Cipher Mining (NASDAQ:CIFR - Free Report) had its target price upped by BTIG Research from $6.00 to $9.00 in a report released on Friday morning,Benzinga reports. BTIG Research currently has a buy rating on the stock.

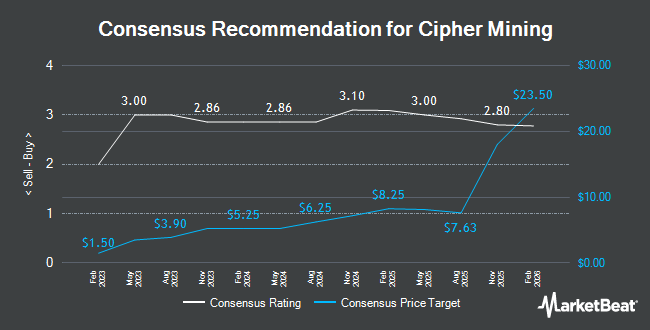

A number of other equities analysts have also recently issued reports on CIFR. Macquarie increased their target price on shares of Cipher Mining from $6.00 to $7.25 and gave the company an "outperform" rating in a report on Thursday, November 7th. Canaccord Genuity Group restated a "buy" rating and set a $7.00 target price on shares of Cipher Mining in a report on Friday, November 1st. Compass Point raised their price target on Cipher Mining from $7.50 to $9.00 and gave the stock a "buy" rating in a research report on Thursday, August 15th. Cantor Fitzgerald reiterated an "overweight" rating and issued a $9.00 price objective on shares of Cipher Mining in a research report on Thursday, October 3rd. Finally, HC Wainwright restated a "buy" rating and issued a $7.00 target price on shares of Cipher Mining in a report on Friday, November 1st. Eight equities research analysts have rated the stock with a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Buy" and a consensus price target of $7.72.

Get Our Latest Analysis on Cipher Mining

Cipher Mining Stock Performance

Shares of NASDAQ:CIFR traded up $0.21 during mid-day trading on Friday, reaching $6.63. The company had a trading volume of 5,921,416 shares, compared to its average volume of 9,355,338. The company has a current ratio of 2.57, a quick ratio of 2.57 and a debt-to-equity ratio of 0.01. The company's 50-day moving average price is $4.61 and its 200-day moving average price is $4.43. Cipher Mining has a one year low of $2.15 and a one year high of $7.99. The firm has a market cap of $2.31 billion, a price-to-earnings ratio of -51.00 and a beta of 2.18.

Cipher Mining (NASDAQ:CIFR - Get Free Report) last posted its quarterly earnings results on Thursday, October 31st. The company reported ($0.26) EPS for the quarter, missing analysts' consensus estimates of ($0.08) by ($0.18). Cipher Mining had a negative return on equity of 8.29% and a negative net margin of 33.39%. The company had revenue of $24.10 million during the quarter, compared to the consensus estimate of $25.84 million. During the same period in the previous year, the business earned ($0.07) earnings per share. As a group, equities research analysts anticipate that Cipher Mining will post -0.18 EPS for the current fiscal year.

Insiders Place Their Bets

In other news, insider William Iwaschuk sold 150,000 shares of Cipher Mining stock in a transaction on Wednesday, September 25th. The shares were sold at an average price of $3.94, for a total transaction of $591,000.00. Following the transaction, the insider now owns 619,148 shares in the company, valued at $2,439,443.12. This trade represents a 19.50 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, major shareholder Top Holdco B.V. Bitfury sold 1,901,112 shares of the business's stock in a transaction on Friday, September 6th. The shares were sold at an average price of $2.74, for a total transaction of $5,209,046.88. Following the sale, the insider now directly owns 103,946,004 shares of the company's stock, valued at approximately $284,812,050.96. The trade was a 1.80 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 7,296,839 shares of company stock valued at $25,974,602. 2.25% of the stock is owned by insiders.

Institutional Trading of Cipher Mining

Hedge funds and other institutional investors have recently modified their holdings of the company. Geode Capital Management LLC grew its holdings in Cipher Mining by 37.8% during the 3rd quarter. Geode Capital Management LLC now owns 5,509,853 shares of the company's stock valued at $21,327,000 after buying an additional 1,511,455 shares in the last quarter. Barclays PLC boosted its position in shares of Cipher Mining by 377.2% during the third quarter. Barclays PLC now owns 296,493 shares of the company's stock worth $1,147,000 after acquiring an additional 234,366 shares during the last quarter. State Street Corp grew its stake in Cipher Mining by 17.3% during the third quarter. State Street Corp now owns 6,919,189 shares of the company's stock valued at $26,777,000 after acquiring an additional 1,019,949 shares in the last quarter. Paloma Partners Management Co bought a new stake in Cipher Mining in the 3rd quarter valued at $4,029,000. Finally, Verition Fund Management LLC increased its holdings in Cipher Mining by 30.7% in the 3rd quarter. Verition Fund Management LLC now owns 13,130 shares of the company's stock valued at $51,000 after acquiring an additional 3,086 shares during the last quarter. 12.26% of the stock is owned by hedge funds and other institutional investors.

Cipher Mining Company Profile

(

Get Free Report)

Cipher Mining Inc, together with its subsidiaries, engages in the development and operation of industrial scale bitcoin mining data centers in the United States. The company was incorporated in 2020 and is based in New York, New York. Cipher Mining Inc operates as a subsidiary of Bitfury Holding B.V.

Read More

Before you consider Cipher Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cipher Mining wasn't on the list.

While Cipher Mining currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.