Citigroup Inc. lowered its holdings in Brookfield Co. (NYSE:BN - Free Report) by 4.6% during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 460,813 shares of the company's stock after selling 22,309 shares during the quarter. Citigroup Inc.'s holdings in Brookfield were worth $24,501,000 at the end of the most recent quarter.

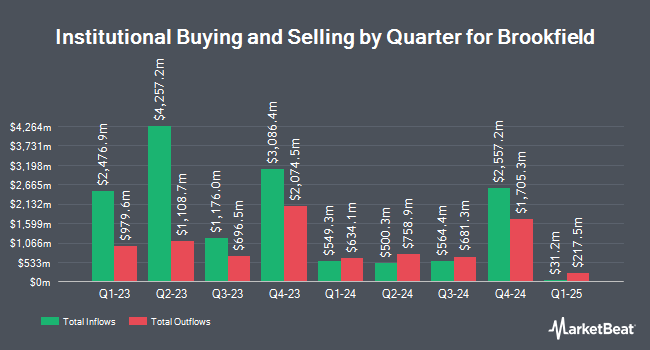

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Blue Trust Inc. lifted its position in shares of Brookfield by 62.8% in the 2nd quarter. Blue Trust Inc. now owns 705 shares of the company's stock worth $30,000 after acquiring an additional 272 shares during the period. Kings Path Partners LLC bought a new stake in shares of Brookfield in the 2nd quarter worth approximately $31,000. Family Firm Inc. bought a new stake in shares of Brookfield in the 2nd quarter worth approximately $36,000. First Personal Financial Services bought a new stake in shares of Brookfield in the 3rd quarter worth approximately $42,000. Finally, Nisa Investment Advisors LLC lifted its position in shares of Brookfield by 63.5% in the 2nd quarter. Nisa Investment Advisors LLC now owns 1,159 shares of the company's stock worth $48,000 after acquiring an additional 450 shares during the period. Institutional investors and hedge funds own 61.60% of the company's stock.

Analyst Ratings Changes

A number of analysts have commented on BN shares. Royal Bank of Canada reduced their price objective on Brookfield from $57.00 to $56.00 and set an "outperform" rating for the company in a research report on Friday, August 9th. JPMorgan Chase & Co. raised their target price on Brookfield from $49.00 to $52.00 and gave the stock an "overweight" rating in a research report on Wednesday, July 31st. Keefe, Bruyette & Woods raised their target price on Brookfield from $44.00 to $46.00 and gave the stock a "market perform" rating in a research report on Friday, August 9th. BMO Capital Markets restated an "outperform" rating and set a $62.00 target price (up previously from $50.00) on shares of Brookfield in a research report on Friday, November 15th. Finally, Scotiabank raised their target price on Brookfield from $65.00 to $69.00 and gave the stock a "sector outperform" rating in a research report on Friday, November 15th. Two research analysts have rated the stock with a hold rating and six have issued a buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average price target of $55.31.

Check Out Our Latest Stock Report on Brookfield

Brookfield Trading Up 0.6 %

Shares of BN opened at $60.06 on Wednesday. The stock has a fifty day moving average price of $54.55 and a two-hundred day moving average price of $48.35. The company has a debt-to-equity ratio of 1.40, a quick ratio of 1.03 and a current ratio of 1.17. Brookfield Co. has a 52-week low of $33.72 and a 52-week high of $60.23. The company has a market cap of $98.90 billion, a price-to-earnings ratio of 127.79 and a beta of 1.53.

Brookfield Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Monday, December 16th will be given a $0.08 dividend. The ex-dividend date of this dividend is Monday, December 16th. This represents a $0.32 annualized dividend and a yield of 0.53%. Brookfield's payout ratio is 68.09%.

About Brookfield

(

Free Report)

Brookfield Corporation is an alternative asset manager and REIT/Real Estate Investment Manager firm focuses on real estate, renewable power, infrastructure and venture capital and private equity assets. It manages a range of public and private investment products and services for institutional and retail clients.

Featured Articles

Before you consider Brookfield, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield wasn't on the list.

While Brookfield currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.