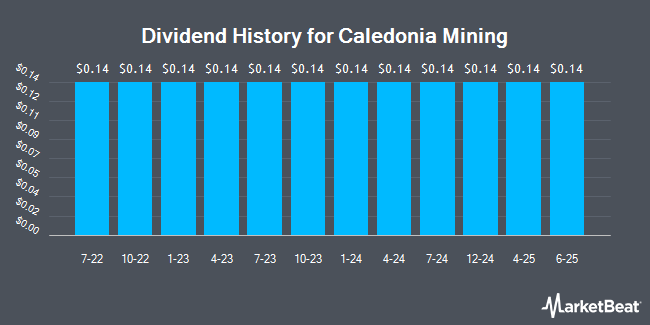

Caledonia Mining Co. Plc (NYSEAMERICAN:CMCL - Get Free Report) announced a quarterly dividend on Monday, March 24th, Wall Street Journal reports. Investors of record on Friday, April 4th will be given a dividend of 0.14 per share on Thursday, April 17th. This represents a $0.56 annualized dividend and a yield of 4.82%. The ex-dividend date of this dividend is Friday, April 4th.

Caledonia Mining has raised its dividend payment by an average of 1.9% per year over the last three years. Caledonia Mining has a dividend payout ratio of 40.3% meaning its dividend is sufficiently covered by earnings.

Caledonia Mining Price Performance

Shares of CMCL stock traded down $0.23 on Friday, hitting $11.61. The stock had a trading volume of 39,173 shares, compared to its average volume of 71,994. The firm has a 50 day moving average of $10.29. Caledonia Mining has a 1 year low of $8.81 and a 1 year high of $16.95. The company has a debt-to-equity ratio of 0.04, a current ratio of 1.44 and a quick ratio of 0.89. The firm has a market capitalization of $223.14 million, a price-to-earnings ratio of 24.19 and a beta of 0.68.

Wall Street Analyst Weigh In

Separately, Maxim Group upgraded shares of Caledonia Mining to a "strong-buy" rating in a research note on Friday, January 3rd.

View Our Latest Stock Report on Caledonia Mining

Caledonia Mining Company Profile

(

Get Free Report)

Caledonia Mining Corporation Plc primarily operates a gold mine. It also engages in the exploration and development of mineral properties for precious metals. The company holds a 64% interest in the Blanket Mine, a gold mine located in Zimbabwe. It also owns 100% interests in the Maligreen project, a brownfield gold exploration project located in the Gweru mining district in the Zimbabwe Midlands; the Bilboes, a gold deposit located to the north of Bulawayo, Zimbabwe; and the Motapa, a gold exploration property located in Southern Zimbabwe.

Read More

Before you consider Caledonia Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Caledonia Mining wasn't on the list.

While Caledonia Mining currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 best stocks to own in Spring 2025, carefully selected for their growth potential amid market volatility. This exclusive report highlights top companies poised to thrive in uncertain economic conditions—download now to gain an investing edge.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.