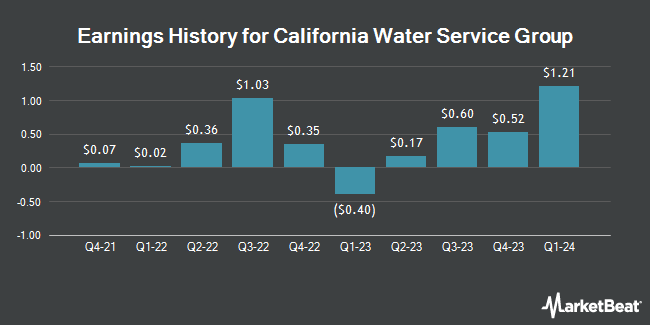

California Water Service Group (NYSE:CWT - Get Free Report) issued its earnings results on Thursday. The utilities provider reported $0.33 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.38 by ($0.05), Zacks reports. California Water Service Group had a net margin of 19.56% and a return on equity of 13.24%. The company had revenue of $222.20 million during the quarter, compared to analysts' expectations of $216.37 million. During the same period last year, the business posted $0.52 earnings per share.

California Water Service Group Price Performance

Shares of NYSE:CWT traded up $0.80 on Monday, hitting $46.25. The company had a trading volume of 417,960 shares, compared to its average volume of 376,055. The company has a current ratio of 0.64, a quick ratio of 0.60 and a debt-to-equity ratio of 0.64. The company has a market cap of $2.75 billion, a PE ratio of 13.37, a PEG ratio of 0.46 and a beta of 0.52. California Water Service Group has a 52-week low of $41.64 and a 52-week high of $56.25. The business has a 50 day moving average of $44.75 and a 200 day moving average of $49.55.

California Water Service Group Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, February 21st. Shareholders of record on Monday, February 10th were given a dividend of $0.30 per share. This is an increase from California Water Service Group's previous quarterly dividend of $0.28. The ex-dividend date was Monday, February 10th. This represents a $1.20 annualized dividend and a yield of 2.59%. California Water Service Group's dividend payout ratio (DPR) is presently 36.70%.

Analyst Ratings Changes

Several equities analysts recently weighed in on the company. StockNews.com raised California Water Service Group from a "sell" rating to a "hold" rating in a research note on Saturday, February 8th. Bank of America initiated coverage on California Water Service Group in a research report on Wednesday, December 11th. They issued a "buy" rating and a $57.00 price target for the company. Finally, Wells Fargo & Company raised California Water Service Group from an "equal weight" rating to an "overweight" rating and cut their price target for the stock from $56.00 to $52.00 in a research note on Tuesday, January 7th. Two equities research analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $53.25.

View Our Latest Analysis on California Water Service Group

California Water Service Group Company Profile

(

Get Free Report)

California Water Service Group, through its subsidiaries, provides water utility and other related services in California, Washington, New Mexico, Hawaii, and Texas. The company is involved in the production, purchase, storage, treatment, testing, distribution, and sale of water for domestic, industrial, public, and irrigation uses, as well as for fire protection services.

Featured Stories

Before you consider California Water Service Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and California Water Service Group wasn't on the list.

While California Water Service Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.