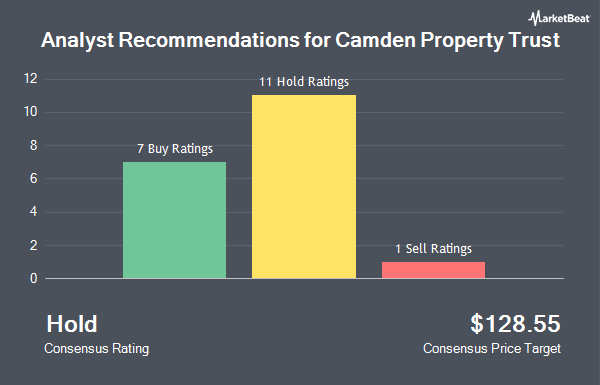

Shares of Camden Property Trust (NYSE:CPT - Get Free Report) have earned a consensus rating of "Hold" from the nineteen research firms that are currently covering the firm, MarketBeat Ratings reports. Fifteen investment analysts have rated the stock with a hold rating and four have issued a buy rating on the company. The average 1-year price target among brokerages that have updated their coverage on the stock in the last year is $122.50.

Several research analysts have recently weighed in on CPT shares. Wedbush boosted their price target on shares of Camden Property Trust from $118.00 to $131.00 and gave the company an "outperform" rating in a research report on Monday, August 5th. Truist Financial lifted their price target on shares of Camden Property Trust from $122.00 to $133.00 and gave the company a "buy" rating in a research report on Monday, August 26th. JPMorgan Chase & Co. increased their price objective on Camden Property Trust from $112.00 to $129.00 and gave the stock a "neutral" rating in a research report on Monday, September 16th. Deutsche Bank Aktiengesellschaft increased their price target on Camden Property Trust from $90.00 to $115.00 and gave the stock a "hold" rating in a report on Tuesday, September 10th. Finally, Scotiabank dropped their target price on shares of Camden Property Trust from $132.00 to $130.00 and set a "sector perform" rating for the company in a report on Thursday, November 14th.

View Our Latest Stock Analysis on Camden Property Trust

Institutional Investors Weigh In On Camden Property Trust

Several institutional investors have recently modified their holdings of CPT. Kings Path Partners LLC purchased a new position in Camden Property Trust during the second quarter worth about $33,000. Federated Hermes Inc. purchased a new position in shares of Camden Property Trust during the 2nd quarter worth about $33,000. Neo Ivy Capital Management acquired a new stake in shares of Camden Property Trust in the third quarter worth approximately $38,000. Family Firm Inc. purchased a new stake in Camden Property Trust in the second quarter valued at approximately $39,000. Finally, Versant Capital Management Inc grew its holdings in Camden Property Trust by 2,187.5% in the second quarter. Versant Capital Management Inc now owns 366 shares of the real estate investment trust's stock valued at $40,000 after purchasing an additional 350 shares during the period. Hedge funds and other institutional investors own 97.22% of the company's stock.

Camden Property Trust Price Performance

CPT traded up $1.39 during trading on Tuesday, reaching $121.28. The company's stock had a trading volume of 746,633 shares, compared to its average volume of 987,770. Camden Property Trust has a 1 year low of $86.50 and a 1 year high of $127.69. The company has a quick ratio of 0.15, a current ratio of 0.15 and a debt-to-equity ratio of 0.72. The company has a market cap of $12.94 billion, a price-to-earnings ratio of 38.38, a PEG ratio of 4.36 and a beta of 0.91. The firm has a fifty day simple moving average of $121.04 and a two-hundred day simple moving average of $115.25.

Camden Property Trust Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Thursday, October 17th. Stockholders of record on Monday, September 30th were issued a $1.03 dividend. The ex-dividend date was Monday, September 30th. This represents a $4.12 annualized dividend and a dividend yield of 3.40%. Camden Property Trust's dividend payout ratio is currently 130.38%.

About Camden Property Trust

(

Get Free ReportCamden Property Trust, an S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities. Camden owns and operates 172 properties containing 58,250 apartment homes across the United States.

Featured Articles

Before you consider Camden Property Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Camden Property Trust wasn't on the list.

While Camden Property Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.