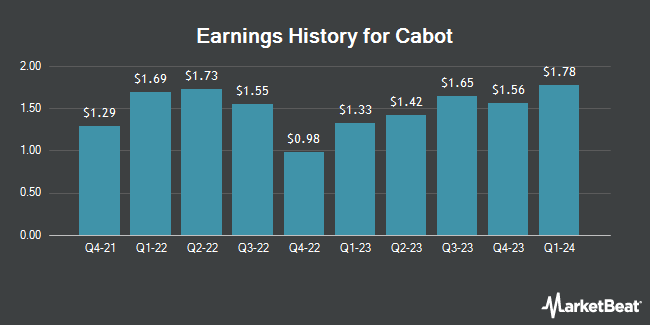

Cabot (NYSE:CBT - Get Free Report) issued its earnings results on Monday. The specialty chemicals company reported $1.80 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.81 by ($0.01), Briefing.com reports. The business had revenue of $1 billion for the quarter, compared to analysts' expectations of $1.01 billion. Cabot had a return on equity of 26.99% and a net margin of 12.05%. The business's quarterly revenue was up 3.7% on a year-over-year basis. During the same period last year, the company posted $1.65 earnings per share. Cabot updated its FY 2025 guidance to 7.400-7.800 EPS and its FY25 guidance to $7.40-7.80 EPS.

Cabot Stock Down 1.1 %

NYSE:CBT traded down $1.21 on Tuesday, hitting $108.88. 742,048 shares of the company's stock traded hands, compared to its average volume of 337,923. The firm has a 50-day moving average price of $108.30 and a 200-day moving average price of $101.01. The company has a current ratio of 2.22, a quick ratio of 1.45 and a debt-to-equity ratio of 0.72. Cabot has a 1 year low of $66.02 and a 1 year high of $117.14. The company has a market cap of $5.97 billion, a PE ratio of 12.87, a price-to-earnings-growth ratio of 0.91 and a beta of 1.20.

Analyst Ratings Changes

Several equities analysts have weighed in on CBT shares. Mizuho raised their price target on Cabot from $103.00 to $122.00 and gave the stock an "outperform" rating in a research report on Tuesday. UBS Group cut their target price on Cabot from $103.00 to $98.00 and set a "neutral" rating on the stock in a research report on Tuesday, August 6th. Finally, JPMorgan Chase & Co. raised their target price on shares of Cabot from $95.00 to $105.00 and gave the company a "neutral" rating in a research note on Wednesday, August 7th. Three research analysts have rated the stock with a hold rating and two have assigned a buy rating to the stock. Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus price target of $105.00.

Check Out Our Latest Research Report on CBT

Insider Buying and Selling

In other news, EVP Hobart Kalkstein sold 5,457 shares of the business's stock in a transaction that occurred on Tuesday, August 20th. The stock was sold at an average price of $100.58, for a total value of $548,865.06. Following the transaction, the executive vice president now directly owns 61,688 shares of the company's stock, valued at $6,204,579.04. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. In other Cabot news, EVP Hobart Kalkstein sold 5,457 shares of the stock in a transaction on Tuesday, August 20th. The stock was sold at an average price of $100.58, for a total value of $548,865.06. Following the transaction, the executive vice president now directly owns 61,688 shares in the company, valued at approximately $6,204,579.04. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, EVP Jeff Ji Zhu sold 1,201 shares of the firm's stock in a transaction dated Monday, August 26th. The shares were sold at an average price of $106.19, for a total transaction of $127,534.19. Following the completion of the transaction, the executive vice president now directly owns 96,000 shares in the company, valued at $10,194,240. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 71,939 shares of company stock worth $7,308,812. Insiders own 3.07% of the company's stock.

Cabot Company Profile

(

Get Free Report)

Cabot Corporation operates as a specialty chemicals and performance materials company. The company operates through two segments, Reinforcement Materials and Performance Chemicals. It offers reinforcing carbons that are used in tires as a rubber reinforcing agent and performance additive, as well as in industrial products, such as hoses, belts, extruded profiles, and molded goods; and engineered elastomer composites solutions.

Recommended Stories

Before you consider Cabot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cabot wasn't on the list.

While Cabot currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.