Principal Financial Group Inc. lessened its stake in shares of Brookfield Infrastructure Co. (NASDAQ:BIPC - Free Report) by 4.9% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 2,733,554 shares of the company's stock after selling 139,400 shares during the quarter. Principal Financial Group Inc. owned about 2.07% of Brookfield Infrastructure worth $118,718,000 as of its most recent SEC filing.

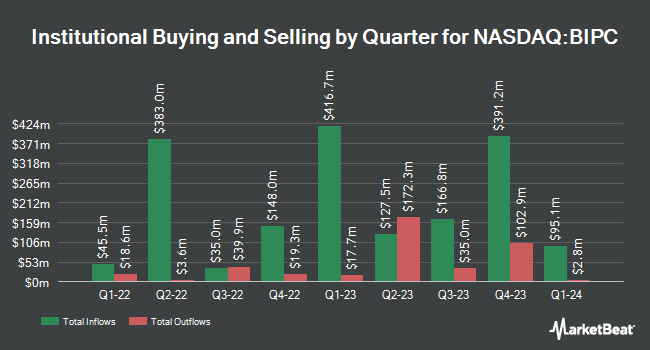

A number of other institutional investors have also recently made changes to their positions in BIPC. Heritage Wealth Advisors boosted its holdings in shares of Brookfield Infrastructure by 43.0% during the 1st quarter. Heritage Wealth Advisors now owns 1,333 shares of the company's stock valued at $48,000 after acquiring an additional 401 shares during the last quarter. Pathway Financial Advisers LLC purchased a new position in shares of Brookfield Infrastructure in the first quarter worth approximately $68,000. Lazard Asset Management LLC purchased a new position in shares of Brookfield Infrastructure in the first quarter worth approximately $73,000. Nisa Investment Advisors LLC boosted its holdings in shares of Brookfield Infrastructure by 11.7% in the second quarter. Nisa Investment Advisors LLC now owns 2,754 shares of the company's stock worth $93,000 after buying an additional 288 shares during the last quarter. Finally, CWM LLC boosted its holdings in shares of Brookfield Infrastructure by 10.7% in the second quarter. CWM LLC now owns 3,148 shares of the company's stock worth $106,000 after buying an additional 305 shares during the last quarter. Hedge funds and other institutional investors own 70.38% of the company's stock.

Brookfield Infrastructure Price Performance

Shares of BIPC traded up $0.20 on Friday, reaching $42.80. The company's stock had a trading volume of 336,591 shares, compared to its average volume of 507,414. The stock has a market capitalization of $5.65 billion, a P/E ratio of 29.72 and a beta of 1.45. The stock's 50 day simple moving average is $42.01 and its two-hundred day simple moving average is $37.84. Brookfield Infrastructure Co. has a 12-month low of $28.47 and a 12-month high of $44.26.

Brookfield Infrastructure Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Friday, November 29th will be issued a $0.405 dividend. This represents a $1.62 dividend on an annualized basis and a dividend yield of 3.79%. The ex-dividend date is Friday, November 29th. Brookfield Infrastructure's payout ratio is 112.50%.

Brookfield Infrastructure Company Profile

(

Free Report)

Brookfield Infrastructure Corporation, together with its subsidiaries, owns and operates regulated natural gas transmission systems in Brazil. The company also engages in the regulated gas and electricity distribution operations in the United Kingdom; and electricity transmission and distribution, as well as gas distribution in Australia.

Further Reading

Before you consider Brookfield Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield Infrastructure wasn't on the list.

While Brookfield Infrastructure currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.