Brown Financial Advisors cut its holdings in Boston Scientific Co. (NYSE:BSX - Free Report) by 33.1% during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 12,374 shares of the medical equipment provider's stock after selling 6,110 shares during the period. Brown Financial Advisors' holdings in Boston Scientific were worth $1,037,000 at the end of the most recent quarter.

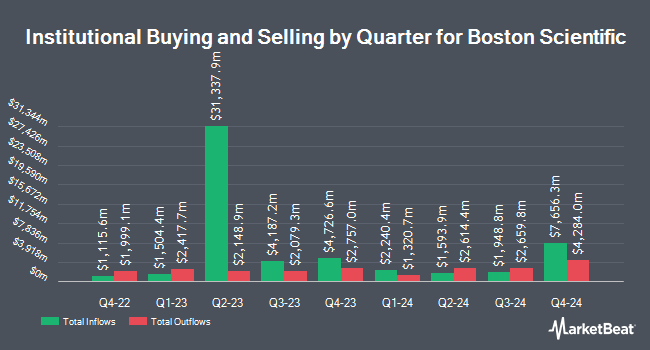

Other institutional investors have also made changes to their positions in the company. Triad Wealth Partners LLC acquired a new position in shares of Boston Scientific during the 2nd quarter worth approximately $26,000. Values First Advisors Inc. acquired a new position in Boston Scientific during the third quarter worth $28,000. Dunhill Financial LLC raised its position in Boston Scientific by 86.4% during the third quarter. Dunhill Financial LLC now owns 328 shares of the medical equipment provider's stock worth $28,000 after acquiring an additional 152 shares in the last quarter. Andra AP fonden acquired a new stake in Boston Scientific in the second quarter valued at $29,000. Finally, E Fund Management Hong Kong Co. Ltd. bought a new position in shares of Boston Scientific in the 3rd quarter valued at about $30,000. Institutional investors own 89.07% of the company's stock.

Insider Activity at Boston Scientific

In other Boston Scientific news, CEO Michael F. Mahoney sold 162,777 shares of the company's stock in a transaction that occurred on Monday, October 7th. The shares were sold at an average price of $84.63, for a total value of $13,775,817.51. Following the completion of the transaction, the chief executive officer now directly owns 1,572,096 shares in the company, valued at approximately $133,046,484.48. This represents a 9.38 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, EVP Wendy Carruthers sold 6,983 shares of Boston Scientific stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $83.86, for a total transaction of $585,594.38. Following the transaction, the executive vice president now owns 34,748 shares in the company, valued at approximately $2,913,967.28. This trade represents a 16.73 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 328,157 shares of company stock valued at $27,957,676 in the last quarter. Insiders own 0.50% of the company's stock.

Wall Street Analyst Weigh In

BSX has been the topic of a number of research analyst reports. Royal Bank of Canada upped their target price on shares of Boston Scientific from $95.00 to $98.00 and gave the company an "outperform" rating in a report on Thursday, October 24th. BTIG Research upped their price objective on Boston Scientific from $84.00 to $93.00 and gave the company a "buy" rating in a research note on Monday, October 14th. Evercore ISI lifted their target price on Boston Scientific from $82.00 to $90.00 and gave the stock an "outperform" rating in a research note on Tuesday, October 1st. TD Cowen increased their price target on Boston Scientific from $86.00 to $100.00 and gave the company a "buy" rating in a research note on Monday, October 21st. Finally, Wells Fargo & Company lifted their price objective on shares of Boston Scientific from $98.00 to $100.00 and gave the stock an "overweight" rating in a research report on Wednesday. Four analysts have rated the stock with a hold rating, nineteen have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, Boston Scientific has an average rating of "Moderate Buy" and a consensus target price of $93.61.

View Our Latest Analysis on BSX

Boston Scientific Price Performance

Shares of BSX stock traded up $0.53 during trading hours on Wednesday, reaching $90.73. The company's stock had a trading volume of 1,192,624 shares, compared to its average volume of 5,981,875. The company has a quick ratio of 1.02, a current ratio of 1.48 and a debt-to-equity ratio of 0.44. Boston Scientific Co. has a fifty-two week low of $54.95 and a fifty-two week high of $91.93. The company has a market capitalization of $133.72 billion, a price-to-earnings ratio of 74.87, a PEG ratio of 2.65 and a beta of 0.80. The firm's 50 day simple moving average is $87.62 and its 200-day simple moving average is $81.55.

Boston Scientific (NYSE:BSX - Get Free Report) last released its earnings results on Wednesday, October 23rd. The medical equipment provider reported $0.63 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.59 by $0.04. Boston Scientific had a return on equity of 17.23% and a net margin of 11.26%. The firm had revenue of $4.21 billion for the quarter, compared to analysts' expectations of $4.04 billion. During the same quarter in the previous year, the business posted $0.50 earnings per share. The business's revenue for the quarter was up 19.3% on a year-over-year basis. Sell-side analysts forecast that Boston Scientific Co. will post 2.46 earnings per share for the current year.

Boston Scientific Profile

(

Free Report)

Boston Scientific Corporation develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide. It operates through two segments, MedSurg and Cardiovascular. The company offers devices to diagnose and treat gastrointestinal and pulmonary conditions, such as resolution clips, biliary stent systems, stents and electrocautery enhanced delivery systems, direct visualization systems, digital catheters, and single-use duodenoscopes; devices to treat urological conditions, including ureteral stents, catheters, baskets, guidewires, sheaths, balloons, single-use digital flexible ureteroscopes, holmium laser systems, artificial urinary sphincter, laser system, fiber, and hydrogel systems; and devices to treat neurological movement disorders and manage chronic pain, such as spinal cord stimulator system, proprietary programming software, radiofrequency generator, indirect decompression systems, practice optimization tools, and deep brain stimulation system.

See Also

Before you consider Boston Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Scientific wasn't on the list.

While Boston Scientific currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.