KeyCorp cut shares of C3.ai (NYSE:AI - Free Report) from a sector weight rating to an underweight rating in a report released on Thursday morning, Marketbeat Ratings reports. KeyCorp currently has $29.00 target price on the stock.

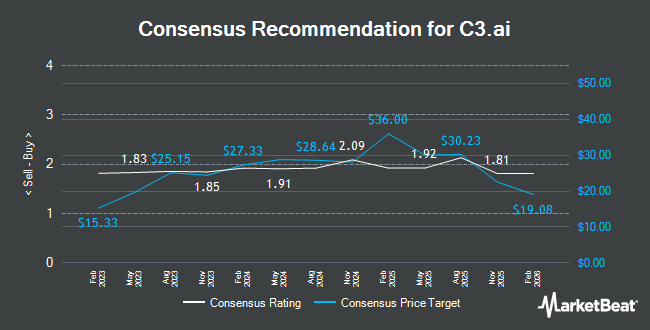

Several other equities research analysts have also recently commented on the stock. Piper Sandler raised their target price on shares of C3.ai from $24.00 to $42.00 and gave the stock a "neutral" rating in a research report on Tuesday, December 10th. Bank of America lowered their price objective on shares of C3.ai from $24.00 to $20.00 and set an "underperform" rating for the company in a report on Thursday, September 5th. Northland Securities upped their target price on C3.ai from $35.00 to $45.00 and gave the stock an "outperform" rating in a report on Tuesday, December 10th. Morgan Stanley increased their target price on C3.ai from $21.00 to $32.00 and gave the stock an "underweight" rating in a research report on Tuesday, December 10th. Finally, JPMorgan Chase & Co. lowered C3.ai from a "neutral" rating to an "underweight" rating and set a $28.00 price target on the stock. in a research report on Wednesday, December 11th. Five investment analysts have rated the stock with a sell rating, five have given a hold rating, four have given a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, C3.ai has an average rating of "Hold" and an average target price of $35.00.

Check Out Our Latest Report on AI

C3.ai Stock Performance

Shares of C3.ai stock traded down $4.24 during midday trading on Thursday, reaching $35.45. 16,105,735 shares of the company's stock traded hands, compared to its average volume of 6,049,832. The company has a market cap of $4.50 billion, a PE ratio of -16.04 and a beta of 2.00. The stock has a 50 day moving average of $31.41 and a 200-day moving average of $27.98. C3.ai has a 12 month low of $18.85 and a 12 month high of $45.08.

Insider Buying and Selling

In other C3.ai news, CFO Hitesh Lath sold 11,339 shares of C3.ai stock in a transaction on Monday, December 9th. The stock was sold at an average price of $42.00, for a total value of $476,238.00. Following the completion of the sale, the chief financial officer now owns 851 shares of the company's stock, valued at approximately $35,742. This trade represents a 93.02 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Jim H. Snabe sold 499,700 shares of the company's stock in a transaction on Tuesday, December 17th. The shares were sold at an average price of $43.05, for a total value of $21,512,085.00. Following the transaction, the director now directly owns 10,000 shares in the company, valued at approximately $430,500. The trade was a 98.04 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 644,988 shares of company stock worth $27,597,453 in the last quarter. Corporate insiders own 33.54% of the company's stock.

Institutional Inflows and Outflows

Several hedge funds have recently made changes to their positions in AI. Blue Trust Inc. lifted its holdings in C3.ai by 148.9% in the second quarter. Blue Trust Inc. now owns 1,028 shares of the company's stock valued at $28,000 after acquiring an additional 615 shares during the period. JTC Employer Solutions Trustee Ltd purchased a new stake in shares of C3.ai during the 3rd quarter valued at about $25,000. Northwestern Mutual Wealth Management Co. lifted its stake in shares of C3.ai by 311.8% in the 2nd quarter. Northwestern Mutual Wealth Management Co. now owns 1,050 shares of the company's stock worth $30,000 after purchasing an additional 795 shares during the period. Point72 Asia Singapore Pte. Ltd. bought a new position in shares of C3.ai in the 2nd quarter worth approximately $41,000. Finally, Quest Partners LLC boosted its holdings in shares of C3.ai by 9,033.3% in the third quarter. Quest Partners LLC now owns 1,644 shares of the company's stock worth $40,000 after buying an additional 1,626 shares during the last quarter. 38.96% of the stock is owned by hedge funds and other institutional investors.

About C3.ai

(

Get Free Report)

C3.ai, Inc operates as an enterprise artificial intelligence (AI) software company in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally. The company provides C3 AI platform, an application development and runtime environment that enables customers to design, develop, and deploy enterprise AI applications; C3 AI Ex Machina for analysis-ready data; C3 AI CRM, an industry specific customer relationship management solution; and C3 Generative AI Product Suite that enables to locate, retrieve, and present information.

Featured Articles

Before you consider C3.ai, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and C3.ai wasn't on the list.

While C3.ai currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.