Bank of Montreal Can raised its stake in Bruker Co. (NASDAQ:BRKR - Free Report) by 31.2% during the third quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 61,138 shares of the medical research company's stock after acquiring an additional 14,547 shares during the period. Bank of Montreal Can's holdings in Bruker were worth $4,321,000 as of its most recent SEC filing.

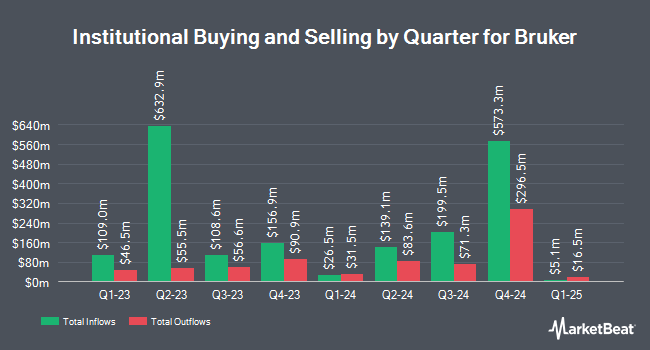

A number of other institutional investors and hedge funds have also made changes to their positions in the business. Nisa Investment Advisors LLC raised its stake in shares of Bruker by 20.0% during the 2nd quarter. Nisa Investment Advisors LLC now owns 991 shares of the medical research company's stock worth $63,000 after acquiring an additional 165 shares in the last quarter. Securian Asset Management Inc. raised its position in shares of Bruker by 2.3% in the second quarter. Securian Asset Management Inc. now owns 7,766 shares of the medical research company's stock valued at $496,000 after buying an additional 175 shares during the last quarter. First Horizon Advisors Inc. increased its position in Bruker by 120.4% during the second quarter. First Horizon Advisors Inc. now owns 399 shares of the medical research company's stock worth $25,000 after purchasing an additional 218 shares during the last quarter. Ameritas Investment Partners Inc. boosted its stake in Bruker by 0.8% during the second quarter. Ameritas Investment Partners Inc. now owns 30,911 shares of the medical research company's stock worth $1,972,000 after buying an additional 235 shares during the period. Finally, EverSource Wealth Advisors LLC boosted its stake in shares of Bruker by 40.7% in the first quarter. EverSource Wealth Advisors LLC now owns 858 shares of the medical research company's stock valued at $81,000 after purchasing an additional 248 shares during the period. 79.52% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at Bruker

In other news, CEO Frank H. Laukien bought 100,000 shares of Bruker stock in a transaction dated Monday, November 18th. The stock was bought at an average price of $50.14 per share, for a total transaction of $5,014,000.00. Following the purchase, the chief executive officer now owns 38,439,563 shares of the company's stock, valued at approximately $1,927,359,688.82. The trade was a 0.26 % increase in their ownership of the stock. The purchase was disclosed in a document filed with the SEC, which is accessible through the SEC website. Company insiders own 28.30% of the company's stock.

Bruker Stock Up 3.4 %

Shares of BRKR traded up $1.95 during mid-day trading on Wednesday, reaching $59.50. The company had a trading volume of 1,328,058 shares, compared to its average volume of 1,114,132. The company has a market capitalization of $9.02 billion, a price-to-earnings ratio of 27.67, a price-to-earnings-growth ratio of 3.92 and a beta of 1.18. Bruker Co. has a 52 week low of $48.07 and a 52 week high of $94.86. The company has a debt-to-equity ratio of 1.24, a quick ratio of 0.73 and a current ratio of 1.66. The firm has a 50-day moving average price of $60.23 and a 200 day moving average price of $63.67.

Bruker (NASDAQ:BRKR - Get Free Report) last issued its quarterly earnings data on Tuesday, November 5th. The medical research company reported $0.60 earnings per share for the quarter, missing analysts' consensus estimates of $0.61 by ($0.01). The firm had revenue of $864.40 million for the quarter, compared to analysts' expectations of $866.46 million. Bruker had a net margin of 9.41% and a return on equity of 21.52%. The company's revenue for the quarter was up 16.4% on a year-over-year basis. During the same quarter in the previous year, the business earned $0.74 EPS. On average, sell-side analysts forecast that Bruker Co. will post 2.4 EPS for the current year.

Bruker Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Monday, December 2nd will be issued a $0.05 dividend. The ex-dividend date of this dividend is Monday, December 2nd. This represents a $0.20 annualized dividend and a yield of 0.34%. Bruker's payout ratio is 9.62%.

Analyst Ratings Changes

A number of research firms have weighed in on BRKR. Citigroup cut their price objective on shares of Bruker from $80.00 to $75.00 and set a "buy" rating on the stock in a report on Wednesday, November 6th. Barclays cut their target price on shares of Bruker from $75.00 to $69.00 and set an "overweight" rating for the company in a research note on Wednesday, November 6th. Wolfe Research cut Bruker from an "outperform" rating to a "peer perform" rating in a report on Monday, September 30th. TD Cowen dropped their price target on shares of Bruker from $72.00 to $70.00 and set a "hold" rating for the company in a research note on Wednesday, November 6th. Finally, Wells Fargo & Company dropped their price objective on shares of Bruker from $78.00 to $75.00 and set an "overweight" rating on the stock in a research note on Wednesday, November 6th. One analyst has rated the stock with a sell rating, four have assigned a hold rating and seven have given a buy rating to the stock. According to MarketBeat, Bruker presently has an average rating of "Moderate Buy" and an average price target of $79.36.

Read Our Latest Stock Analysis on BRKR

About Bruker

(

Free Report)

Bruker Corporation, together with its subsidiaries, develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally. The company operates through four segments: Bruker Scientific Instruments (BSI) BioSpin, BSI CALID, BSI Nano, and Bruker Energy & Supercon Technologies.

Further Reading

Before you consider Bruker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bruker wasn't on the list.

While Bruker currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.