Bryce Point Capital LLC bought a new position in VeriSign, Inc. (NASDAQ:VRSN - Free Report) during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm bought 4,156 shares of the information services provider's stock, valued at approximately $860,000.

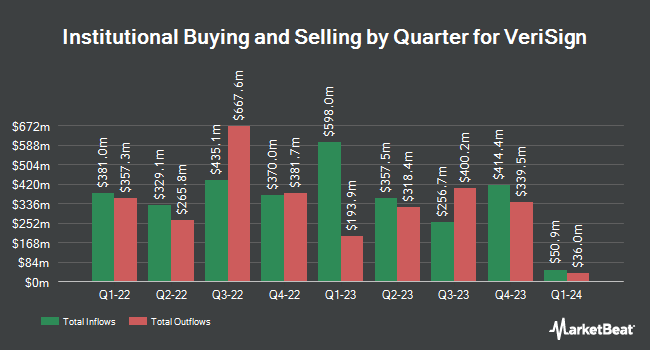

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. Franklin Resources Inc. increased its holdings in VeriSign by 15.4% during the fourth quarter. Franklin Resources Inc. now owns 117,807 shares of the information services provider's stock valued at $24,381,000 after buying an additional 15,765 shares during the last quarter. O Shaughnessy Asset Management LLC raised its holdings in VeriSign by 39.9% during the fourth quarter. O Shaughnessy Asset Management LLC now owns 2,340 shares of the information services provider's stock valued at $484,000 after acquiring an additional 667 shares during the period. Physician Wealth Advisors Inc. purchased a new position in VeriSign in the 4th quarter worth approximately $54,000. Arrowstreet Capital Limited Partnership boosted its stake in VeriSign by 10.0% in the 4th quarter. Arrowstreet Capital Limited Partnership now owns 1,284,759 shares of the information services provider's stock worth $265,894,000 after purchasing an additional 116,833 shares during the period. Finally, Allianz SE purchased a new stake in VeriSign during the 4th quarter valued at approximately $1,420,000. Hedge funds and other institutional investors own 92.90% of the company's stock.

VeriSign Stock Up 3.0 %

NASDAQ VRSN traded up $7.12 during trading hours on Tuesday, hitting $241.61. 224,322 shares of the company were exchanged, compared to its average volume of 733,209. The stock has a market cap of $22.86 billion, a PE ratio of 30.24 and a beta of 0.87. VeriSign, Inc. has a 52 week low of $167.05 and a 52 week high of $258.67. The stock has a 50-day moving average price of $235.13 and a 200 day moving average price of $207.56.

VeriSign (NASDAQ:VRSN - Get Free Report) last issued its quarterly earnings results on Thursday, February 6th. The information services provider reported $2.00 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $2.00. VeriSign had a negative return on equity of 43.01% and a net margin of 50.47%.

Wall Street Analyst Weigh In

VRSN has been the topic of a number of research reports. Baird R W upgraded shares of VeriSign from a "hold" rating to a "strong-buy" rating in a report on Monday, December 9th. StockNews.com upgraded VeriSign from a "hold" rating to a "buy" rating in a research report on Thursday, April 3rd. Robert W. Baird lifted their price objective on VeriSign from $255.00 to $275.00 and gave the stock an "outperform" rating in a research note on Tuesday, April 1st. Finally, Citigroup raised their target price on shares of VeriSign from $246.00 to $250.00 and gave the company a "buy" rating in a report on Tuesday, February 4th.

View Our Latest Analysis on VeriSign

Insider Activity at VeriSign

In other news, SVP John Calys sold 447 shares of the business's stock in a transaction on Monday, February 24th. The shares were sold at an average price of $231.75, for a total transaction of $103,592.25. Following the completion of the sale, the senior vice president now directly owns 23,735 shares of the company's stock, valued at approximately $5,500,586.25. The trade was a 1.85 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. 0.84% of the stock is currently owned by insiders.

VeriSign Company Profile

(

Free Report)

VeriSign, Inc, together with its subsidiaries, provides domain name registry services and internet infrastructure that enables internet navigation for various recognized domain names worldwide. The company enables the security, stability, and resiliency of internet infrastructure and services, including providing root zone maintainer services, operating two of thirteen internet root servers; and offering registration services and authoritative resolution for the .com and .net domains, which supports global e-commerce.

Read More

Before you consider VeriSign, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and VeriSign wasn't on the list.

While VeriSign currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.