Stanley Laman Group Ltd. cut its holdings in Cameco Co. (NYSE:CCJ - Free Report) TSE: CCO by 14.2% in the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 234,744 shares of the basic materials company's stock after selling 38,995 shares during the period. Cameco makes up 1.7% of Stanley Laman Group Ltd.'s portfolio, making the stock its 4th largest position. Stanley Laman Group Ltd. owned 0.05% of Cameco worth $12,063,000 as of its most recent SEC filing.

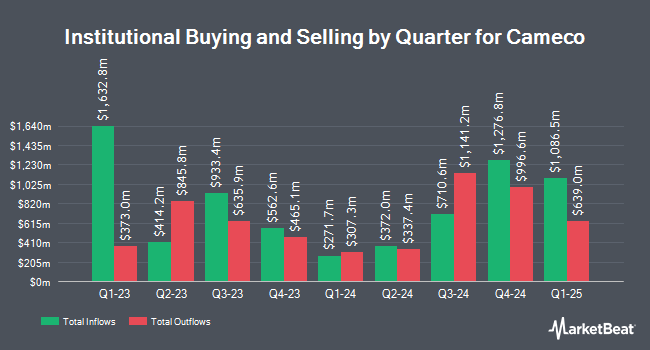

Other hedge funds have also added to or reduced their stakes in the company. CIBC Asset Management Inc raised its stake in shares of Cameco by 58.0% during the third quarter. CIBC Asset Management Inc now owns 3,777,866 shares of the basic materials company's stock valued at $181,382,000 after acquiring an additional 1,386,639 shares during the last quarter. Bridgewater Associates LP raised its stake in Cameco by 19.9% in the third quarter. Bridgewater Associates LP now owns 2,478,488 shares of the basic materials company's stock worth $118,386,000 after buying an additional 410,711 shares in the last quarter. Progeny 3 Inc. raised its stake in Cameco by 7.5% in the third quarter. Progeny 3 Inc. now owns 2,268,132 shares of the basic materials company's stock worth $108,326,000 after buying an additional 159,200 shares in the last quarter. The Manufacturers Life Insurance Company raised its stake in Cameco by 9.4% in the third quarter. The Manufacturers Life Insurance Company now owns 2,175,038 shares of the basic materials company's stock worth $103,968,000 after buying an additional 187,512 shares in the last quarter. Finally, Massachusetts Financial Services Co. MA raised its stake in Cameco by 44.7% in the third quarter. Massachusetts Financial Services Co. MA now owns 2,151,105 shares of the basic materials company's stock worth $102,737,000 after buying an additional 664,828 shares in the last quarter. 70.21% of the stock is owned by institutional investors.

Cameco Trading Down 3.8 %

CCJ stock traded down $1.86 during trading on Friday, reaching $47.22. The company had a trading volume of 5,178,500 shares, compared to its average volume of 4,709,515. Cameco Co. has a 52 week low of $35.43 and a 52 week high of $62.55. The company has a market cap of $20.56 billion, a P/E ratio of 248.56 and a beta of 0.94. The business has a 50 day moving average of $51.80 and a 200 day moving average of $49.52. The company has a debt-to-equity ratio of 0.20, a current ratio of 2.88 and a quick ratio of 1.26.

Cameco Profile

(

Free Report)

Cameco Corporation provides uranium for the generation of electricity. It operates through Uranium, Fuel Services, Westinghouse segments. The Uranium segment is involved in the exploration for, mining, and milling, purchase, and sale of uranium concentrate. The Fuel Services segment engages in the refining, conversion, and fabrication of uranium concentrate, as well as the purchase and sale of conversion services.

Further Reading

Before you consider Cameco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cameco wasn't on the list.

While Cameco currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.