Corient Private Wealth LLC boosted its holdings in shares of Brookfield Co. (NYSE:BN - Free Report) by 0.8% in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 3,328,164 shares of the company's stock after purchasing an additional 25,911 shares during the period. Corient Private Wealth LLC owned about 0.20% of Brookfield worth $191,203,000 at the end of the most recent quarter.

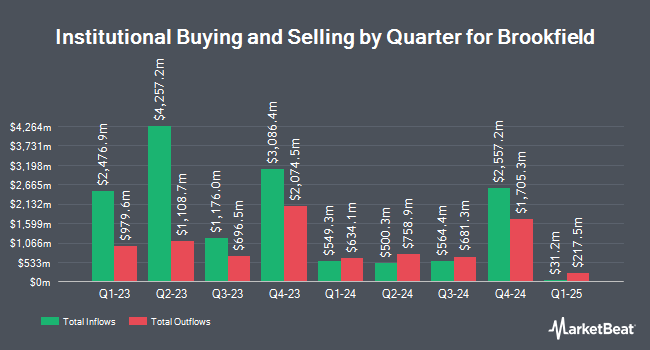

A number of other large investors have also recently modified their holdings of BN. CIBC Asset Management Inc lifted its stake in Brookfield by 6.2% in the 4th quarter. CIBC Asset Management Inc now owns 14,178,133 shares of the company's stock valued at $814,585,000 after purchasing an additional 823,428 shares during the last quarter. The Manufacturers Life Insurance Company raised its position in Brookfield by 31.6% in the third quarter. The Manufacturers Life Insurance Company now owns 11,736,712 shares of the company's stock valued at $623,783,000 after purchasing an additional 2,818,716 shares during the last quarter. EdgePoint Investment Group Inc. grew its holdings in Brookfield by 1.7% during the 3rd quarter. EdgePoint Investment Group Inc. now owns 11,512,817 shares of the company's stock worth $611,383,000 after acquiring an additional 196,790 shares during the last quarter. Toronto Dominion Bank lifted its holdings in shares of Brookfield by 23.4% during the third quarter. Toronto Dominion Bank now owns 6,851,397 shares of the company's stock worth $364,152,000 after purchasing an additional 1,301,072 shares during the period. Finally, Connor Clark & Lunn Investment Management Ltd. grew its stake in shares of Brookfield by 11.5% in the fourth quarter. Connor Clark & Lunn Investment Management Ltd. now owns 6,507,113 shares of the company's stock worth $373,527,000 after purchasing an additional 668,630 shares during the last quarter. Institutional investors and hedge funds own 61.60% of the company's stock.

Brookfield Stock Up 2.7 %

BN stock traded up $1.40 during mid-day trading on Wednesday, reaching $53.56. 1,001,486 shares of the company traded hands, compared to its average volume of 2,525,103. The company has a quick ratio of 1.09, a current ratio of 1.21 and a debt-to-equity ratio of 1.40. The firm's 50 day moving average price is $57.28 and its 200 day moving average price is $55.91. The stock has a market cap of $88.16 billion, a price-to-earnings ratio of 178.37 and a beta of 1.65. Brookfield Co. has a fifty-two week low of $38.18 and a fifty-two week high of $62.78.

Brookfield (NYSE:BN - Get Free Report) last announced its earnings results on Thursday, February 13th. The company reported $1.01 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.88 by $0.13. Brookfield had a return on equity of 3.93% and a net margin of 0.75%. As a group, equities research analysts predict that Brookfield Co. will post 3.85 EPS for the current fiscal year.

Brookfield Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Monday, March 31st. Investors of record on Friday, March 14th will be given a dividend of $0.09 per share. This represents a $0.36 dividend on an annualized basis and a dividend yield of 0.67%. The ex-dividend date is Friday, March 14th. Brookfield's payout ratio is currently 120.00%.

Analysts Set New Price Targets

Several brokerages have commented on BN. Scotiabank lifted their target price on Brookfield from $69.00 to $71.00 and gave the stock a "sector outperform" rating in a report on Monday, February 3rd. TD Securities upped their target price on Brookfield from $74.00 to $75.00 and gave the company a "buy" rating in a report on Tuesday, February 11th. CIBC lifted their price objective on Brookfield from $68.00 to $70.00 and gave the stock an "outperformer" rating in a research report on Thursday, January 23rd. Finally, Morgan Stanley started coverage on shares of Brookfield in a research report on Thursday, January 23rd. They set an "overweight" rating and a $80.00 target price on the stock. One analyst has rated the stock with a hold rating and six have assigned a buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $64.00.

Check Out Our Latest Stock Analysis on Brookfield

About Brookfield

(

Free Report)

Brookfield Corporation is an alternative asset manager and REIT/Real Estate Investment Manager firm focuses on real estate, renewable power, infrastructure and venture capital and private equity assets. It manages a range of public and private investment products and services for institutional and retail clients.

See Also

Before you consider Brookfield, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield wasn't on the list.

While Brookfield currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.