Cameco (TSE:CCO - Get Free Report) NYSE: CCJ had its price objective boosted by investment analysts at BMO Capital Markets from C$78.00 to C$84.00 in a research note issued on Friday,BayStreet.CA reports. BMO Capital Markets' price target suggests a potential upside of 15.81% from the company's previous close.

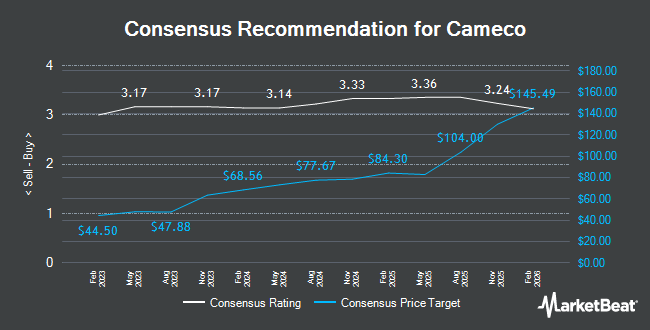

CCO has been the topic of several other research reports. Eight Capital boosted their price objective on shares of Cameco from C$80.00 to C$90.00 in a research note on Friday. National Bankshares boosted their price objective on shares of Cameco from C$85.00 to C$87.00 in a research note on Friday. Janney Montgomery Scott raised shares of Cameco to a "strong-buy" rating in a research note on Friday, October 4th. TD Securities upped their target price on shares of Cameco from C$79.00 to C$80.00 in a research note on Monday, July 22nd. Finally, Scotiabank dropped their target price on shares of Cameco from C$81.00 to C$80.00 in a research note on Monday, August 19th. Eight analysts have rated the stock with a buy rating and four have issued a strong buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Buy" and a consensus target price of C$81.40.

Check Out Our Latest Stock Report on CCO

Cameco Trading Down 2.3 %

Shares of CCO traded down C$1.70 during trading hours on Friday, reaching C$72.53. 461,171 shares of the company traded hands, compared to its average volume of 1,245,935. Cameco has a 12 month low of C$48.71 and a 12 month high of C$81.12. The company has a quick ratio of 3.74, a current ratio of 3.22 and a debt-to-equity ratio of 25.39. The company's fifty day moving average price is C$64.45 and its two-hundred day moving average price is C$65.80. The company has a market capitalization of C$31.56 billion, a price-to-earnings ratio of 122.93, a price-to-earnings-growth ratio of 2.22 and a beta of 0.90.

Insider Activity

In other news, Senior Officer Ronald Liam Mooney sold 3,400 shares of Cameco stock in a transaction that occurred on Friday, October 4th. The shares were sold at an average price of C$70.49, for a total transaction of C$239,666.00. In related news, Senior Officer Ronald Liam Mooney sold 3,400 shares of the business's stock in a transaction on Friday, October 4th. The shares were sold at an average price of C$70.49, for a total value of C$239,666.00. Also, Senior Officer Cory John-Paul Kos purchased 500 shares of the business's stock in a transaction that occurred on Monday, August 19th. The stock was bought at an average cost of C$56.23 per share, with a total value of C$28,115.00. Insiders own 0.15% of the company's stock.

About Cameco

(

Get Free Report)

Cameco Corporation provides uranium for the generation of electricity. It operates through Uranium, Fuel Services, Westinghouse segments. The Uranium segment is involved in the exploration for, mining, and milling, purchase, and sale of uranium concentrate. The Fuel Services segment engages in the refining, conversion, and fabrication of uranium concentrate, as well as the purchase and sale of conversion services.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cameco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cameco wasn't on the list.

While Cameco currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.