Callan Family Office LLC bought a new stake in shares of Honeywell International Inc. (NASDAQ:HON - Free Report) during the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund bought 11,187 shares of the conglomerate's stock, valued at approximately $2,527,000.

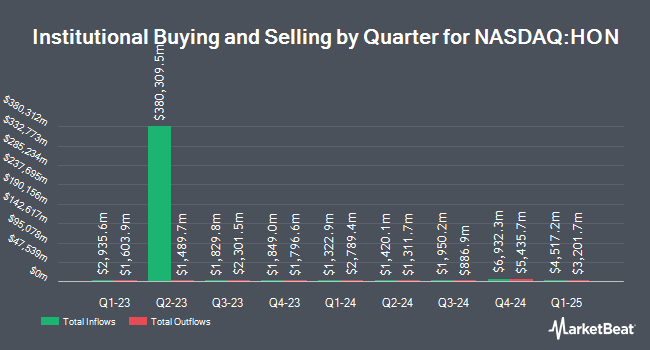

A number of other hedge funds have also recently modified their holdings of HON. State Street Corp raised its position in shares of Honeywell International by 0.3% in the 3rd quarter. State Street Corp now owns 31,026,897 shares of the conglomerate's stock worth $6,413,570,000 after purchasing an additional 92,112 shares during the last quarter. Wellington Management Group LLP raised its position in Honeywell International by 8.4% in the 3rd quarter. Wellington Management Group LLP now owns 17,826,700 shares of the conglomerate's stock worth $3,684,957,000 after buying an additional 1,376,479 shares during the last quarter. Geode Capital Management LLC raised its position in Honeywell International by 4.0% in the 3rd quarter. Geode Capital Management LLC now owns 14,360,730 shares of the conglomerate's stock worth $2,959,535,000 after buying an additional 547,998 shares during the last quarter. Bank of New York Mellon Corp raised its position in Honeywell International by 10.3% in the 4th quarter. Bank of New York Mellon Corp now owns 6,763,764 shares of the conglomerate's stock worth $1,527,867,000 after buying an additional 631,761 shares during the last quarter. Finally, Janus Henderson Group PLC raised its position in Honeywell International by 7.2% in the 3rd quarter. Janus Henderson Group PLC now owns 3,978,872 shares of the conglomerate's stock worth $822,458,000 after buying an additional 265,789 shares during the last quarter. Institutional investors own 75.91% of the company's stock.

Insider Activity

In other news, VP Anne T. Madden sold 28,885 shares of the stock in a transaction that occurred on Monday, February 10th. The stock was sold at an average price of $207.89, for a total transaction of $6,004,902.65. Following the completion of the transaction, the vice president now directly owns 41,580 shares in the company, valued at approximately $8,644,066.20. This represents a 40.99 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Corporate insiders own 0.41% of the company's stock.

Analyst Ratings Changes

A number of equities analysts have weighed in on the company. Royal Bank of Canada decreased their target price on Honeywell International from $253.00 to $236.00 and set a "sector perform" rating for the company in a research report on Friday, February 7th. Morgan Stanley boosted their target price on Honeywell International from $210.00 to $217.00 and gave the stock an "equal weight" rating in a research report on Tuesday, February 11th. Bank of America upped their price target on shares of Honeywell International from $220.00 to $240.00 and gave the company a "neutral" rating in a research report on Thursday, November 14th. Hsbc Global Res raised shares of Honeywell International to a "strong-buy" rating in a research report on Wednesday, December 11th. Finally, Deutsche Bank Aktiengesellschaft raised shares of Honeywell International from a "hold" rating to a "buy" rating and upped their price target for the company from $236.00 to $260.00 in a research report on Friday, February 7th. Ten research analysts have rated the stock with a hold rating, six have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $249.38.

Get Our Latest Research Report on Honeywell International

Honeywell International Price Performance

HON stock traded up $3.26 during midday trading on Friday, hitting $214.52. The company's stock had a trading volume of 5,682,281 shares, compared to its average volume of 4,335,279. Honeywell International Inc. has a 12 month low of $189.75 and a 12 month high of $242.77. The company has a quick ratio of 1.01, a current ratio of 1.31 and a debt-to-equity ratio of 1.33. The firm has a market capitalization of $139.42 billion, a price-to-earnings ratio of 24.63, a price-to-earnings-growth ratio of 2.51 and a beta of 1.08. The company has a 50 day moving average of $216.76 and a two-hundred day moving average of $216.28.

Honeywell International (NASDAQ:HON - Get Free Report) last posted its quarterly earnings results on Thursday, February 6th. The conglomerate reported $2.47 earnings per share for the quarter, topping the consensus estimate of $2.37 by $0.10. Honeywell International had a return on equity of 35.78% and a net margin of 14.82%. On average, analysts expect that Honeywell International Inc. will post 10.34 EPS for the current year.

Honeywell International Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, March 14th. Stockholders of record on Friday, February 28th will be given a dividend of $1.13 per share. The ex-dividend date is Friday, February 28th. This represents a $4.52 dividend on an annualized basis and a dividend yield of 2.11%. Honeywell International's dividend payout ratio is currently 51.89%.

Honeywell International Company Profile

(

Free Report)

Honeywell International Inc engages in the aerospace technologies, building automation, energy and sustainable solutions, and industrial automation businesses in the United States, Europe, and internationally. The company's Aerospace segment offers auxiliary power units, propulsion engines, integrated avionics, environmental control and electric power systems, engine controls, flight safety, communications, navigation hardware, data and software applications, radar and surveillance systems, aircraft lighting, advanced systems and instruments, satellite and space components, and aircraft wheels and brakes; spare parts; repair, overhaul, and maintenance services; and thermal systems, as well as wireless connectivity services.

See Also

Before you consider Honeywell International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Honeywell International wasn't on the list.

While Honeywell International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report