Buck Wealth Strategies LLC increased its holdings in Watsco, Inc. (NYSE:WSO - Free Report) by 29.5% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 17,450 shares of the construction company's stock after purchasing an additional 3,973 shares during the quarter. Buck Wealth Strategies LLC's holdings in Watsco were worth $8,269,000 at the end of the most recent quarter.

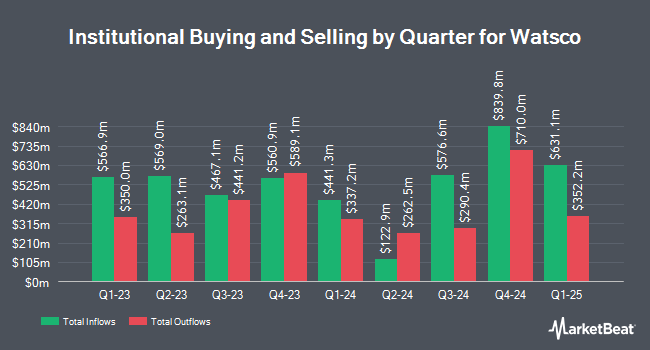

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. SG Americas Securities LLC purchased a new position in Watsco in the 3rd quarter worth about $282,000. GAMMA Investing LLC boosted its holdings in shares of Watsco by 37.2% in the third quarter. GAMMA Investing LLC now owns 491 shares of the construction company's stock worth $242,000 after buying an additional 133 shares during the period. Atomi Financial Group Inc. increased its position in shares of Watsco by 105.7% in the third quarter. Atomi Financial Group Inc. now owns 973 shares of the construction company's stock worth $479,000 after acquiring an additional 500 shares in the last quarter. CWM LLC raised its holdings in shares of Watsco by 2.6% during the third quarter. CWM LLC now owns 952 shares of the construction company's stock valued at $468,000 after acquiring an additional 24 shares during the period. Finally, LVW Advisors LLC lifted its position in shares of Watsco by 12.5% in the 3rd quarter. LVW Advisors LLC now owns 1,926 shares of the construction company's stock valued at $947,000 after acquiring an additional 214 shares in the last quarter. 89.71% of the stock is owned by institutional investors and hedge funds.

Watsco Stock Up 0.7 %

Shares of Watsco stock traded up $3.03 on Monday, hitting $468.16. 148,167 shares of the company traded hands, compared to its average volume of 209,378. Watsco, Inc. has a 12-month low of $373.33 and a 12-month high of $571.41. The company has a market cap of $18.91 billion, a PE ratio of 36.18 and a beta of 0.95. The company has a 50-day moving average price of $491.50 and a 200 day moving average price of $491.80.

Watsco Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, January 31st. Shareholders of record on Friday, January 17th were given a $2.70 dividend. This represents a $10.80 annualized dividend and a yield of 2.31%. The ex-dividend date was Friday, January 17th. Watsco's payout ratio is currently 83.46%.

Wall Street Analysts Forecast Growth

WSO has been the topic of several research analyst reports. Robert W. Baird lowered their price objective on shares of Watsco from $550.00 to $540.00 and set an "outperform" rating on the stock in a research report on Thursday, October 24th. Raymond James began coverage on Watsco in a research report on Friday, January 17th. They set a "market perform" rating on the stock. Finally, Northcoast Research assumed coverage on Watsco in a research note on Friday, November 22nd. They issued a "neutral" rating for the company. Three investment analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. According to MarketBeat.com, Watsco currently has an average rating of "Hold" and a consensus target price of $488.33.

Check Out Our Latest Report on WSO

Insider Transactions at Watsco

In related news, EVP Barry S. Logan sold 10,998 shares of the stock in a transaction that occurred on Wednesday, December 18th. The stock was sold at an average price of $508.21, for a total value of $5,589,293.58. The transaction was disclosed in a filing with the SEC, which is available at this link. Company insiders own 12.86% of the company's stock.

About Watsco

(

Free Report)

Watsco, Inc, together with its subsidiaries, engages in the distribution of air conditioning, heating, refrigeration equipment, and related parts and supplies in the United States and internationally. The company distributes equipment, including residential ducted and ductless air conditioners, such as gas, electric, and oil furnaces; commercial air conditioning and heating equipment systems; and other specialized equipment.

Recommended Stories

Before you consider Watsco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Watsco wasn't on the list.

While Watsco currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.