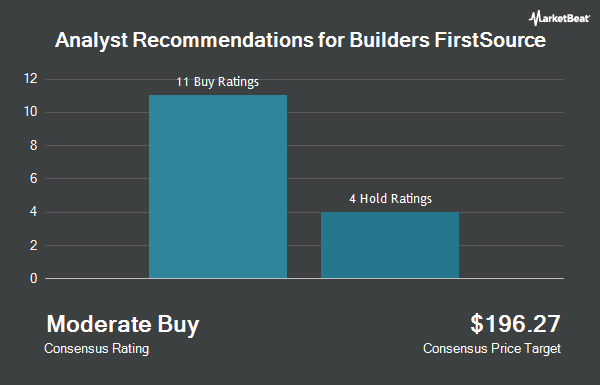

Shares of Builders FirstSource, Inc. (NYSE:BLDR - Get Free Report) have earned an average recommendation of "Moderate Buy" from the eighteen brokerages that are presently covering the firm, MarketBeat reports. Three investment analysts have rated the stock with a hold rating, fourteen have issued a buy rating and one has assigned a strong buy rating to the company. The average 12-month price objective among brokers that have updated their coverage on the stock in the last year is $210.00.

BLDR has been the topic of several recent analyst reports. Barclays increased their target price on shares of Builders FirstSource from $182.00 to $211.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 9th. Stephens lifted their price objective on Builders FirstSource from $178.00 to $200.00 and gave the company an "overweight" rating in a research note on Thursday, November 7th. Jefferies Financial Group boosted their target price on Builders FirstSource from $185.00 to $223.00 and gave the stock a "buy" rating in a research report on Wednesday, October 9th. The Goldman Sachs Group assumed coverage on Builders FirstSource in a report on Thursday, October 10th. They issued a "buy" rating and a $225.00 price target on the stock. Finally, Wedbush reissued an "outperform" rating and set a $230.00 price objective on shares of Builders FirstSource in a report on Wednesday.

Check Out Our Latest Research Report on BLDR

Builders FirstSource Stock Performance

Builders FirstSource stock traded down $5.74 during midday trading on Thursday, reaching $146.29. The stock had a trading volume of 2,432,762 shares, compared to its average volume of 1,537,213. The firm has a market capitalization of $16.84 billion, a PE ratio of 14.29, a P/E/G ratio of 0.96 and a beta of 2.06. Builders FirstSource has a 12 month low of $130.75 and a 12 month high of $214.70. The company has a quick ratio of 1.16, a current ratio of 1.77 and a debt-to-equity ratio of 0.83. The firm's 50-day moving average price is $179.54 and its 200 day moving average price is $169.01.

Builders FirstSource (NYSE:BLDR - Get Free Report) last released its quarterly earnings data on Tuesday, November 5th. The company reported $3.07 earnings per share for the quarter, missing analysts' consensus estimates of $3.09 by ($0.02). The business had revenue of $4.23 billion during the quarter, compared to analysts' expectations of $4.44 billion. Builders FirstSource had a net margin of 7.40% and a return on equity of 33.55%. The firm's quarterly revenue was down 6.7% on a year-over-year basis. During the same quarter in the prior year, the firm posted $4.24 earnings per share. As a group, research analysts predict that Builders FirstSource will post 11.55 earnings per share for the current fiscal year.

Insider Transactions at Builders FirstSource

In other news, Director Cleveland A. Christophe sold 10,000 shares of the firm's stock in a transaction that occurred on Thursday, November 7th. The stock was sold at an average price of $178.41, for a total value of $1,784,100.00. Following the completion of the transaction, the director now owns 33,083 shares in the company, valued at $5,902,338.03. This trade represents a 23.21 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Corporate insiders own 1.80% of the company's stock.

Institutional Investors Weigh In On Builders FirstSource

Several hedge funds have recently bought and sold shares of the business. Forsta AP Fonden boosted its holdings in Builders FirstSource by 12.1% in the third quarter. Forsta AP Fonden now owns 26,800 shares of the company's stock worth $5,195,000 after acquiring an additional 2,900 shares in the last quarter. Raymond James Financial Services Advisors Inc. boosted its stake in Builders FirstSource by 18.6% in the 2nd quarter. Raymond James Financial Services Advisors Inc. now owns 115,995 shares of the company's stock worth $16,055,000 after purchasing an additional 18,223 shares in the last quarter. Charles Schwab Investment Management Inc. grew its position in Builders FirstSource by 2.1% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 785,842 shares of the company's stock valued at $152,343,000 after purchasing an additional 16,000 shares during the last quarter. AMF Tjanstepension AB bought a new stake in Builders FirstSource during the 3rd quarter valued at about $1,471,000. Finally, Brophy Wealth Management LLC purchased a new position in Builders FirstSource in the third quarter worth about $894,000. Institutional investors own 95.53% of the company's stock.

Builders FirstSource Company Profile

(

Get Free ReportBuilders FirstSource, Inc, together with its subsidiaries, manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States. It offers lumber and lumber sheet goods comprising dimensional lumber, plywood, and oriented strand board products that are used in on-site house framing; manufactured products, such as wood floor and roof trusses, floor trusses, wall panels, stairs, and engineered wood products; and windows, and interior and exterior door units, as well as interior trims and custom products comprising intricate mouldings, stair parts, and columns under the Synboard brand name.

Further Reading

Before you consider Builders FirstSource, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Builders FirstSource wasn't on the list.

While Builders FirstSource currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.