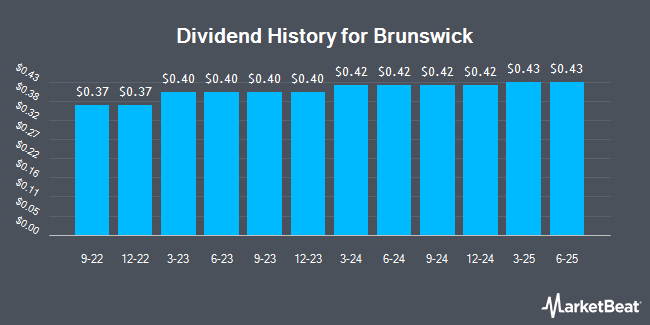

Brunswick Co. (NYSE:BC - Get Free Report) announced a quarterly dividend on Thursday, February 13th,RTT News reports. Stockholders of record on Monday, February 24th will be paid a dividend of 0.43 per share on Friday, March 14th. This represents a $1.72 annualized dividend and a dividend yield of 2.62%. The ex-dividend date of this dividend is Monday, February 24th. This is a boost from Brunswick's previous quarterly dividend of $0.42.

Brunswick has raised its dividend by an average of 9.6% annually over the last three years and has increased its dividend every year for the last 12 years. Brunswick has a dividend payout ratio of 32.5% meaning its dividend is sufficiently covered by earnings. Equities analysts expect Brunswick to earn $5.36 per share next year, which means the company should continue to be able to cover its $1.72 annual dividend with an expected future payout ratio of 32.1%.

Brunswick Price Performance

Shares of NYSE:BC traded up $0.57 during trading on Monday, hitting $65.55. 441,920 shares of the stock were exchanged, compared to its average volume of 744,441. Brunswick has a 12-month low of $62.64 and a 12-month high of $96.65. The company has a current ratio of 1.65, a quick ratio of 0.63 and a debt-to-equity ratio of 1.11. The company has a fifty day moving average price of $67.50 and a two-hundred day moving average price of $75.56. The company has a market cap of $4.33 billion, a PE ratio of 34.50 and a beta of 1.54.

Brunswick (NYSE:BC - Get Free Report) last posted its earnings results on Thursday, January 30th. The company reported $0.24 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.18 by $0.06. Brunswick had a return on equity of 15.41% and a net margin of 2.48%. During the same period last year, the company posted $1.45 EPS. On average, analysts forecast that Brunswick will post 4.2 EPS for the current year.

Insider Buying and Selling

In other Brunswick news, Director Nancy E. Cooper sold 433 shares of Brunswick stock in a transaction that occurred on Monday, February 3rd. The shares were sold at an average price of $65.65, for a total transaction of $28,426.45. Following the transaction, the director now directly owns 25,361 shares in the company, valued at approximately $1,664,949.65. The trade was a 1.68 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Company insiders own 0.81% of the company's stock.

Analysts Set New Price Targets

A number of analysts recently weighed in on BC shares. Roth Mkm decreased their price target on shares of Brunswick from $91.00 to $85.00 and set a "buy" rating for the company in a research report on Friday, January 24th. Citigroup decreased their price target on shares of Brunswick from $92.00 to $85.00 and set a "buy" rating for the company in a research report on Tuesday, January 28th. DA Davidson decreased their price objective on shares of Brunswick from $80.00 to $60.00 and set a "neutral" rating for the company in a research report on Wednesday, January 22nd. Benchmark decreased their price objective on shares of Brunswick from $100.00 to $90.00 and set a "buy" rating for the company in a research report on Friday, January 31st. Finally, Truist Financial dropped their price objective on shares of Brunswick from $90.00 to $85.00 and set a "buy" rating on the stock in a research note on Tuesday, January 7th. Six research analysts have rated the stock with a hold rating and seven have given a buy rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $81.85.

Check Out Our Latest Research Report on Brunswick

Brunswick Company Profile

(

Get Free Report)

Brunswick Corporation designs, manufactures, and markets recreation products in the United States, Europe, the Asia-Pacific, Canada, and internationally. It operates through four segments: Propulsion, Engine P&A, Navico Group, and Boat. The Propulsion segment provides outboard, sterndrive, inboard engines, propulsion-related controls, rigging, and propellers for boat builders through marine retail dealers under the Mercury, Mercury MerCruiser, Mariner, Mercury Racing, Mercury Diesel, Avator, and Fliteboard brands.

Recommended Stories

Before you consider Brunswick, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brunswick wasn't on the list.

While Brunswick currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.