Jennison Associates LLC decreased its position in Brookline Bancorp, Inc. (NASDAQ:BRKL - Free Report) by 41.5% during the 3rd quarter, according to its most recent filing with the SEC. The institutional investor owned 2,908,477 shares of the bank's stock after selling 2,063,240 shares during the period. Jennison Associates LLC owned about 3.27% of Brookline Bancorp worth $29,347,000 as of its most recent filing with the SEC.

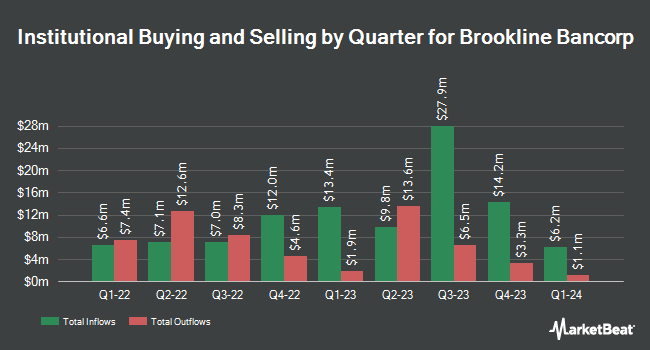

Several other large investors have also added to or reduced their stakes in the business. Sei Investments Co. grew its holdings in Brookline Bancorp by 26.2% during the first quarter. Sei Investments Co. now owns 47,640 shares of the bank's stock worth $474,000 after purchasing an additional 9,878 shares during the period. ProShare Advisors LLC lifted its holdings in Brookline Bancorp by 7.4% during the 1st quarter. ProShare Advisors LLC now owns 17,640 shares of the bank's stock valued at $176,000 after purchasing an additional 1,223 shares during the last quarter. State Board of Administration of Florida Retirement System boosted its position in Brookline Bancorp by 126.0% during the first quarter. State Board of Administration of Florida Retirement System now owns 56,337 shares of the bank's stock worth $592,000 after purchasing an additional 31,410 shares during the period. Vanguard Group Inc. increased its holdings in shares of Brookline Bancorp by 0.5% in the first quarter. Vanguard Group Inc. now owns 10,145,485 shares of the bank's stock valued at $101,049,000 after purchasing an additional 54,211 shares during the last quarter. Finally, EntryPoint Capital LLC bought a new position in shares of Brookline Bancorp in the first quarter valued at about $47,000. Institutional investors and hedge funds own 78.91% of the company's stock.

Brookline Bancorp Stock Performance

BRKL traded up $0.31 during trading on Friday, hitting $12.57. The stock had a trading volume of 211,306 shares, compared to its average volume of 513,962. The company has a debt-to-equity ratio of 1.22, a current ratio of 1.13 and a quick ratio of 1.13. The company has a 50 day moving average price of $10.87 and a 200-day moving average price of $9.80. Brookline Bancorp, Inc. has a one year low of $8.01 and a one year high of $13.15. The firm has a market cap of $1.12 billion, a price-to-earnings ratio of 14.93 and a beta of 0.76.

Brookline Bancorp (NASDAQ:BRKL - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The bank reported $0.23 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.20 by $0.03. Brookline Bancorp had a net margin of 11.40% and a return on equity of 6.20%. The company had revenue of $165.91 million during the quarter, compared to analysts' expectations of $88.67 million. During the same quarter in the previous year, the business posted $0.26 earnings per share. As a group, research analysts predict that Brookline Bancorp, Inc. will post 0.82 EPS for the current year.

Brookline Bancorp Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, November 29th. Stockholders of record on Friday, November 15th will be issued a dividend of $0.135 per share. The ex-dividend date of this dividend is Friday, November 15th. This represents a $0.54 annualized dividend and a dividend yield of 4.30%. Brookline Bancorp's dividend payout ratio is presently 65.06%.

Analyst Ratings Changes

Separately, Keefe, Bruyette & Woods lifted their target price on shares of Brookline Bancorp from $10.50 to $11.00 and gave the stock a "market perform" rating in a report on Friday, July 26th.

Read Our Latest Stock Analysis on Brookline Bancorp

About Brookline Bancorp

(

Free Report)

Brookline Bancorp, Inc operates as a bank holding company for the Brookline Bank that provide commercial, business, and retail banking services to corporate, municipal, and retail customers in the United States. Its deposit products include demand checking, NOW, money market, and savings accounts. The company's loan portfolio primarily comprises first mortgage loans secured by commercial, multi-family, and residential real estate properties; loans to business entities comprising commercial lines of credit; loans to condominium associations; loans and leases used to finance equipment for small businesses; financing for construction and development projects; and home equity and other consumer loans.

See Also

Before you consider Brookline Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookline Bancorp wasn't on the list.

While Brookline Bancorp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.