Callan Family Office LLC lifted its stake in shares of Ross Stores, Inc. (NASDAQ:ROST - Free Report) by 586.4% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 14,724 shares of the apparel retailer's stock after buying an additional 12,579 shares during the quarter. Callan Family Office LLC's holdings in Ross Stores were worth $2,227,000 as of its most recent filing with the SEC.

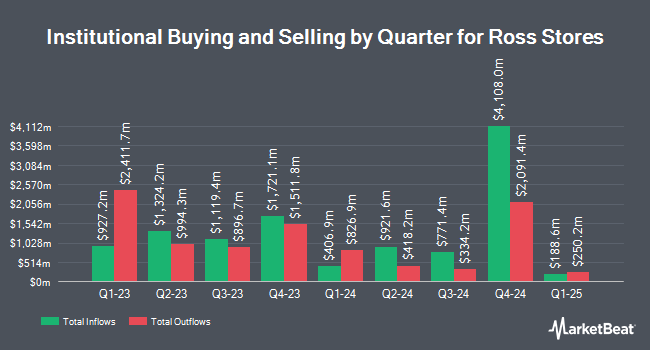

Several other hedge funds have also modified their holdings of ROST. Peapack Gladstone Financial Corp increased its holdings in Ross Stores by 1.8% during the 3rd quarter. Peapack Gladstone Financial Corp now owns 3,910 shares of the apparel retailer's stock worth $588,000 after purchasing an additional 70 shares during the last quarter. Howe & Rusling Inc. increased its holdings in Ross Stores by 1.9% during the 3rd quarter. Howe & Rusling Inc. now owns 3,986 shares of the apparel retailer's stock worth $600,000 after purchasing an additional 73 shares during the last quarter. Brown Brothers Harriman & Co. increased its holdings in Ross Stores by 19.1% during the 3rd quarter. Brown Brothers Harriman & Co. now owns 473 shares of the apparel retailer's stock worth $71,000 after purchasing an additional 76 shares during the last quarter. Alhambra Investment Management LLC increased its holdings in Ross Stores by 5.2% during the 4th quarter. Alhambra Investment Management LLC now owns 1,549 shares of the apparel retailer's stock worth $234,000 after purchasing an additional 76 shares during the last quarter. Finally, Key Financial Inc increased its holdings in Ross Stores by 13.2% during the 4th quarter. Key Financial Inc now owns 662 shares of the apparel retailer's stock worth $100,000 after purchasing an additional 77 shares during the last quarter. 86.86% of the stock is currently owned by hedge funds and other institutional investors.

Ross Stores Stock Performance

ROST stock traded down $1.93 during trading on Friday, reaching $135.96. 4,252,671 shares of the company's stock were exchanged, compared to its average volume of 2,583,287. The company has a quick ratio of 0.98, a current ratio of 1.57 and a debt-to-equity ratio of 0.29. Ross Stores, Inc. has a 1-year low of $127.53 and a 1-year high of $163.60. The company's fifty day moving average price is $145.37 and its 200-day moving average price is $147.49. The firm has a market cap of $44.86 billion, a PE ratio of 21.41, a P/E/G ratio of 2.13 and a beta of 1.15.

Ross Stores (NASDAQ:ROST - Get Free Report) last announced its quarterly earnings results on Tuesday, March 4th. The apparel retailer reported $1.79 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.65 by $0.14. Ross Stores had a return on equity of 41.83% and a net margin of 9.95%. The company had revenue of $5.91 billion during the quarter, compared to analyst estimates of $5.95 billion. On average, research analysts expect that Ross Stores, Inc. will post 6.17 EPS for the current fiscal year.

Ross Stores Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, March 31st. Stockholders of record on Tuesday, March 18th will be issued a $0.405 dividend. This is a positive change from Ross Stores's previous quarterly dividend of $0.37. The ex-dividend date is Tuesday, March 18th. This represents a $1.62 annualized dividend and a dividend yield of 1.19%. Ross Stores's dividend payout ratio is 25.63%.

Wall Street Analyst Weigh In

A number of equities research analysts have recently weighed in on the company. UBS Group lowered their price target on Ross Stores from $168.00 to $163.00 and set a "neutral" rating for the company in a report on Wednesday. BMO Capital Markets lowered their price target on Ross Stores from $168.00 to $156.00 and set an "outperform" rating for the company in a report on Wednesday. Loop Capital lowered their price target on Ross Stores from $190.00 to $175.00 and set a "buy" rating for the company in a report on Wednesday. JPMorgan Chase & Co. boosted their price target on Ross Stores from $171.00 to $173.00 and gave the company an "overweight" rating in a report on Friday, November 22nd. Finally, TD Cowen lowered their price target on Ross Stores from $185.00 to $177.00 and set a "buy" rating for the company in a report on Tuesday, November 19th. Seven analysts have rated the stock with a hold rating, nine have issued a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, Ross Stores presently has an average rating of "Moderate Buy" and an average price target of $163.07.

Get Our Latest Stock Report on Ross Stores

Ross Stores Profile

(

Free Report)

Ross Stores, Inc, together with its subsidiaries, operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd's DISCOUNTS brand names in the United States. Its stores primarily offer apparel, accessories, footwear, and home fashions. The company's Ross Dress for Less stores sell its products at department and specialty stores to middle income households; and dd's DISCOUNTS stores sell its products at department and discount stores for households with moderate income.

See Also

Before you consider Ross Stores, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ross Stores wasn't on the list.

While Ross Stores currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.