Upwork (NASDAQ:UPWK - Get Free Report) had its price target hoisted by investment analysts at BTIG Research from $14.00 to $16.00 in a research report issued on Thursday,Benzinga reports. The firm presently has a "buy" rating on the stock. BTIG Research's price target indicates a potential downside of 1.17% from the stock's previous close.

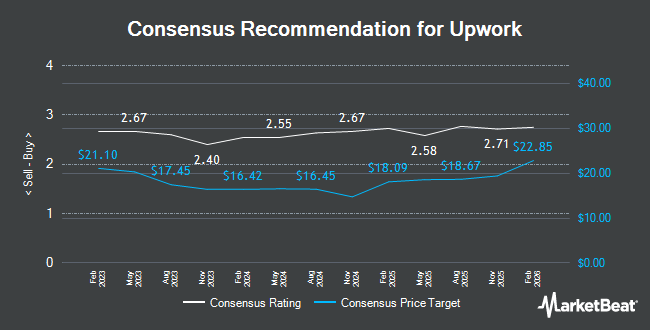

Other equities research analysts have also recently issued reports about the company. Canaccord Genuity Group lowered their price objective on Upwork from $19.00 to $15.00 and set a "buy" rating on the stock in a research note on Thursday, August 8th. UBS Group lowered their price target on Upwork from $12.00 to $11.00 and set a "neutral" rating on the stock in a report on Thursday, August 8th. Roth Mkm raised their target price on shares of Upwork from $13.00 to $20.00 and gave the company a "buy" rating in a research note on Thursday. Piper Sandler reiterated an "overweight" rating and set a $18.00 price objective (up from $13.00) on shares of Upwork in a research report on Thursday. Finally, Citigroup cut their price objective on shares of Upwork from $13.00 to $11.00 and set a "neutral" rating for the company in a research note on Wednesday, September 25th. Three investment analysts have rated the stock with a hold rating and eight have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $17.00.

Read Our Latest Stock Report on Upwork

Upwork Stock Up 11.0 %

Shares of NASDAQ UPWK traded up $1.61 during trading on Thursday, hitting $16.19. 7,803,205 shares of the company traded hands, compared to its average volume of 2,154,868. Upwork has a fifty-two week low of $8.43 and a fifty-two week high of $17.79. The business's fifty day moving average is $10.86 and its 200 day moving average is $10.92. The company has a debt-to-equity ratio of 0.99, a quick ratio of 3.00 and a current ratio of 3.00. The firm has a market capitalization of $2.14 billion, a price-to-earnings ratio of 29.80 and a beta of 1.49.

Upwork (NASDAQ:UPWK - Get Free Report) last released its quarterly earnings results on Wednesday, August 7th. The company reported $0.26 earnings per share for the quarter, beating analysts' consensus estimates of $0.23 by $0.03. The company had revenue of $193.13 million for the quarter, compared to analyst estimates of $193.05 million. Upwork had a net margin of 10.00% and a return on equity of 20.75%. The firm's revenue was up 14.5% on a year-over-year basis. During the same period last year, the firm earned ($0.03) earnings per share. Equities research analysts predict that Upwork will post 0.51 earnings per share for the current fiscal year.

Insiders Place Their Bets

In related news, VP Dave Bottoms sold 5,818 shares of the stock in a transaction that occurred on Tuesday, August 27th. The shares were sold at an average price of $9.81, for a total transaction of $57,074.58. Following the completion of the sale, the vice president now owns 5,818 shares of the company's stock, valued at $57,074.58. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. In other news, VP Dave Bottoms sold 5,818 shares of the stock in a transaction dated Tuesday, August 27th. The shares were sold at an average price of $9.81, for a total transaction of $57,074.58. Following the sale, the vice president now directly owns 5,818 shares of the company's stock, valued at $57,074.58. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, CFO Erica Gessert sold 20,353 shares of the firm's stock in a transaction dated Monday, August 19th. The shares were sold at an average price of $9.65, for a total transaction of $196,406.45. Following the completion of the transaction, the chief financial officer now directly owns 107,313 shares in the company, valued at $1,035,570.45. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 176,783 shares of company stock worth $1,800,221 in the last ninety days. 7.60% of the stock is owned by company insiders.

Institutional Investors Weigh In On Upwork

A number of hedge funds have recently bought and sold shares of UPWK. Vanguard Group Inc. raised its holdings in Upwork by 5.1% in the first quarter. Vanguard Group Inc. now owns 15,996,306 shares of the company's stock valued at $196,115,000 after acquiring an additional 770,088 shares in the last quarter. Divisadero Street Capital Management LP lifted its position in shares of Upwork by 32.9% during the 2nd quarter. Divisadero Street Capital Management LP now owns 3,320,912 shares of the company's stock worth $35,700,000 after purchasing an additional 822,518 shares during the last quarter. Dimensional Fund Advisors LP raised its stake in Upwork by 27.4% in the second quarter. Dimensional Fund Advisors LP now owns 1,806,969 shares of the company's stock valued at $19,424,000 after buying an additional 389,006 shares in the last quarter. Acadian Asset Management LLC increased its position in shares of Upwork by 71.0% during the second quarter. Acadian Asset Management LLC now owns 1,635,602 shares of the company's stock worth $17,572,000 after purchasing an additional 679,028 shares in the last quarter. Finally, Invenomic Capital Management LP raised its position in Upwork by 132.5% in the 1st quarter. Invenomic Capital Management LP now owns 964,641 shares of the company's stock valued at $11,826,000 after purchasing an additional 549,733 shares during the last quarter. Institutional investors and hedge funds own 77.71% of the company's stock.

Upwork Company Profile

(

Get Free Report)

Upwork Inc, together with its subsidiaries, operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally. The company's work marketplace provides access to talent with various skills across a range of categories, including administrative support, sales and marketing, design and creative, and customer service, as well as web, mobile, and software development.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Upwork, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Upwork wasn't on the list.

While Upwork currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.