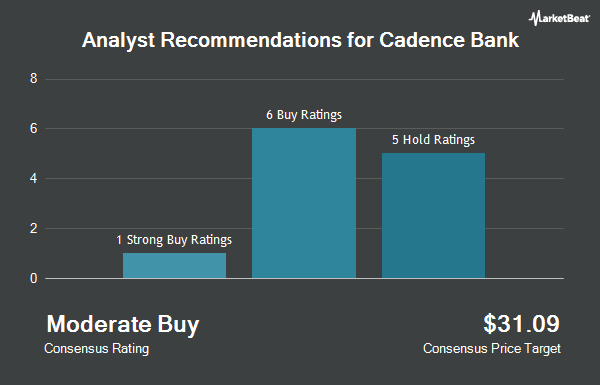

Shares of Cadence Bank (NYSE:CADE - Get Free Report) have earned an average recommendation of "Moderate Buy" from the eleven research firms that are currently covering the stock, MarketBeat Ratings reports. Three analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the company. The average 1-year target price among brokers that have issued a report on the stock in the last year is $37.32.

Several analysts have recently commented on the company. Truist Financial raised their target price on Cadence Bank from $37.00 to $38.00 and gave the stock a "buy" rating in a research report on Wednesday, October 23rd. DA Davidson raised their price objective on Cadence Bank from $36.00 to $40.00 and gave the stock a "buy" rating in a research report on Wednesday, October 23rd. Keefe, Bruyette & Woods upped their target price on Cadence Bank from $38.00 to $45.00 and gave the company an "outperform" rating in a report on Wednesday, December 4th. Morgan Stanley raised shares of Cadence Bank from an "equal weight" rating to an "overweight" rating and increased their price target for the stock from $36.00 to $39.00 in a research report on Monday, September 30th. Finally, Barclays raised shares of Cadence Bank from an "equal weight" rating to an "overweight" rating and boosted their price objective for the company from $41.00 to $44.00 in a research report on Thursday, December 19th.

Get Our Latest Stock Analysis on CADE

Cadence Bank Trading Up 0.1 %

CADE stock traded up $0.05 during mid-day trading on Wednesday, reaching $34.45. 655,883 shares of the stock traded hands, compared to its average volume of 1,296,465. Cadence Bank has a 52-week low of $24.99 and a 52-week high of $40.20. The stock's fifty day moving average is $36.27 and its 200-day moving average is $32.71. The company has a market cap of $6.28 billion, a P/E ratio of 9.90 and a beta of 0.98. The company has a current ratio of 0.87, a quick ratio of 0.87 and a debt-to-equity ratio of 0.04.

Cadence Bank (NYSE:CADE - Get Free Report) last issued its quarterly earnings results on Monday, October 21st. The company reported $0.73 EPS for the quarter, beating the consensus estimate of $0.64 by $0.09. Cadence Bank had a net margin of 25.99% and a return on equity of 8.95%. The business had revenue of $447.36 million during the quarter, compared to the consensus estimate of $450.97 million. During the same quarter in the prior year, the firm earned $0.56 EPS. The firm's quarterly revenue was up 11.0% on a year-over-year basis. As a group, sell-side analysts expect that Cadence Bank will post 2.71 earnings per share for the current year.

Cadence Bank Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, January 2nd. Investors of record on Friday, December 13th will be paid a $0.25 dividend. This represents a $1.00 annualized dividend and a dividend yield of 2.90%. The ex-dividend date of this dividend is Friday, December 13th. Cadence Bank's payout ratio is presently 28.74%.

Institutional Trading of Cadence Bank

Large investors have recently made changes to their positions in the stock. V Square Quantitative Management LLC acquired a new stake in shares of Cadence Bank in the third quarter worth $25,000. Point72 Hong Kong Ltd bought a new position in Cadence Bank in the 3rd quarter worth $32,000. GAMMA Investing LLC lifted its position in Cadence Bank by 55.8% during the 3rd quarter. GAMMA Investing LLC now owns 1,561 shares of the company's stock worth $50,000 after acquiring an additional 559 shares during the last quarter. TD Private Client Wealth LLC boosted its holdings in Cadence Bank by 23.0% during the third quarter. TD Private Client Wealth LLC now owns 4,954 shares of the company's stock valued at $158,000 after acquiring an additional 926 shares during the period. Finally, KBC Group NV grew its position in shares of Cadence Bank by 11.5% in the third quarter. KBC Group NV now owns 5,036 shares of the company's stock valued at $160,000 after purchasing an additional 519 shares during the last quarter. Institutional investors own 84.61% of the company's stock.

Cadence Bank Company Profile

(

Get Free ReportCadence Bank provides commercial banking and financial services. Its products and services include consumer banking, consumer loans, mortgages, home equity lines and loans, credit cards, commercial and business banking, treasury management, specialized and asset-based lending, commercial real estate, equipment financing, and correspondent banking services.

Featured Articles

Before you consider Cadence Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cadence Bank wasn't on the list.

While Cadence Bank currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.