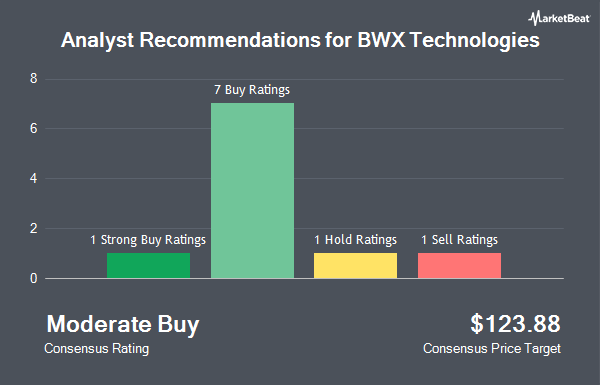

Shares of BWX Technologies, Inc. (NYSE:BWXT - Get Free Report) have been given a consensus recommendation of "Moderate Buy" by the eight brokerages that are covering the stock, Marketbeat.com reports. One investment analyst has rated the stock with a sell recommendation, one has issued a hold recommendation and six have issued a buy recommendation on the company. The average 12-month price objective among brokers that have covered the stock in the last year is $124.57.

BWXT has been the topic of a number of research analyst reports. StockNews.com downgraded shares of BWX Technologies from a "buy" rating to a "hold" rating in a report on Wednesday, November 6th. Bank of America raised their target price on shares of BWX Technologies from $115.00 to $160.00 and gave the stock a "buy" rating in a report on Thursday, November 14th. Barclays lifted their price target on shares of BWX Technologies from $90.00 to $105.00 and gave the company an "underweight" rating in a research report on Monday. Deutsche Bank Aktiengesellschaft upped their price target on BWX Technologies from $129.00 to $130.00 and gave the company a "buy" rating in a report on Wednesday, November 6th. Finally, Alembic Global Advisors upgraded BWX Technologies from a "neutral" rating to an "overweight" rating and set a $148.00 price target for the company in a research report on Tuesday, November 12th.

Read Our Latest Research Report on BWX Technologies

BWX Technologies Trading Up 0.8 %

Shares of BWXT stock traded up $0.95 during trading hours on Monday, reaching $121.86. The company had a trading volume of 664,288 shares, compared to its average volume of 649,920. The firm has a market cap of $11.14 billion, a price-to-earnings ratio of 40.35, a P/E/G ratio of 4.12 and a beta of 0.70. BWX Technologies has a 1-year low of $74.69 and a 1-year high of $136.31. The company has a debt-to-equity ratio of 1.15, a current ratio of 2.25 and a quick ratio of 2.25. The company has a 50 day moving average of $124.86 and a 200 day moving average of $107.72.

BWX Technologies (NYSE:BWXT - Get Free Report) last announced its earnings results on Monday, November 4th. The technology company reported $0.83 EPS for the quarter, topping the consensus estimate of $0.77 by $0.06. The company had revenue of $672.00 million for the quarter, compared to analysts' expectations of $658.84 million. BWX Technologies had a net margin of 10.32% and a return on equity of 31.95%. The business's revenue for the quarter was up 13.9% on a year-over-year basis. During the same period last year, the firm earned $0.67 earnings per share. On average, equities research analysts anticipate that BWX Technologies will post 3.23 EPS for the current year.

BWX Technologies Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Tuesday, December 10th. Stockholders of record on Tuesday, November 19th were paid a $0.24 dividend. The ex-dividend date of this dividend was Tuesday, November 19th. This represents a $0.96 annualized dividend and a dividend yield of 0.79%. BWX Technologies's payout ratio is 31.79%.

Hedge Funds Weigh In On BWX Technologies

A number of hedge funds have recently added to or reduced their stakes in the company. Stone House Investment Management LLC lifted its holdings in BWX Technologies by 76.2% during the 3rd quarter. Stone House Investment Management LLC now owns 229 shares of the technology company's stock worth $25,000 after buying an additional 99 shares in the last quarter. Quent Capital LLC boosted its position in BWX Technologies by 147.6% during the 3rd quarter. Quent Capital LLC now owns 255 shares of the technology company's stock worth $28,000 after acquiring an additional 152 shares during the last quarter. UMB Bank n.a. raised its holdings in BWX Technologies by 729.0% during the third quarter. UMB Bank n.a. now owns 257 shares of the technology company's stock worth $28,000 after acquiring an additional 226 shares in the last quarter. Quarry LP raised its stake in BWX Technologies by 93.6% in the 3rd quarter. Quarry LP now owns 271 shares of the technology company's stock valued at $29,000 after acquiring an additional 131 shares during the period. Finally, V Square Quantitative Management LLC acquired a new position in BWX Technologies in the 3rd quarter valued at $31,000. Institutional investors and hedge funds own 94.39% of the company's stock.

About BWX Technologies

(

Get Free ReportBWX Technologies, Inc, together with its subsidiaries, manufactures and sells nuclear components in the United States, Canada, and internationally. It operates through two segments, Government Operations and Commercial Operations. The Government Operations segment designs and manufactures naval nuclear components, reactors, and nuclear fuel; fabrication activities; and supplies proprietary and sole-source valves, manifolds, and fittings to naval and commercial shipping customers.

Further Reading

Before you consider BWX Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BWX Technologies wasn't on the list.

While BWX Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.