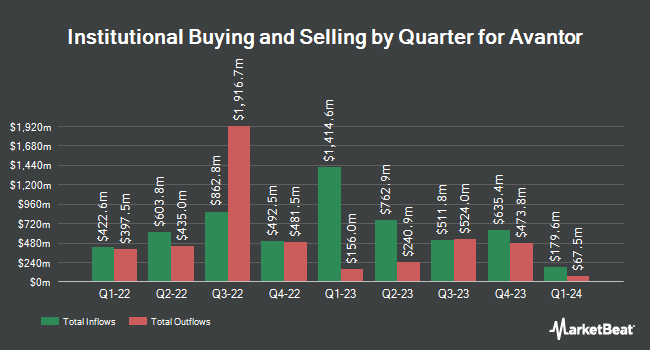

Brown Brothers Harriman & Co. reduced its stake in shares of Avantor, Inc. (NYSE:AVTR - Free Report) by 13.1% during the 3rd quarter, according to its most recent filing with the SEC. The firm owned 2,913,965 shares of the company's stock after selling 437,848 shares during the period. Brown Brothers Harriman & Co. owned approximately 0.43% of Avantor worth $75,384,000 at the end of the most recent quarter.

Other institutional investors have also modified their holdings of the company. 1832 Asset Management L.P. increased its stake in shares of Avantor by 1,634.9% in the 2nd quarter. 1832 Asset Management L.P. now owns 8,530,118 shares of the company's stock valued at $180,839,000 after purchasing an additional 8,038,451 shares in the last quarter. Sound Shore Management Inc. CT acquired a new position in shares of Avantor during the 2nd quarter worth approximately $76,412,000. Principal Financial Group Inc. raised its stake in shares of Avantor by 146.5% during the 3rd quarter. Principal Financial Group Inc. now owns 2,628,372 shares of the company's stock worth $67,996,000 after buying an additional 1,562,018 shares during the period. Canada Pension Plan Investment Board lifted its holdings in Avantor by 6.8% during the second quarter. Canada Pension Plan Investment Board now owns 22,927,325 shares of the company's stock valued at $486,059,000 after purchasing an additional 1,463,695 shares in the last quarter. Finally, Boston Partners lifted its stake in Avantor by 2.2% in the 1st quarter. Boston Partners now owns 28,561,802 shares of the company's stock valued at $729,298,000 after buying an additional 624,369 shares in the last quarter. Hedge funds and other institutional investors own 95.08% of the company's stock.

Insider Buying and Selling at Avantor

In related news, CAO Steven W. Eck sold 3,525 shares of Avantor stock in a transaction that occurred on Thursday, September 5th. The shares were sold at an average price of $25.06, for a total value of $88,336.50. Following the completion of the transaction, the chief accounting officer now owns 29,544 shares in the company, valued at $740,372.64. The trade was a 10.66 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 1.30% of the stock is currently owned by corporate insiders.

Avantor Trading Up 1.6 %

NYSE AVTR traded up $0.33 during trading on Monday, hitting $21.11. The stock had a trading volume of 8,711,981 shares, compared to its average volume of 6,511,732. The company has a quick ratio of 1.06, a current ratio of 1.54 and a debt-to-equity ratio of 0.84. The company has a market capitalization of $14.37 billion, a PE ratio of 45.17, a PEG ratio of 2.52 and a beta of 1.35. The firm has a 50 day moving average price of $23.89 and a 200 day moving average price of $23.85. Avantor, Inc. has a twelve month low of $19.59 and a twelve month high of $28.00.

Wall Street Analyst Weigh In

A number of brokerages have recently commented on AVTR. Barclays reduced their target price on shares of Avantor from $28.00 to $25.00 and set an "overweight" rating for the company in a research report on Friday, October 25th. TD Cowen raised their target price on shares of Avantor from $28.00 to $31.00 and gave the stock a "buy" rating in a research note on Monday, July 29th. Robert W. Baird dropped their price target on Avantor from $27.00 to $26.00 and set an "outperform" rating for the company in a research report on Monday, October 28th. UBS Group reduced their price objective on Avantor from $30.00 to $29.00 and set a "buy" rating on the stock in a research report on Tuesday, October 8th. Finally, Royal Bank of Canada reaffirmed an "outperform" rating and issued a $34.00 target price on shares of Avantor in a research note on Thursday, September 26th. Three investment analysts have rated the stock with a hold rating and twelve have issued a buy rating to the stock. According to data from MarketBeat.com, Avantor presently has an average rating of "Moderate Buy" and a consensus target price of $27.57.

Check Out Our Latest Stock Report on Avantor

Avantor Profile

(

Free Report)

Avantor, Inc engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa. The company offers materials and consumables, such as purity chemicals and reagents, lab products and supplies, formulated silicone materials, customized excipients, customized single-use assemblies, process chromatography resins and columns, analytical sample prep kits, education and microbiology products, clinical trial kits, peristaltic pumps, and fluid handling tips.

See Also

Before you consider Avantor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avantor wasn't on the list.

While Avantor currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.