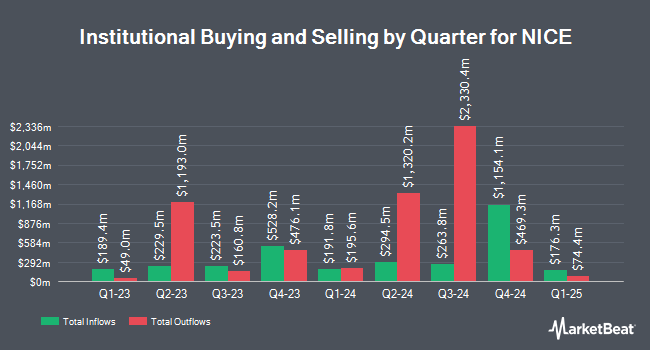

Buckingham Capital Management Inc. lifted its holdings in shares of NICE Ltd. (NASDAQ:NICE - Free Report) by 43.5% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 19,214 shares of the technology company's stock after buying an additional 5,829 shares during the period. Buckingham Capital Management Inc.'s holdings in NICE were worth $3,337,000 at the end of the most recent reporting period.

Other hedge funds have also modified their holdings of the company. B. Riley Wealth Advisors Inc. grew its position in NICE by 4.8% during the first quarter. B. Riley Wealth Advisors Inc. now owns 1,408 shares of the technology company's stock worth $367,000 after buying an additional 65 shares during the period. Aurora Investment Counsel grew its holdings in shares of NICE by 0.7% in the 2nd quarter. Aurora Investment Counsel now owns 10,906 shares of the technology company's stock worth $1,876,000 after acquiring an additional 80 shares during the period. Financial Perspectives Inc increased its stake in NICE by 17.8% in the 2nd quarter. Financial Perspectives Inc now owns 569 shares of the technology company's stock valued at $98,000 after purchasing an additional 86 shares in the last quarter. Mendota Financial Group LLC raised its holdings in NICE by 11.4% during the third quarter. Mendota Financial Group LLC now owns 841 shares of the technology company's stock worth $146,000 after purchasing an additional 86 shares during the last quarter. Finally, Legacy Advisors LLC boosted its position in NICE by 1.3% during the second quarter. Legacy Advisors LLC now owns 6,678 shares of the technology company's stock worth $1,148,000 after purchasing an additional 88 shares in the last quarter. 63.34% of the stock is owned by institutional investors and hedge funds.

NICE Trading Up 1.1 %

Shares of NICE traded up $2.08 during mid-day trading on Monday, reaching $192.07. The company had a trading volume of 584,128 shares, compared to its average volume of 505,684. NICE Ltd. has a fifty-two week low of $151.52 and a fifty-two week high of $270.73. The firm has a fifty day simple moving average of $170.69 and a 200-day simple moving average of $179.01. The stock has a market cap of $12.08 billion, a price-to-earnings ratio of 31.72, a price-to-earnings-growth ratio of 1.54 and a beta of 1.04. The company has a current ratio of 2.45, a quick ratio of 2.45 and a debt-to-equity ratio of 0.13.

NICE (NASDAQ:NICE - Get Free Report) last posted its quarterly earnings results on Thursday, August 15th. The technology company reported $2.64 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.58 by $0.06. The firm had revenue of $664.40 million during the quarter, compared to the consensus estimate of $664.10 million. NICE had a return on equity of 14.68% and a net margin of 15.55%. The firm's quarterly revenue was up 14.3% compared to the same quarter last year. During the same quarter in the previous year, the business earned $1.63 earnings per share. On average, sell-side analysts anticipate that NICE Ltd. will post 8.5 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

NICE has been the topic of several recent research reports. JMP Securities reaffirmed a "market outperform" rating and issued a $300.00 price target on shares of NICE in a report on Friday, August 16th. Northland Securities dropped their price target on NICE from $305.00 to $275.00 and set an "outperform" rating for the company in a research report on Friday, August 16th. Rosenblatt Securities restated a "buy" rating and issued a $225.00 price objective on shares of NICE in a research report on Tuesday, August 13th. Royal Bank of Canada reiterated an "outperform" rating and set a $260.00 price objective on shares of NICE in a research report on Thursday, October 3rd. Finally, Barclays reduced their target price on shares of NICE from $320.00 to $286.00 and set an "overweight" rating on the stock in a report on Thursday, July 25th. Sixteen equities research analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, NICE presently has a consensus rating of "Buy" and an average price target of $269.64.

Check Out Our Latest Stock Analysis on NICE

NICE Profile

(

Free Report)

NICE Ltd., together with its subsidiaries, provides cloud platforms for AI-driven digital business solutions worldwide. It offers CXone, a cloud native open platform; Enlighten, an AI engine for the customer engagement market; and smart self service enable organizations to address consumers' needs; and journey orchestration solutions that empower organizations to connect and route customers to deal with the customer's request, and connects them using real time AI-based routing.

Read More

Before you consider NICE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NICE wasn't on the list.

While NICE currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.