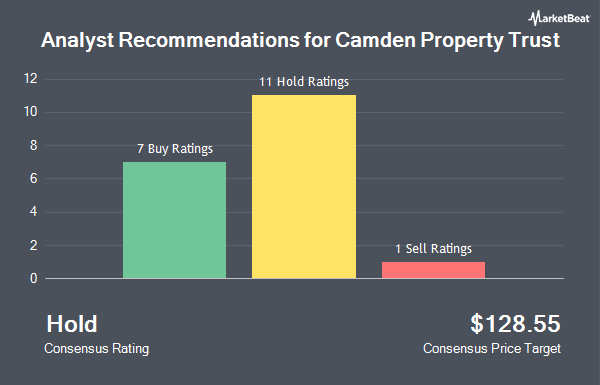

Camden Property Trust (NYSE:CPT - Get Free Report) has earned a consensus recommendation of "Hold" from the nineteen ratings firms that are presently covering the stock, Marketbeat Ratings reports. Fifteen equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. The average 1-year price target among brokerages that have issued ratings on the stock in the last year is $122.50.

A number of research analysts recently weighed in on CPT shares. Deutsche Bank Aktiengesellschaft lifted their price objective on shares of Camden Property Trust from $90.00 to $115.00 and gave the company a "hold" rating in a report on Tuesday, September 10th. The Goldman Sachs Group initiated coverage on Camden Property Trust in a report on Wednesday, September 4th. They set a "neutral" rating and a $139.00 price target on the stock. Piper Sandler boosted their price objective on Camden Property Trust from $110.00 to $128.00 and gave the stock a "neutral" rating in a research report on Monday, August 26th. Evercore ISI raised their target price on shares of Camden Property Trust from $116.00 to $118.00 and gave the company an "in-line" rating in a report on Monday, September 16th. Finally, JPMorgan Chase & Co. boosted their price target on shares of Camden Property Trust from $112.00 to $129.00 and gave the stock a "neutral" rating in a report on Monday, September 16th.

View Our Latest Analysis on CPT

Camden Property Trust Trading Down 0.6 %

CPT traded down $0.78 during mid-day trading on Friday, hitting $120.17. 611,481 shares of the stock were exchanged, compared to its average volume of 963,176. The firm's fifty day moving average is $120.61 and its two-hundred day moving average is $117.38. Camden Property Trust has a 1-year low of $90.50 and a 1-year high of $127.69. The company has a market cap of $12.82 billion, a PE ratio of 38.03, a PEG ratio of 4.40 and a beta of 0.92. The company has a current ratio of 0.15, a quick ratio of 0.15 and a debt-to-equity ratio of 0.72.

Camden Property Trust Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, January 17th. Stockholders of record on Wednesday, December 18th will be issued a $1.03 dividend. The ex-dividend date is Wednesday, December 18th. This represents a $4.12 dividend on an annualized basis and a dividend yield of 3.43%. Camden Property Trust's payout ratio is 130.38%.

Institutional Investors Weigh In On Camden Property Trust

A number of institutional investors and hedge funds have recently made changes to their positions in the business. Kings Path Partners LLC acquired a new stake in shares of Camden Property Trust during the second quarter worth $33,000. Federated Hermes Inc. purchased a new position in Camden Property Trust during the 2nd quarter worth $33,000. Neo Ivy Capital Management acquired a new stake in shares of Camden Property Trust in the 3rd quarter worth $38,000. Family Firm Inc. purchased a new stake in shares of Camden Property Trust in the second quarter valued at about $39,000. Finally, American Capital Advisory LLC increased its stake in shares of Camden Property Trust by 42.7% during the third quarter. American Capital Advisory LLC now owns 428 shares of the real estate investment trust's stock worth $53,000 after acquiring an additional 128 shares during the period. 97.22% of the stock is owned by hedge funds and other institutional investors.

Camden Property Trust Company Profile

(

Get Free ReportCamden Property Trust, an S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities. Camden owns and operates 172 properties containing 58,250 apartment homes across the United States.

Featured Stories

Before you consider Camden Property Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Camden Property Trust wasn't on the list.

While Camden Property Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.