Business First Bancshares (NASDAQ:BFST - Get Free Report) will likely be announcing its earnings results after the market closes on Thursday, January 23rd. Analysts expect the company to announce earnings of $0.49 per share and revenue of $74,745.25 billion for the quarter. Individual interested in participating in the company's earnings conference call can do so using this link.

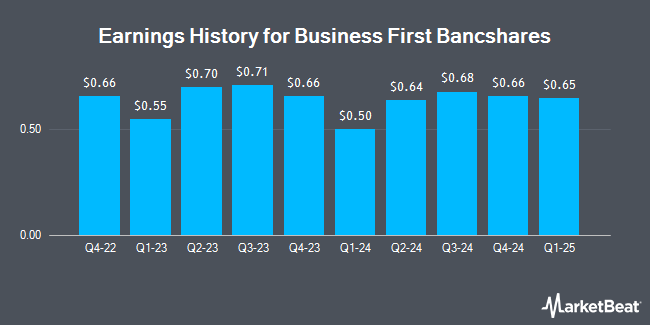

Business First Bancshares (NASDAQ:BFST - Get Free Report) last posted its quarterly earnings results on Thursday, October 24th. The company reported $0.68 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.57 by $0.11. Business First Bancshares had a net margin of 14.92% and a return on equity of 11.57%. The firm had revenue of $113.52 million for the quarter, compared to analyst estimates of $65.24 million. During the same period in the prior year, the firm posted $0.71 earnings per share. On average, analysts expect Business First Bancshares to post $2 EPS for the current fiscal year and $3 EPS for the next fiscal year.

Business First Bancshares Stock Performance

Shares of BFST traded down $0.24 during trading hours on Thursday, hitting $25.13. The company had a trading volume of 101,249 shares, compared to its average volume of 102,825. The business has a fifty day moving average of $27.06 and a 200-day moving average of $25.25. The company has a quick ratio of 0.99, a current ratio of 0.99 and a debt-to-equity ratio of 0.75. The firm has a market cap of $742.34 million, a price-to-earnings ratio of 10.83 and a beta of 1.00. Business First Bancshares has a 12 month low of $18.97 and a 12 month high of $30.30.

Business First Bancshares Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Saturday, November 30th. Investors of record on Friday, November 15th were paid a $0.14 dividend. The ex-dividend date was Friday, November 15th. This represents a $0.56 dividend on an annualized basis and a yield of 2.23%. Business First Bancshares's dividend payout ratio (DPR) is currently 24.14%.

Insider Transactions at Business First Bancshares

In other news, Director Joseph Vernon Johnson sold 2,500 shares of Business First Bancshares stock in a transaction on Monday, November 4th. The stock was sold at an average price of $26.33, for a total transaction of $65,825.00. Following the completion of the sale, the director now owns 183,057 shares of the company's stock, valued at approximately $4,819,890.81. This trade represents a 1.35 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Over the last 90 days, insiders sold 12,480 shares of company stock valued at $329,972. 6.45% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

BFST has been the subject of a number of research analyst reports. Raymond James upgraded Business First Bancshares from a "market perform" rating to an "outperform" rating and set a $30.00 price objective for the company in a report on Thursday, December 19th. Hovde Group downgraded Business First Bancshares from an "outperform" rating to a "market perform" rating and boosted their price target for the company from $30.00 to $31.50 in a research note on Wednesday, November 13th.

View Our Latest Research Report on BFST

About Business First Bancshares

(

Get Free Report)

Business First Bancshares, Inc operates as the bank holding company for b1BANK that provides various banking products and services in Louisiana and Texas. It offers various deposit products and services, including checking, demand, money market, time, and savings accounts; and certificates of deposits, remote deposit capture, and direct deposit services.

Featured Articles

Before you consider Business First Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Business First Bancshares wasn't on the list.

While Business First Bancshares currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.