Callan Family Office LLC acquired a new position in ING Groep (NYSE:ING - Free Report) in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund acquired 62,564 shares of the financial services provider's stock, valued at approximately $980,000.

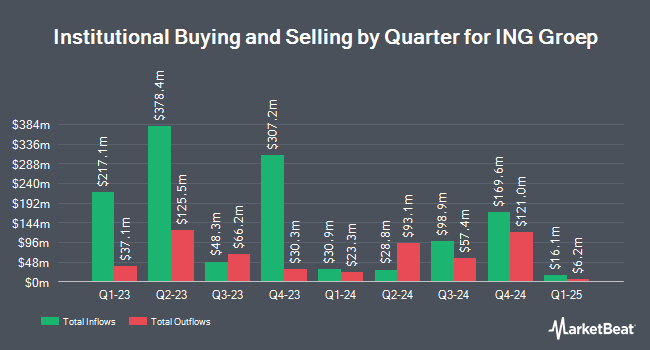

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Verdence Capital Advisors LLC lifted its holdings in shares of ING Groep by 2.2% during the third quarter. Verdence Capital Advisors LLC now owns 51,547 shares of the financial services provider's stock valued at $936,000 after purchasing an additional 1,105 shares in the last quarter. Crossmark Global Holdings Inc. boosted its holdings in shares of ING Groep by 30.8% during the 3rd quarter. Crossmark Global Holdings Inc. now owns 266,994 shares of the financial services provider's stock valued at $4,849,000 after acquiring an additional 62,801 shares during the last quarter. Zions Bancorporation N.A. grew its stake in shares of ING Groep by 42.2% in the third quarter. Zions Bancorporation N.A. now owns 52,427 shares of the financial services provider's stock worth $952,000 after acquiring an additional 15,547 shares during the period. OneDigital Investment Advisors LLC raised its holdings in shares of ING Groep by 6.2% during the third quarter. OneDigital Investment Advisors LLC now owns 22,672 shares of the financial services provider's stock valued at $412,000 after purchasing an additional 1,314 shares during the last quarter. Finally, Natixis Advisors LLC lifted its position in ING Groep by 71.3% during the third quarter. Natixis Advisors LLC now owns 3,306,798 shares of the financial services provider's stock valued at $60,051,000 after purchasing an additional 1,376,713 shares during the period. 4.49% of the stock is owned by institutional investors.

Analyst Ratings Changes

Separately, Morgan Stanley downgraded shares of ING Groep from an "overweight" rating to an "equal weight" rating in a research report on Tuesday, November 26th.

Get Our Latest Stock Report on ING Groep

ING Groep Stock Performance

ING stock traded down $0.13 during trading on Tuesday, reaching $19.84. The stock had a trading volume of 1,802,464 shares, compared to its average volume of 3,096,318. The stock's 50 day moving average is $16.92 and its two-hundred day moving average is $16.84. The firm has a market cap of $69.39 billion, a PE ratio of 9.26, a PEG ratio of 6.42 and a beta of 1.44. ING Groep has a 52 week low of $15.09 and a 52 week high of $20.79. The company has a current ratio of 1.13, a quick ratio of 1.13 and a debt-to-equity ratio of 2.89.

ING Groep (NYSE:ING - Get Free Report) last posted its quarterly earnings data on Thursday, February 6th. The financial services provider reported $0.39 earnings per share for the quarter, missing analysts' consensus estimates of $0.41 by ($0.02). ING Groep had a net margin of 28.30% and a return on equity of 11.81%. As a group, equities analysts anticipate that ING Groep will post 2.14 earnings per share for the current year.

ING Groep Cuts Dividend

The firm also recently declared a semi-annual dividend, which was paid on Thursday, January 23rd. Investors of record on Monday, January 13th were paid a dividend of $0.1667 per share. This represents a yield of 6.4%. The ex-dividend date was Monday, January 13th. ING Groep's payout ratio is 29.91%.

About ING Groep

(

Free Report)

ING Groep N.V. provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally. It operates through five segments: Retail Netherlands, Retail Belgium, Retail Germany, Retail Other, and Wholesale Banking. The company accepts current and savings accounts.

Read More

Before you consider ING Groep, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ING Groep wasn't on the list.

While ING Groep currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.