Buck Wealth Strategies LLC lowered its holdings in shares of Phillips 66 (NYSE:PSX - Free Report) by 9.7% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 43,685 shares of the oil and gas company's stock after selling 4,678 shares during the quarter. Buck Wealth Strategies LLC's holdings in Phillips 66 were worth $5,742,000 at the end of the most recent quarter.

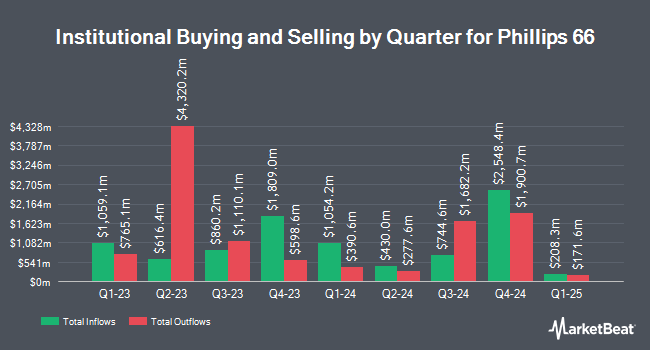

Other hedge funds have also recently bought and sold shares of the company. Bleakley Financial Group LLC lifted its stake in Phillips 66 by 4.9% during the first quarter. Bleakley Financial Group LLC now owns 8,649 shares of the oil and gas company's stock worth $1,413,000 after purchasing an additional 407 shares during the last quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. increased its holdings in Phillips 66 by 10.7% in the first quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 58,808 shares of the oil and gas company's stock valued at $9,606,000 after purchasing an additional 5,690 shares during the period. State Board of Administration of Florida Retirement System increased its holdings in Phillips 66 by 10.0% in the first quarter. State Board of Administration of Florida Retirement System now owns 556,671 shares of the oil and gas company's stock valued at $90,927,000 after purchasing an additional 50,744 shares during the period. Mitsubishi UFJ Asset Management Co. Ltd. increased its holdings in Phillips 66 by 20.4% in the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 520,500 shares of the oil and gas company's stock valued at $85,018,000 after purchasing an additional 88,160 shares during the period. Finally, Delta Investment Management LLC increased its holdings in Phillips 66 by 5.0% in the first quarter. Delta Investment Management LLC now owns 2,192 shares of the oil and gas company's stock valued at $358,000 after purchasing an additional 105 shares during the period. 76.93% of the stock is currently owned by institutional investors.

Phillips 66 Price Performance

PSX traded up $2.30 during trading on Wednesday, hitting $130.00. 710,510 shares of the company traded hands, compared to its average volume of 2,660,535. Phillips 66 has a 1 year low of $111.90 and a 1 year high of $174.08. The company has a market cap of $53.69 billion, a PE ratio of 16.38, a P/E/G ratio of 4.18 and a beta of 1.33. The stock's 50-day simple moving average is $129.73 and its two-hundred day simple moving average is $136.04. The company has a current ratio of 1.21, a quick ratio of 0.83 and a debt-to-equity ratio of 0.62.

Phillips 66 (NYSE:PSX - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The oil and gas company reported $2.04 EPS for the quarter, topping analysts' consensus estimates of $1.63 by $0.41. Phillips 66 had a net margin of 2.24% and a return on equity of 13.12%. The business had revenue of $36.16 billion during the quarter, compared to analysts' expectations of $36.31 billion. During the same period last year, the company posted $4.63 EPS. The business's revenue was down 10.3% on a year-over-year basis. As a group, sell-side analysts anticipate that Phillips 66 will post 7.63 earnings per share for the current fiscal year.

Phillips 66 Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, December 2nd. Shareholders of record on Monday, November 18th will be paid a $1.15 dividend. The ex-dividend date of this dividend is Monday, November 18th. This represents a $4.60 dividend on an annualized basis and a dividend yield of 3.54%. Phillips 66's payout ratio is currently 59.05%.

Insiders Place Their Bets

In other news, CFO Kevin J. Mitchell sold 30,000 shares of the firm's stock in a transaction dated Thursday, August 15th. The shares were sold at an average price of $139.01, for a total value of $4,170,300.00. Following the completion of the sale, the chief financial officer now owns 81,937 shares in the company, valued at approximately $11,390,062.37. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Corporate insiders own 0.22% of the company's stock.

Analyst Ratings Changes

A number of analysts recently weighed in on PSX shares. Scotiabank decreased their price objective on Phillips 66 from $145.00 to $136.00 and set a "sector outperform" rating for the company in a report on Thursday, October 10th. Mizuho decreased their price target on Phillips 66 from $154.00 to $150.00 and set a "neutral" rating for the company in a report on Monday, September 16th. JPMorgan Chase & Co. decreased their price target on Phillips 66 from $160.00 to $141.00 and set an "overweight" rating for the company in a report on Wednesday, October 2nd. Barclays decreased their price target on Phillips 66 from $133.00 to $124.00 and set an "equal weight" rating for the company in a report on Monday. Finally, Piper Sandler set a $144.00 target price on Phillips 66 in a research note on Thursday, October 17th. Five analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $149.69.

Check Out Our Latest Stock Report on Phillips 66

About Phillips 66

(

Free Report)

Phillips 66 operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally. It operates through four segments: Midstream, Chemicals, Refining, and Marketing and Specialties (M&S). The Midstream segment transports crude oil and other feedstocks; delivers refined petroleum products to market; provides terminaling and storage services for crude oil and refined petroleum products; transports, stores, fractionates, exports, and markets natural gas liquids; provides other fee-based processing services; and gathers, processes, transports, and markets natural gas.

Recommended Stories

Before you consider Phillips 66, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Phillips 66 wasn't on the list.

While Phillips 66 currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.