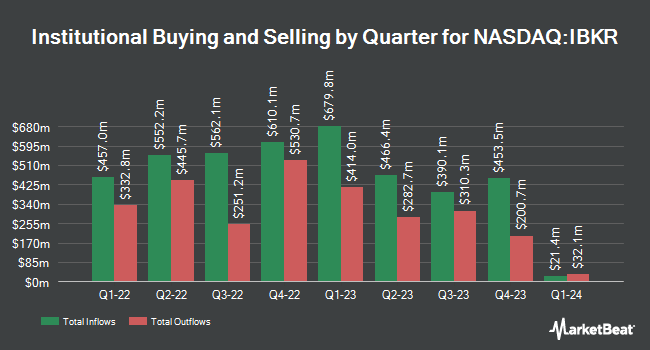

Brown Brothers Harriman & Co. decreased its holdings in shares of Interactive Brokers Group, Inc. (NASDAQ:IBKR - Free Report) by 44.0% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 7,421 shares of the financial services provider's stock after selling 5,822 shares during the period. Brown Brothers Harriman & Co.'s holdings in Interactive Brokers Group were worth $1,034,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the business. Greenwich Wealth Management LLC increased its holdings in shares of Interactive Brokers Group by 0.3% during the second quarter. Greenwich Wealth Management LLC now owns 2,979,372 shares of the financial services provider's stock worth $365,271,000 after buying an additional 8,038 shares in the last quarter. Marshall Wace LLP increased its holdings in shares of Interactive Brokers Group by 23.8% during the second quarter. Marshall Wace LLP now owns 2,507,059 shares of the financial services provider's stock worth $307,365,000 after buying an additional 481,826 shares in the last quarter. Millennium Management LLC increased its holdings in shares of Interactive Brokers Group by 1,292.1% during the second quarter. Millennium Management LLC now owns 1,082,017 shares of the financial services provider's stock worth $132,655,000 after buying an additional 1,004,289 shares in the last quarter. Bronte Capital Management Pty Ltd. increased its holdings in shares of Interactive Brokers Group by 2.9% during the third quarter. Bronte Capital Management Pty Ltd. now owns 833,627 shares of the financial services provider's stock worth $116,174,000 after buying an additional 23,828 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. increased its holdings in shares of Interactive Brokers Group by 2.2% during the third quarter. Charles Schwab Investment Management Inc. now owns 799,423 shares of the financial services provider's stock worth $111,408,000 after buying an additional 17,195 shares in the last quarter. Institutional investors own 23.80% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts have recently weighed in on the stock. Piper Sandler reaffirmed an "overweight" rating and set a $163.00 price objective on shares of Interactive Brokers Group in a report on Wednesday, October 16th. Jefferies Financial Group raised their price target on shares of Interactive Brokers Group from $152.00 to $165.00 and gave the company a "buy" rating in a report on Friday, October 4th. UBS Group raised their price target on shares of Interactive Brokers Group from $155.00 to $170.00 and gave the company a "buy" rating in a report on Tuesday, October 8th. Finally, Barclays lowered their price target on shares of Interactive Brokers Group from $166.00 to $165.00 and set an "overweight" rating for the company in a report on Wednesday, October 16th. One analyst has rated the stock with a hold rating and eight have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $143.00.

Read Our Latest Stock Report on Interactive Brokers Group

Interactive Brokers Group Stock Performance

IBKR traded down $1.64 during trading on Wednesday, reaching $191.31. 784,577 shares of the company's stock were exchanged, compared to its average volume of 1,013,380. The company's fifty day moving average price is $156.53 and its 200-day moving average price is $134.62. Interactive Brokers Group, Inc. has a fifty-two week low of $72.60 and a fifty-two week high of $193.42. The firm has a market capitalization of $80.83 billion, a PE ratio of 29.15, a P/E/G ratio of 1.50 and a beta of 0.79.

Interactive Brokers Group (NASDAQ:IBKR - Get Free Report) last released its earnings results on Tuesday, October 15th. The financial services provider reported $1.75 EPS for the quarter, missing analysts' consensus estimates of $1.78 by ($0.03). Interactive Brokers Group had a return on equity of 4.83% and a net margin of 7.89%. The business had revenue of $2.45 billion for the quarter, compared to analyst estimates of $1.32 billion. During the same period in the prior year, the firm posted $1.55 EPS. Research analysts forecast that Interactive Brokers Group, Inc. will post 6.82 earnings per share for the current fiscal year.

Interactive Brokers Group Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Friday, November 29th will be given a dividend of $0.25 per share. The ex-dividend date of this dividend is Friday, November 29th. This represents a $1.00 dividend on an annualized basis and a dividend yield of 0.52%. Interactive Brokers Group's dividend payout ratio is 15.27%.

Interactive Brokers Group Profile

(

Free Report)

Interactive Brokers Group, Inc operates as an automated electronic broker worldwide. The company engages in the execution, clearance, and settlement of trades in stocks, options, futures, foreign exchange instruments, bonds, mutual funds, exchange traded funds (ETFs), precious metals, and cryptocurrencies.

See Also

Before you consider Interactive Brokers Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Interactive Brokers Group wasn't on the list.

While Interactive Brokers Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.