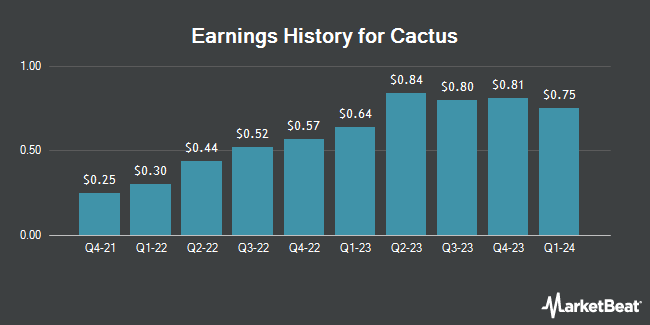

Cactus (NYSE:WHD - Get Free Report) posted its earnings results on Wednesday. The company reported $0.71 EPS for the quarter, missing analysts' consensus estimates of $0.72 by ($0.01), Zacks reports. Cactus had a net margin of 16.57% and a return on equity of 20.24%. The business had revenue of $272.12 million for the quarter, compared to analyst estimates of $277.59 million.

Cactus Price Performance

Shares of Cactus stock traded up $0.47 on Friday, hitting $52.55. 902,319 shares of the company were exchanged, compared to its average volume of 509,254. The stock has a market capitalization of $4.18 billion, a price-to-earnings ratio of 18.63, a price-to-earnings-growth ratio of 5.13 and a beta of 1.97. The company has a 50-day moving average price of $59.83 and a 200 day moving average price of $61.08. Cactus has a 1-year low of $44.57 and a 1-year high of $70.01. The company has a quick ratio of 2.67, a current ratio of 3.82 and a debt-to-equity ratio of 0.01.

Cactus Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, March 20th. Investors of record on Monday, March 3rd will be issued a $0.13 dividend. This represents a $0.52 annualized dividend and a yield of 0.99%. The ex-dividend date of this dividend is Monday, March 3rd. Cactus's payout ratio is 18.84%.

Analyst Ratings Changes

Separately, Barclays cut Cactus from an "overweight" rating to an "equal weight" rating and set a $61.00 target price on the stock. in a research report on Monday, November 4th. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating and two have assigned a buy rating to the company. According to MarketBeat, the stock presently has an average rating of "Hold" and a consensus price target of $56.40.

View Our Latest Stock Report on Cactus

Cactus Company Profile

(

Get Free Report)

Cactus, Inc, together with its subsidiaries, designs, manufactures, sells, and leases pressure control and spoolable pipes in the United States, Australia, Canada, the Middle East, and internationally. It operates through two segments, Pressure Control and Spoolable Technologies. The Pressure Control segment designs, manufactures, sells, and rents a range of wellhead and pressure control equipment under the Cactus Wellhead brand name through service centers.

Featured Articles

Before you consider Cactus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cactus wasn't on the list.

While Cactus currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.