Lord Abbett & CO. LLC cut its holdings in Brookfield Infrastructure Co. (NASDAQ:BIPC - Free Report) by 50.0% during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 84,417 shares of the company's stock after selling 84,417 shares during the period. Lord Abbett & CO. LLC owned approximately 0.06% of Brookfield Infrastructure worth $3,666,000 as of its most recent filing with the SEC.

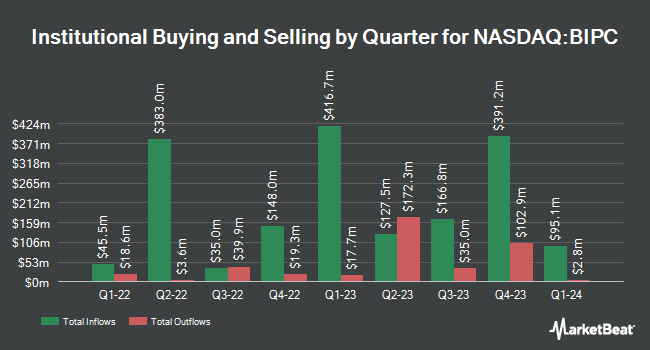

Other hedge funds have also bought and sold shares of the company. Nisa Investment Advisors LLC increased its holdings in shares of Brookfield Infrastructure by 11.7% during the second quarter. Nisa Investment Advisors LLC now owns 2,754 shares of the company's stock worth $93,000 after purchasing an additional 288 shares during the period. Gryphon Financial Partners LLC bought a new position in Brookfield Infrastructure during the 2nd quarter worth $136,000. Covestor Ltd increased its stake in Brookfield Infrastructure by 64.0% during the 3rd quarter. Covestor Ltd now owns 3,405 shares of the company's stock worth $148,000 after acquiring an additional 1,329 shares during the period. Toth Financial Advisory Corp raised its holdings in Brookfield Infrastructure by 111.6% in the 3rd quarter. Toth Financial Advisory Corp now owns 3,602 shares of the company's stock valued at $156,000 after acquiring an additional 1,900 shares in the last quarter. Finally, Signaturefd LLC lifted its position in shares of Brookfield Infrastructure by 9.8% during the 3rd quarter. Signaturefd LLC now owns 4,078 shares of the company's stock valued at $177,000 after acquiring an additional 363 shares during the period. 70.38% of the stock is owned by institutional investors.

Brookfield Infrastructure Stock Performance

Shares of NASDAQ BIPC traded down $0.50 during mid-day trading on Tuesday, reaching $39.36. The company had a trading volume of 529,242 shares, compared to its average volume of 497,116. Brookfield Infrastructure Co. has a one year low of $28.47 and a one year high of $45.29. The business's 50-day simple moving average is $42.86 and its 200 day simple moving average is $39.67. The firm has a market cap of $5.20 billion, a price-to-earnings ratio of 27.33 and a beta of 1.45.

Brookfield Infrastructure Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Friday, November 29th will be given a $0.405 dividend. This represents a $1.62 annualized dividend and a dividend yield of 4.12%. The ex-dividend date of this dividend is Friday, November 29th. Brookfield Infrastructure's payout ratio is presently 112.50%.

Brookfield Infrastructure Profile

(

Free Report)

Brookfield Infrastructure Corporation, together with its subsidiaries, owns and operates regulated natural gas transmission systems in Brazil. The company also engages in the regulated gas and electricity distribution operations in the United Kingdom; and electricity transmission and distribution, as well as gas distribution in Australia.

Read More

Before you consider Brookfield Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield Infrastructure wasn't on the list.

While Brookfield Infrastructure currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.