Callahan Advisors LLC trimmed its holdings in shares of Kinder Morgan, Inc. (NYSE:KMI - Free Report) by 3.7% in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 461,177 shares of the pipeline company's stock after selling 17,682 shares during the period. Kinder Morgan comprises approximately 1.2% of Callahan Advisors LLC's holdings, making the stock its 29th biggest holding. Callahan Advisors LLC's holdings in Kinder Morgan were worth $12,636,000 as of its most recent SEC filing.

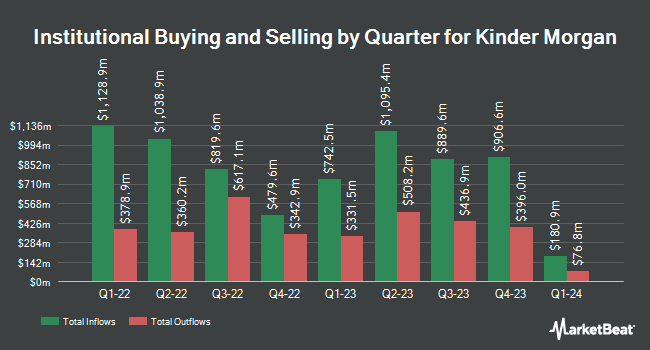

Other institutional investors have also recently modified their holdings of the company. Kestra Investment Management LLC lifted its stake in shares of Kinder Morgan by 25.1% during the fourth quarter. Kestra Investment Management LLC now owns 11,820 shares of the pipeline company's stock valued at $324,000 after buying an additional 2,373 shares during the period. Atria Wealth Solutions Inc. grew its position in shares of Kinder Morgan by 10.8% in the fourth quarter. Atria Wealth Solutions Inc. now owns 184,779 shares of the pipeline company's stock valued at $5,063,000 after purchasing an additional 18,078 shares during the period. Venturi Wealth Management LLC increased its stake in Kinder Morgan by 5.8% in the fourth quarter. Venturi Wealth Management LLC now owns 12,392 shares of the pipeline company's stock valued at $340,000 after purchasing an additional 683 shares during the last quarter. D.A. Davidson & CO. lifted its position in Kinder Morgan by 2.2% during the fourth quarter. D.A. Davidson & CO. now owns 618,274 shares of the pipeline company's stock worth $16,941,000 after buying an additional 13,118 shares during the period. Finally, CIBC Asset Management Inc boosted its stake in Kinder Morgan by 2.5% in the 4th quarter. CIBC Asset Management Inc now owns 349,695 shares of the pipeline company's stock worth $9,582,000 after buying an additional 8,641 shares during the last quarter. 62.52% of the stock is currently owned by institutional investors and hedge funds.

Kinder Morgan Stock Down 0.7 %

KMI traded down $0.19 during trading hours on Friday, reaching $26.41. 21,468,445 shares of the stock traded hands, compared to its average volume of 15,875,047. Kinder Morgan, Inc. has a fifty-two week low of $17.02 and a fifty-two week high of $31.48. The company has a market cap of $58.67 billion, a price-to-earnings ratio of 22.57, a PEG ratio of 3.11 and a beta of 0.94. The company has a debt-to-equity ratio of 0.94, a current ratio of 0.49 and a quick ratio of 0.39. The firm's fifty day simple moving average is $27.77 and its two-hundred day simple moving average is $25.30.

Kinder Morgan (NYSE:KMI - Get Free Report) last announced its earnings results on Wednesday, January 22nd. The pipeline company reported $0.32 earnings per share for the quarter, missing the consensus estimate of $0.33 by ($0.01). Kinder Morgan had a net margin of 17.31% and a return on equity of 8.09%. As a group, analysts forecast that Kinder Morgan, Inc. will post 1.25 earnings per share for the current fiscal year.

Kinder Morgan Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Tuesday, February 18th. Stockholders of record on Monday, February 3rd were paid a dividend of $0.2875 per share. This represents a $1.15 annualized dividend and a dividend yield of 4.36%. The ex-dividend date of this dividend was Monday, February 3rd. Kinder Morgan's dividend payout ratio (DPR) is currently 98.29%.

Analysts Set New Price Targets

KMI has been the subject of a number of research analyst reports. Citigroup upped their price objective on shares of Kinder Morgan from $25.00 to $28.00 and gave the company a "neutral" rating in a research note on Wednesday, January 29th. The Goldman Sachs Group increased their price target on shares of Kinder Morgan from $26.00 to $29.00 and gave the stock a "buy" rating in a research note on Tuesday, November 26th. Mizuho boosted their price objective on shares of Kinder Morgan from $31.00 to $33.00 and gave the company an "overweight" rating in a research note on Thursday, January 23rd. Scotiabank initiated coverage on Kinder Morgan in a research report on Friday, January 10th. They issued a "sector perform" rating and a $26.00 target price on the stock. Finally, Morgan Stanley boosted their price target on Kinder Morgan from $24.00 to $36.00 in a research report on Thursday, January 23rd. Nine investment analysts have rated the stock with a hold rating, six have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, Kinder Morgan has an average rating of "Moderate Buy" and an average target price of $29.14.

View Our Latest Analysis on Kinder Morgan

Insider Buying and Selling at Kinder Morgan

In other Kinder Morgan news, President Thomas A. Martin sold 18,000 shares of the firm's stock in a transaction dated Thursday, January 2nd. The shares were sold at an average price of $27.91, for a total transaction of $502,380.00. Following the transaction, the president now owns 861,652 shares of the company's stock, valued at approximately $24,048,707.32. This trade represents a 2.05 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, VP John W. Schlosser sold 75,461 shares of the company's stock in a transaction on Tuesday, February 18th. The shares were sold at an average price of $26.65, for a total value of $2,011,035.65. Following the completion of the sale, the vice president now owns 220,681 shares of the company's stock, valued at approximately $5,881,148.65. This trade represents a 25.48 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 129,461 shares of company stock worth $3,504,136 in the last ninety days. 12.64% of the stock is owned by insiders.

About Kinder Morgan

(

Free Report)

Kinder Morgan, Inc operates as an energy infrastructure company primarily in North America. The company operates through Natural Gas Pipelines, Products Pipelines, Terminals, and CO2 segments. The Natural Gas Pipelines segment owns and operates interstate and intrastate natural gas pipeline, and storage systems; natural gas gathering systems and natural gas processing and treating facilities; natural gas liquids fractionation facilities and transportation systems; and liquefied natural gas gasification, liquefaction, and storage facilities.

Featured Articles

Before you consider Kinder Morgan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kinder Morgan wasn't on the list.

While Kinder Morgan currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report