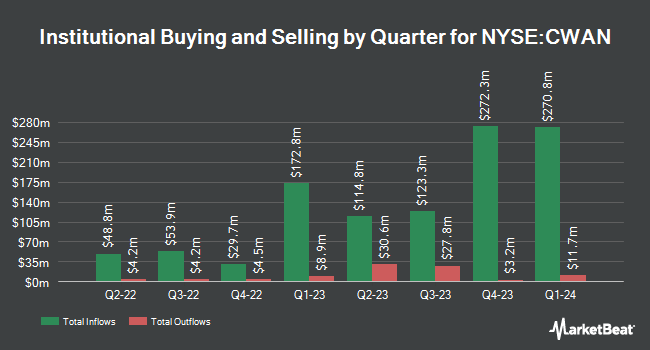

Bullseye Asset Management LLC increased its holdings in shares of Clearwater Analytics Holdings, Inc. (NYSE:CWAN - Free Report) by 46.1% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 111,000 shares of the company's stock after purchasing an additional 35,000 shares during the quarter. Bullseye Asset Management LLC's holdings in Clearwater Analytics were worth $2,803,000 as of its most recent SEC filing.

Other hedge funds have also added to or reduced their stakes in the company. Whittier Trust Co. of Nevada Inc. acquired a new position in shares of Clearwater Analytics during the 3rd quarter worth about $45,000. Financial Management Professionals Inc. bought a new stake in Clearwater Analytics during the third quarter worth about $58,000. Advisors Asset Management Inc. boosted its position in Clearwater Analytics by 38.6% during the third quarter. Advisors Asset Management Inc. now owns 3,574 shares of the company's stock valued at $90,000 after purchasing an additional 995 shares during the last quarter. Benjamin F. Edwards & Company Inc. boosted its position in Clearwater Analytics by 124.6% during the second quarter. Benjamin F. Edwards & Company Inc. now owns 4,372 shares of the company's stock valued at $81,000 after purchasing an additional 2,425 shares during the last quarter. Finally, Exchange Traded Concepts LLC bought a new position in Clearwater Analytics in the third quarter valued at approximately $117,000. Institutional investors own 50.10% of the company's stock.

Insider Activity at Clearwater Analytics

In other Clearwater Analytics news, CFO James S. Cox sold 18,700 shares of the firm's stock in a transaction on Monday, September 16th. The stock was sold at an average price of $24.44, for a total transaction of $457,028.00. Following the transaction, the chief financial officer now owns 227,503 shares in the company, valued at $5,560,173.32. This trade represents a 7.60 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CRO Scott Stanley Erickson sold 3,890 shares of the stock in a transaction on Thursday, October 10th. The stock was sold at an average price of $25.38, for a total value of $98,728.20. Following the sale, the executive now directly owns 6,373 shares in the company, valued at approximately $161,746.74. This trade represents a 37.90 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 203,052 shares of company stock worth $5,761,856 in the last ninety days. 4.60% of the stock is owned by company insiders.

Clearwater Analytics Stock Performance

Shares of Clearwater Analytics stock traded up $0.19 on Tuesday, hitting $29.02. The stock had a trading volume of 3,548,951 shares, compared to its average volume of 1,674,498. The stock has a market cap of $7.17 billion, a price-to-earnings ratio of 2,901.50, a price-to-earnings-growth ratio of 10.62 and a beta of 0.68. The company has a quick ratio of 4.66, a current ratio of 4.66 and a debt-to-equity ratio of 0.10. Clearwater Analytics Holdings, Inc. has a twelve month low of $15.62 and a twelve month high of $35.71. The business's 50 day moving average is $28.41 and its two-hundred day moving average is $23.99.

Analysts Set New Price Targets

Several equities research analysts have recently commented on the company. Oppenheimer increased their price objective on Clearwater Analytics from $35.00 to $40.00 and gave the company an "outperform" rating in a report on Tuesday, December 3rd. DA Davidson cut shares of Clearwater Analytics from a "buy" rating to a "neutral" rating and increased their price target for the company from $31.00 to $35.00 in a research note on Friday, November 8th. Citigroup began coverage on shares of Clearwater Analytics in a research note on Monday, August 19th. They set a "buy" rating and a $28.00 price objective on the stock. Wells Fargo & Company raised their target price on shares of Clearwater Analytics from $33.00 to $35.00 and gave the company an "overweight" rating in a research note on Thursday, December 5th. Finally, Royal Bank of Canada boosted their price target on Clearwater Analytics from $32.00 to $36.00 and gave the stock an "outperform" rating in a research report on Friday, November 22nd. One analyst has rated the stock with a sell rating, three have issued a hold rating and five have issued a buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Hold" and a consensus price target of $31.89.

Check Out Our Latest Report on CWAN

Clearwater Analytics Company Profile

(

Free Report)

Clearwater Analytics Holdings, Inc develops and provides a Software-as-a-Service (SaaS) solution for automated investment data aggregation, reconciliation, accounting, and reporting services to insurers, investment managers, corporations, institutional investors, and government entities in the United States and internationally.

Read More

Before you consider Clearwater Analytics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clearwater Analytics wasn't on the list.

While Clearwater Analytics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for January 2025. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.