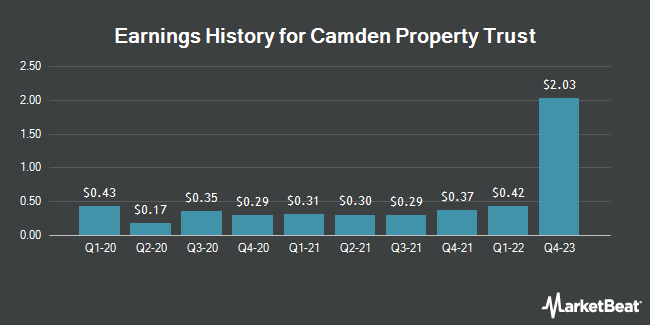

Camden Property Trust (NYSE:CPT - Get Free Report) posted its earnings results on Thursday. The real estate investment trust reported $1.73 EPS for the quarter, beating analysts' consensus estimates of $1.68 by $0.05, Zacks reports. Camden Property Trust had a net margin of 10.58% and a return on equity of 3.32%. Camden Property Trust updated its FY 2025 guidance to 6.600-6.900 EPS and its Q1 2025 guidance to 1.660-1.700 EPS.

Camden Property Trust Stock Performance

Shares of CPT stock traded up $0.30 during mid-day trading on Monday, hitting $119.46. The stock had a trading volume of 854,508 shares, compared to its average volume of 874,471. Camden Property Trust has a fifty-two week low of $90.50 and a fifty-two week high of $127.69. The firm has a market cap of $12.74 billion, a PE ratio of 79.64, a PEG ratio of 4.27 and a beta of 0.94. The company has a debt-to-equity ratio of 0.72, a current ratio of 0.15 and a quick ratio of 0.15. The company's 50-day simple moving average is $115.42 and its 200-day simple moving average is $119.03.

Camden Property Trust Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, April 17th. Stockholders of record on Monday, March 31st will be paid a $1.05 dividend. This represents a $4.20 annualized dividend and a dividend yield of 3.52%. The ex-dividend date of this dividend is Monday, March 31st. This is a boost from Camden Property Trust's previous quarterly dividend of $1.03. Camden Property Trust's dividend payout ratio (DPR) is 274.67%.

Insider Transactions at Camden Property Trust

In other news, Director Heather J. Brunner sold 1,853 shares of the stock in a transaction dated Monday, January 6th. The shares were sold at an average price of $114.50, for a total value of $212,168.50. Following the completion of the transaction, the director now owns 10,537 shares in the company, valued at $1,206,486.50. This trade represents a 14.96 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CFO Alexander J. Jessett sold 1,862 shares of the stock in a transaction dated Wednesday, January 8th. The shares were sold at an average price of $110.06, for a total transaction of $204,931.72. Following the completion of the transaction, the chief financial officer now owns 122,384 shares of the company's stock, valued at $13,469,583.04. This represents a 1.50 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 25,413 shares of company stock worth $2,895,718. Company insiders own 1.80% of the company's stock.

Analyst Upgrades and Downgrades

CPT has been the topic of a number of recent analyst reports. Stifel Nicolaus increased their target price on shares of Camden Property Trust from $121.00 to $122.00 and gave the company a "hold" rating in a research report on Friday. Royal Bank of Canada increased their target price on shares of Camden Property Trust from $121.00 to $123.00 and gave the company a "sector perform" rating in a research report on Monday. Mizuho dropped their target price on shares of Camden Property Trust from $129.00 to $125.00 and set an "outperform" rating on the stock in a research report on Monday, January 6th. StockNews.com downgraded shares of Camden Property Trust from a "hold" rating to a "sell" rating in a research report on Friday, November 1st. Finally, JPMorgan Chase & Co. downgraded shares of Camden Property Trust from a "neutral" rating to an "underweight" rating and dropped their target price for the company from $129.00 to $128.00 in a research report on Tuesday, December 17th. Two equities research analysts have rated the stock with a sell rating, twelve have assigned a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat, Camden Property Trust has a consensus rating of "Hold" and an average price target of $126.03.

Read Our Latest Stock Analysis on CPT

Camden Property Trust Company Profile

(

Get Free Report)

Camden Property Trust, an S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities. Camden owns and operates 172 properties containing 58,250 apartment homes across the United States.

Recommended Stories

Before you consider Camden Property Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Camden Property Trust wasn't on the list.

While Camden Property Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.