California Public Employees Retirement System cut its holdings in KE Holdings Inc. (NYSE:BEKE - Free Report) by 7.6% during the fourth quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 866,136 shares of the company's stock after selling 71,331 shares during the quarter. California Public Employees Retirement System owned about 0.07% of KE worth $15,954,000 as of its most recent filing with the SEC.

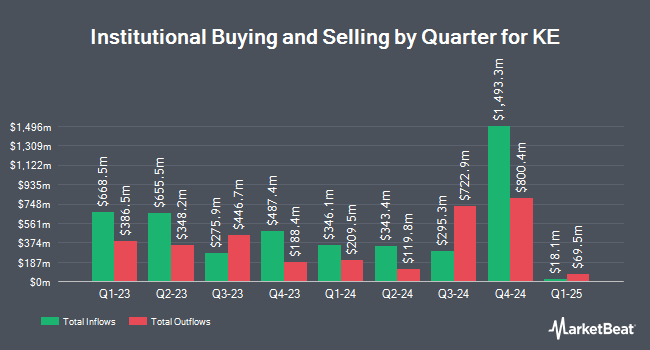

Other institutional investors and hedge funds have also made changes to their positions in the company. Norges Bank acquired a new stake in KE during the 4th quarter worth approximately $130,167,000. H Capital V GP L.P. acquired a new stake in shares of KE in the 4th quarter worth $91,147,000. WT Asset Management Ltd boosted its holdings in shares of KE by 1,761.8% in the fourth quarter. WT Asset Management Ltd now owns 2,327,198 shares of the company's stock valued at $42,867,000 after acquiring an additional 2,202,198 shares in the last quarter. Carrhae Capital LLP purchased a new position in KE during the fourth quarter worth about $32,156,000. Finally, Lord Abbett & CO. LLC purchased a new position in shares of KE during the 3rd quarter worth approximately $28,956,000. 39.34% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of analysts recently weighed in on BEKE shares. Jefferies Financial Group restated a "buy" rating on shares of KE in a research note on Tuesday, March 18th. Morgan Stanley raised their price objective on shares of KE from $19.00 to $27.00 and gave the company an "overweight" rating in a research note on Wednesday, March 19th. Finally, UBS Group downgraded shares of KE from a "buy" rating to a "neutral" rating and boosted their price objective for the stock from $22.70 to $24.50 in a report on Thursday, March 20th. One equities research analyst has rated the stock with a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $27.26.

Get Our Latest Stock Analysis on BEKE

KE Stock Up 4.7 %

Shares of BEKE traded up $0.82 during mid-day trading on Wednesday, reaching $18.35. 15,929,959 shares of the company's stock were exchanged, compared to its average volume of 9,783,110. The company has a market cap of $22.17 billion, a price-to-earnings ratio of 37.45, a PEG ratio of 3.45 and a beta of -0.73. The company has a 50-day simple moving average of $20.77 and a two-hundred day simple moving average of $20.02. KE Holdings Inc. has a 52-week low of $12.49 and a 52-week high of $26.05.

KE Increases Dividend

The firm also recently declared a -- dividend, which will be paid on Friday, April 25th. Shareholders of record on Wednesday, April 9th will be paid a dividend of $0.36 per share. This represents a dividend yield of 1.4%. The ex-dividend date of this dividend is Wednesday, April 9th. This is a positive change from KE's previous -- dividend of $0.17. KE's dividend payout ratio is currently 64.58%.

KE Company Profile

(

Free Report)

KE Holdings Inc, through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China. It operates through four segments: Existing Home Transaction Services, New Home Transaction Services, Home Renovation and Furnishing, and Emerging and Other Services.

Featured Articles

Before you consider KE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KE wasn't on the list.

While KE currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.