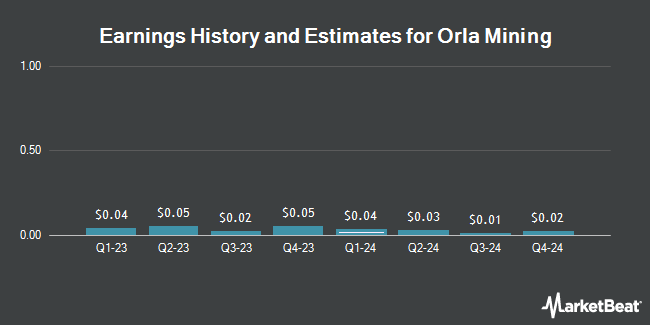

Orla Mining Ltd. (NYSEAMERICAN:ORLA - Free Report) - Research analysts at Stifel Canada dropped their FY2024 earnings per share estimates for shares of Orla Mining in a research report issued on Monday, December 2nd. Stifel Canada analyst S. Soock now anticipates that the company will post earnings per share of $0.10 for the year, down from their prior estimate of $0.25. The consensus estimate for Orla Mining's current full-year earnings is $0.23 per share.

ORLA has been the subject of several other reports. Desjardins raised Orla Mining to a "moderate buy" rating in a research report on Thursday, October 31st. Scotiabank raised Orla Mining from a "hold" rating to a "strong-buy" rating in a research report on Wednesday, November 27th.

Check Out Our Latest Report on ORLA

Orla Mining Stock Up 1.8 %

Shares of NYSEAMERICAN ORLA traded up $0.09 during trading on Wednesday, hitting $4.96. 476,834 shares of the company were exchanged, compared to its average volume of 432,132. Orla Mining has a 12-month low of $2.60 and a 12-month high of $5.16. The company has a quick ratio of 3.95, a current ratio of 4.54 and a debt-to-equity ratio of 0.12. The firm has a market cap of $1.59 billion, a PE ratio of -494.51 and a beta of 0.75.

Institutional Investors Weigh In On Orla Mining

Institutional investors have recently added to or reduced their stakes in the business. Goehring & Rozencwajg Associates LLC lifted its stake in Orla Mining by 16.3% during the second quarter. Goehring & Rozencwajg Associates LLC now owns 1,295,214 shares of the company's stock worth $4,969,000 after purchasing an additional 181,900 shares during the last quarter. CWA Asset Management Group LLC purchased a new stake in Orla Mining in the third quarter valued at approximately $5,927,000. Allspring Global Investments Holdings LLC lifted its stake in Orla Mining by 50.0% in the third quarter. Allspring Global Investments Holdings LLC now owns 450,000 shares of the company's stock valued at $1,812,000 after buying an additional 150,000 shares during the last quarter. International Assets Investment Management LLC purchased a new stake in Orla Mining in the third quarter valued at approximately $43,000. Finally, Renaissance Technologies LLC purchased a new stake in Orla Mining in the second quarter valued at approximately $102,000. Hedge funds and other institutional investors own 43.04% of the company's stock.

About Orla Mining

(

Get Free Report)

Orla Mining Ltd. acquires, explores, develops, and exploits mineral properties. The company explores for gold, silver, zinc, lead, and copper deposits. It owns 100% interests in the Camino Rojo project that consists of seven concessions covering an area of 138,636 hectares located in Zacatecas, Mexico; Cerro Quema project totaling an area of 15,000 hectares located in the Azuero Peninsula, Panama; and the South Railroad project consisting of an area of 21,000 hectares located in Elko, Nevada.

See Also

Before you consider Orla Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Orla Mining wasn't on the list.

While Orla Mining currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.