Burkehill Global Management LP acquired a new stake in Camping World Holdings, Inc. (NYSE:CWH - Free Report) during the 4th quarter, according to its most recent disclosure with the SEC. The fund acquired 750,000 shares of the company's stock, valued at approximately $15,810,000. Camping World makes up about 1.5% of Burkehill Global Management LP's portfolio, making the stock its 21st biggest holding. Burkehill Global Management LP owned 0.88% of Camping World as of its most recent SEC filing.

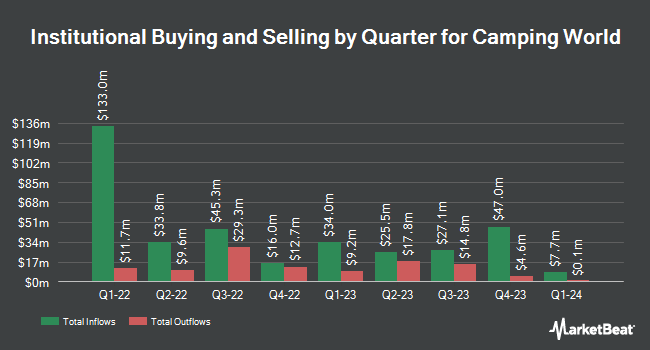

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in CWH. JPMorgan Chase & Co. boosted its position in shares of Camping World by 611.9% during the third quarter. JPMorgan Chase & Co. now owns 292,888 shares of the company's stock worth $7,094,000 after buying an additional 251,748 shares during the period. Soros Fund Management LLC bought a new stake in Camping World in the 3rd quarter valued at approximately $6,053,000. Charles Schwab Investment Management Inc. boosted its position in Camping World by 26.9% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 827,823 shares of the company's stock worth $17,451,000 after acquiring an additional 175,554 shares during the last quarter. Barclays PLC boosted its position in Camping World by 96.9% during the 3rd quarter. Barclays PLC now owns 317,052 shares of the company's stock worth $7,678,000 after acquiring an additional 156,055 shares during the last quarter. Finally, Wellington Management Group LLP bought a new position in shares of Camping World during the 3rd quarter worth approximately $2,578,000. 52.54% of the stock is owned by institutional investors and hedge funds.

Camping World Stock Performance

Shares of CWH stock opened at $16.49 on Thursday. The company has a fifty day moving average price of $21.46 and a two-hundred day moving average price of $22.37. Camping World Holdings, Inc. has a one year low of $15.39 and a one year high of $28.33. The stock has a market cap of $1.68 billion, a P/E ratio of -23.90, a P/E/G ratio of 0.92 and a beta of 2.57. The company has a debt-to-equity ratio of 9.67, a current ratio of 1.23 and a quick ratio of 0.19.

Camping World (NYSE:CWH - Get Free Report) last issued its earnings results on Tuesday, February 25th. The company reported ($0.55) earnings per share (EPS) for the quarter, meeting the consensus estimate of ($0.55). The business had revenue of $1.20 billion during the quarter, compared to the consensus estimate of $1.13 billion. Camping World had a negative net margin of 0.40% and a negative return on equity of 23.77%. As a group, equities analysts predict that Camping World Holdings, Inc. will post -0.66 EPS for the current year.

Camping World Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, March 27th. Stockholders of record on Friday, March 14th will be paid a dividend of $0.125 per share. The ex-dividend date is Friday, March 14th. This represents a $0.50 annualized dividend and a dividend yield of 3.03%. Camping World's dividend payout ratio is currently -65.79%.

Analyst Upgrades and Downgrades

Several research analysts recently commented on CWH shares. StockNews.com upgraded shares of Camping World from a "sell" rating to a "hold" rating in a report on Thursday, November 14th. Truist Financial boosted their price target on shares of Camping World from $26.00 to $28.00 and gave the stock a "buy" rating in a research report on Monday, February 10th. Finally, Bank of America assumed coverage on Camping World in a report on Thursday, December 19th. They issued a "buy" rating and a $30.00 price objective for the company. Two research analysts have rated the stock with a hold rating and six have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $27.71.

Read Our Latest Analysis on Camping World

Insider Buying and Selling

In related news, President Matthew D. Wagner acquired 5,725 shares of Camping World stock in a transaction on Tuesday, March 4th. The stock was purchased at an average cost of $17.61 per share, with a total value of $100,817.25. Following the completion of the transaction, the president now directly owns 300,640 shares in the company, valued at $5,294,270.40. This trade represents a 1.94 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. 43.80% of the stock is owned by insiders.

Camping World Profile

(

Free Report)

Camping World Holdings, Inc, together its subsidiaries, retails recreational vehicles (RVs), and related products and services in the United States. It operates in two segments, Good Sam Services and Plans; and RV and Outdoor Retail. The company provides a portfolio of services, protection plans, products, and resources in the RV industry.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Camping World, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Camping World wasn't on the list.

While Camping World currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.