Citigroup Inc. grew its holdings in California Resources Co. (NYSE:CRC - Free Report) by 24.7% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 113,038 shares of the oil and gas producer's stock after acquiring an additional 22,405 shares during the period. Citigroup Inc. owned about 0.17% of California Resources worth $5,931,000 at the end of the most recent quarter.

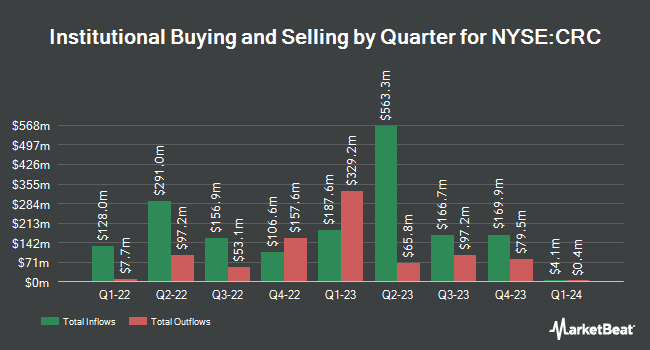

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. Point72 Asset Management L.P. raised its position in California Resources by 2,615.2% during the second quarter. Point72 Asset Management L.P. now owns 843,011 shares of the oil and gas producer's stock valued at $44,865,000 after acquiring an additional 811,963 shares in the last quarter. Samlyn Capital LLC acquired a new position in shares of California Resources in the 2nd quarter valued at $28,566,000. American Century Companies Inc. boosted its holdings in California Resources by 18.1% during the second quarter. American Century Companies Inc. now owns 1,631,432 shares of the oil and gas producer's stock worth $86,825,000 after buying an additional 250,367 shares in the last quarter. SIR Capital Management L.P. acquired a new stake in California Resources during the second quarter valued at $11,820,000. Finally, Dimensional Fund Advisors LP increased its holdings in California Resources by 4.9% in the second quarter. Dimensional Fund Advisors LP now owns 3,576,306 shares of the oil and gas producer's stock valued at $190,328,000 after buying an additional 165,629 shares in the last quarter. Institutional investors and hedge funds own 97.79% of the company's stock.

Analyst Ratings Changes

Several equities research analysts have recently issued reports on the stock. UBS Group assumed coverage on shares of California Resources in a research note on Wednesday, October 16th. They set a "buy" rating and a $68.00 target price on the stock. Citigroup raised their price objective on California Resources from $63.00 to $65.00 and gave the company a "buy" rating in a report on Thursday, September 5th. StockNews.com upgraded California Resources from a "sell" rating to a "hold" rating in a research report on Saturday, November 16th. Jefferies Financial Group began coverage on California Resources in a research report on Thursday, October 24th. They set a "buy" rating and a $64.00 target price on the stock. Finally, Barclays boosted their price target on shares of California Resources from $55.00 to $57.00 and gave the stock an "equal weight" rating in a report on Thursday, October 3rd. Two research analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $66.40.

Get Our Latest Research Report on California Resources

California Resources Price Performance

CRC stock traded down $1.82 during midday trading on Monday, reaching $57.34. The stock had a trading volume of 637,877 shares, compared to its average volume of 836,948. The company's fifty day simple moving average is $54.49 and its 200 day simple moving average is $51.44. The company has a market cap of $3.89 billion, a price-to-earnings ratio of 9.05, a price-to-earnings-growth ratio of 1.47 and a beta of 0.98. The company has a current ratio of 0.97, a quick ratio of 0.89 and a debt-to-equity ratio of 0.32. California Resources Co. has a 52-week low of $43.09 and a 52-week high of $60.41.

California Resources (NYSE:CRC - Get Free Report) last posted its quarterly earnings results on Tuesday, November 5th. The oil and gas producer reported $1.50 EPS for the quarter, beating the consensus estimate of $0.88 by $0.62. The firm had revenue of $1.35 billion during the quarter, compared to analysts' expectations of $973.13 million. California Resources had a return on equity of 12.16% and a net margin of 17.43%. The business's revenue for the quarter was up 194.1% on a year-over-year basis. During the same quarter last year, the firm earned $1.02 earnings per share. As a group, sell-side analysts predict that California Resources Co. will post 3.42 earnings per share for the current fiscal year.

California Resources Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Monday, December 2nd will be given a dividend of $0.3875 per share. This represents a $1.55 annualized dividend and a yield of 2.70%. The ex-dividend date is Monday, December 2nd. California Resources's payout ratio is currently 24.41%.

Insiders Place Their Bets

In other California Resources news, VP Noelle M. Repetti sold 8,770 shares of California Resources stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $55.75, for a total transaction of $488,927.50. Following the completion of the sale, the vice president now directly owns 8,531 shares in the company, valued at $475,603.25. This trade represents a 50.69 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Francisco Leon sold 7,500 shares of the company's stock in a transaction that occurred on Thursday, September 5th. The stock was sold at an average price of $49.18, for a total transaction of $368,850.00. Following the completion of the transaction, the chief executive officer now owns 166,357 shares in the company, valued at approximately $8,181,437.26. This represents a 4.31 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 26,270 shares of company stock valued at $1,387,778 over the last ninety days. Company insiders own 0.03% of the company's stock.

California Resources Profile

(

Free Report)

California Resources Corporation operates as an independent oil and natural gas exploration and production, and carbon management company in the United States. The company explores, produces, and markets crude oil, natural gas, and natural gas liquids for marketers, California refineries, and other purchasers that have access to transportation and storage facilities.

See Also

Before you consider California Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and California Resources wasn't on the list.

While California Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.