Brown Brothers Harriman & Co. lowered its position in shares of Clarivate Plc (NYSE:CLVT - Free Report) by 11.4% in the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 5,535,980 shares of the company's stock after selling 713,474 shares during the quarter. Brown Brothers Harriman & Co. owned 0.78% of Clarivate worth $28,123,000 at the end of the most recent reporting period.

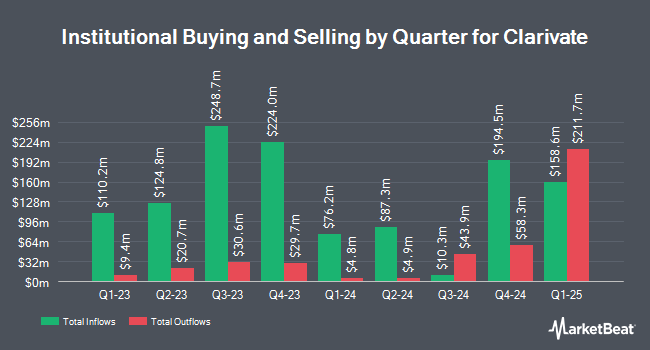

Several other hedge funds also recently made changes to their positions in CLVT. GAMMA Investing LLC grew its stake in Clarivate by 161.4% in the fourth quarter. GAMMA Investing LLC now owns 5,256 shares of the company's stock valued at $27,000 after purchasing an additional 3,245 shares in the last quarter. Kathmere Capital Management LLC bought a new position in shares of Clarivate in the fourth quarter valued at $58,000. Truist Financial Corp increased its holdings in Clarivate by 27.3% during the fourth quarter. Truist Financial Corp now owns 14,000 shares of the company's stock worth $71,000 after buying an additional 3,000 shares during the last quarter. Pitcairn Co. acquired a new stake in Clarivate in the third quarter valued at $100,000. Finally, Fox Run Management L.L.C. bought a new position in shares of Clarivate in the 4th quarter valued at about $72,000. 85.72% of the stock is owned by institutional investors.

Clarivate Stock Performance

CLVT stock traded up $0.09 during midday trading on Wednesday, reaching $4.01. 2,159,309 shares of the company were exchanged, compared to its average volume of 4,932,190. Clarivate Plc has a one year low of $3.83 and a one year high of $7.77. The firm has a market capitalization of $2.76 billion, a price-to-earnings ratio of -4.18 and a beta of 1.28. The business has a 50-day moving average price of $4.63 and a two-hundred day moving average price of $5.37. The company has a debt-to-equity ratio of 0.88, a current ratio of 0.87 and a quick ratio of 0.88.

Clarivate announced that its Board of Directors has initiated a share repurchase program on Monday, December 16th that permits the company to buyback $500.00 million in shares. This buyback authorization permits the company to buy up to 12.8% of its stock through open market purchases. Stock buyback programs are typically an indication that the company's leadership believes its stock is undervalued.

Analyst Upgrades and Downgrades

Separately, Royal Bank of Canada reiterated a "sector perform" rating and issued a $6.00 target price on shares of Clarivate in a research note on Thursday, February 20th.

Check Out Our Latest Research Report on Clarivate

Clarivate Profile

(

Free Report)

Clarivate Plc operates as an information services provider in the Americas, the Middle East, Africa, Europe, and the Asia Pacific. It operates through three segments: Academia & Government, Life Sciences & Healthcare, and Intellectual Property. The company offers Web of Science and InCites, that analyzes and explores the academic research landscape and manages research information; ProQuest One and Ebook Central that provides comprehensive content collections to institutions in a cost-effective manner; and Alma and Polaris, that manages academic resources and services, connect users, and support research publications.

Further Reading

Before you consider Clarivate, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clarivate wasn't on the list.

While Clarivate currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.