Caisse DE Depot ET Placement DU Quebec raised its holdings in shares of RB Global, Inc. (NYSE:RBA - Free Report) TSE: RBA by 4.3% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 440,729 shares of the business services provider's stock after purchasing an additional 18,177 shares during the period. Caisse DE Depot ET Placement DU Quebec owned about 0.24% of RB Global worth $35,511,000 as of its most recent SEC filing.

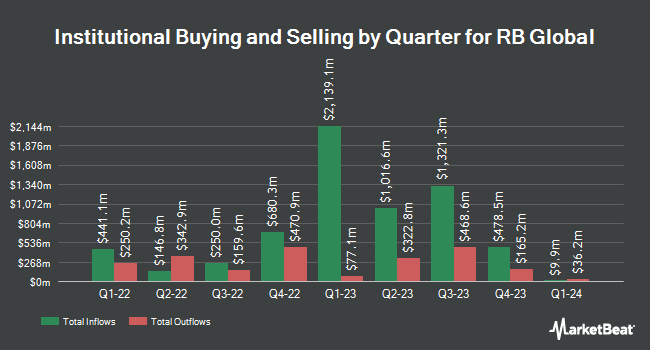

A number of other institutional investors and hedge funds also recently modified their holdings of the business. Verition Fund Management LLC grew its position in shares of RB Global by 271.1% during the 3rd quarter. Verition Fund Management LLC now owns 46,397 shares of the business services provider's stock valued at $3,734,000 after buying an additional 33,896 shares during the last quarter. Northwest & Ethical Investments L.P. acquired a new position in RB Global in the third quarter valued at approximately $15,179,000. Zurcher Kantonalbank Zurich Cantonalbank grew its holdings in shares of RB Global by 86.4% during the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 69,533 shares of the business services provider's stock valued at $5,602,000 after purchasing an additional 32,235 shares during the last quarter. Glenmede Trust Co. NA raised its position in shares of RB Global by 37.8% during the 3rd quarter. Glenmede Trust Co. NA now owns 4,292 shares of the business services provider's stock worth $345,000 after purchasing an additional 1,178 shares during the period. Finally, FMR LLC lifted its holdings in shares of RB Global by 60.5% in the 3rd quarter. FMR LLC now owns 1,180,975 shares of the business services provider's stock worth $95,057,000 after purchasing an additional 445,004 shares during the last quarter. 95.37% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, CEO James Francis Kessler sold 17,883 shares of the firm's stock in a transaction dated Monday, September 9th. The stock was sold at an average price of $83.09, for a total transaction of $1,485,898.47. Following the completion of the transaction, the chief executive officer now owns 86,247 shares of the company's stock, valued at $7,166,263.23. This trade represents a 17.17 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. 4.32% of the stock is owned by corporate insiders.

RB Global Price Performance

RB Global stock traded down $0.56 during trading hours on Monday, hitting $97.20. 1,390,806 shares of the company traded hands, compared to its average volume of 1,010,905. RB Global, Inc. has a 1-year low of $60.84 and a 1-year high of $99.79. The firm has a market cap of $17.93 billion, a P/E ratio of 52.83, a P/E/G ratio of 4.70 and a beta of 0.92. The firm's 50-day simple moving average is $87.13 and its two-hundred day simple moving average is $82.23. The company has a quick ratio of 1.17, a current ratio of 1.28 and a debt-to-equity ratio of 0.52.

RB Global Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 18th. Investors of record on Wednesday, November 27th will be paid a dividend of $0.29 per share. The ex-dividend date of this dividend is Wednesday, November 27th. This represents a $1.16 dividend on an annualized basis and a dividend yield of 1.19%. RB Global's dividend payout ratio is presently 63.04%.

Analysts Set New Price Targets

RBA has been the subject of a number of recent research reports. Bank of America upped their price objective on RB Global from $79.00 to $92.50 and gave the stock a "neutral" rating in a research note on Monday, August 26th. Royal Bank of Canada increased their price objective on shares of RB Global from $99.00 to $107.00 and gave the stock an "outperform" rating in a report on Monday, November 11th. Raymond James lifted their price objective on shares of RB Global from $95.00 to $98.00 and gave the company an "outperform" rating in a research report on Thursday, August 8th. Robert W. Baird upped their target price on shares of RB Global from $86.00 to $100.00 and gave the stock an "outperform" rating in a research report on Monday, November 11th. Finally, BMO Capital Markets lifted their price target on RB Global from $105.00 to $107.00 and gave the company an "outperform" rating in a report on Monday, November 11th. Two equities research analysts have rated the stock with a hold rating and six have issued a buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $98.36.

Check Out Our Latest Analysis on RB Global

RB Global Profile

(

Free Report)

RB Global, Inc, an omnichannel marketplace, provides insights, services, and transaction solutions for buyers and sellers of commercial assets and vehicles worldwide. Its marketplace brands include Ritchie Bros., an auctioneer of commercial assets and vehicles offering online bidding; IAA, a digital marketplace connecting vehicle buyers and sellers; Rouse Services, which provides asset management, data-driven intelligence, and performance benchmarking system; SmartEquip, a technology platform that supports customers' management of the equipment lifecycle; and Veritread, an online marketplace for heavy haul transport solution.

Featured Articles

Before you consider RB Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RB Global wasn't on the list.

While RB Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.