developing and commercializing seralutinib for the treatment of pulmonary arterial hypertension (PAH) in the United States. The company is developing GB002, an inhaled, small molecule, platelet-derived growth factor receptor, or PDGFR, colony-stimulatin factor 1 receptor and c-KIT inhibitor, which is in Phase 3 clinical trial for the treatment of PAH.

See Also

Before you consider Gossamer Bio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gossamer Bio wasn't on the list.

While Gossamer Bio currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.