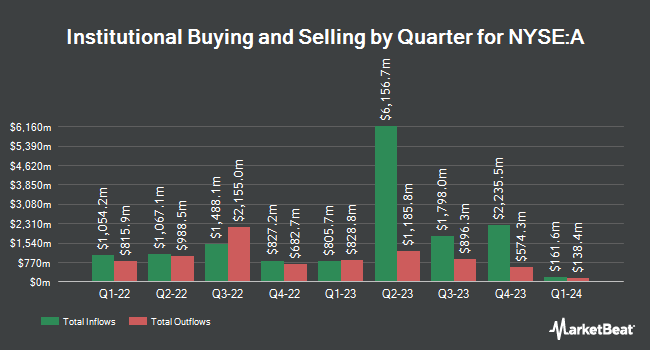

Callan Family Office LLC purchased a new stake in Agilent Technologies, Inc. (NYSE:A - Free Report) in the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund purchased 8,015 shares of the medical research company's stock, valued at approximately $1,077,000.

Other institutional investors have also recently made changes to their positions in the company. Farther Finance Advisors LLC grew its position in Agilent Technologies by 11.9% in the 3rd quarter. Farther Finance Advisors LLC now owns 1,944 shares of the medical research company's stock valued at $288,000 after purchasing an additional 207 shares during the period. Impax Asset Management Group plc increased its holdings in Agilent Technologies by 8.2% during the 3rd quarter. Impax Asset Management Group plc now owns 2,667,616 shares of the medical research company's stock worth $396,088,000 after purchasing an additional 203,234 shares in the last quarter. Graypoint LLC purchased a new stake in shares of Agilent Technologies in the third quarter worth approximately $229,000. Consolidated Planning Corp lifted its holdings in shares of Agilent Technologies by 25.3% in the third quarter. Consolidated Planning Corp now owns 2,592 shares of the medical research company's stock valued at $385,000 after purchasing an additional 523 shares in the last quarter. Finally, CWA Asset Management Group LLC purchased a new position in shares of Agilent Technologies during the third quarter valued at approximately $216,000.

Wall Street Analyst Weigh In

A has been the subject of a number of analyst reports. Barclays raised Agilent Technologies from an "underweight" rating to an "equal weight" rating and increased their price target for the company from $135.00 to $145.00 in a research report on Monday, February 10th. Wells Fargo & Company lowered their target price on shares of Agilent Technologies from $157.00 to $155.00 and set an "overweight" rating for the company in a report on Monday, December 9th. Robert W. Baird cut their price target on shares of Agilent Technologies from $161.00 to $159.00 and set an "outperform" rating on the stock in a report on Thursday, February 27th. Citigroup upped their price objective on shares of Agilent Technologies to $165.00 and gave the stock a "buy" rating in a research report on Thursday, December 19th. Finally, StockNews.com raised shares of Agilent Technologies from a "hold" rating to a "buy" rating in a research report on Tuesday, December 24th. Seven analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. Based on data from MarketBeat, Agilent Technologies presently has an average rating of "Moderate Buy" and a consensus price target of $146.15.

Check Out Our Latest Stock Report on Agilent Technologies

Agilent Technologies Price Performance

Agilent Technologies stock opened at $126.59 on Friday. The business's 50 day simple moving average is $139.67 and its 200 day simple moving average is $138.69. Agilent Technologies, Inc. has a 12 month low of $121.45 and a 12 month high of $155.35. The company has a market cap of $36.09 billion, a price-to-earnings ratio of 29.10, a PEG ratio of 3.56 and a beta of 1.11. The company has a current ratio of 2.20, a quick ratio of 1.66 and a debt-to-equity ratio of 0.56.

Agilent Technologies (NYSE:A - Get Free Report) last issued its earnings results on Wednesday, February 26th. The medical research company reported $1.31 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.27 by $0.04. The firm had revenue of $1.68 billion for the quarter, compared to analyst estimates of $1.67 billion. Agilent Technologies had a return on equity of 25.56% and a net margin of 19.27%. Sell-side analysts forecast that Agilent Technologies, Inc. will post 5.57 EPS for the current year.

Agilent Technologies Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, April 23rd. Shareholders of record on Tuesday, April 1st will be given a dividend of $0.248 per share. The ex-dividend date is Tuesday, April 1st. This represents a $0.99 dividend on an annualized basis and a yield of 0.78%. Agilent Technologies's dividend payout ratio is presently 22.76%.

Insider Transactions at Agilent Technologies

In other news, CEO Padraig Mcdonnell sold 1,911 shares of the firm's stock in a transaction on Tuesday, January 21st. The stock was sold at an average price of $150.00, for a total value of $286,650.00. Following the completion of the transaction, the chief executive officer now directly owns 39,652 shares of the company's stock, valued at $5,947,800. This trade represents a 4.60 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website.

Agilent Technologies Profile

(

Free Report)

Agilent Technologies, Inc provides application focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide. The company operates in three segments: Life Sciences and Applied Markets, Diagnostics and Genomics, and Agilent CrossLab. The Life Sciences and Applied Markets segment offers liquid chromatography systems and components; liquid chromatography mass spectrometry systems; gas chromatography systems and components; gas chromatography mass spectrometry systems; inductively coupled plasma mass spectrometry instruments; atomic absorption instruments; microwave plasma-atomic emission spectrometry instruments; inductively coupled plasma optical emission spectrometry instruments; raman spectroscopy; cell analysis plate based assays; flow cytometer; real-time cell analyzer; cell imaging systems; microplate reader; laboratory software; information management and analytics; laboratory automation and robotic systems; dissolution testing; and vacuum pumps, and measurement technologies.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Agilent Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agilent Technologies wasn't on the list.

While Agilent Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.