Canaccord Genuity Group began coverage on shares of Planet Fitness (NYSE:PLNT - Get Free Report) in a research report issued to clients and investors on Thursday,Briefing.com Automated Import reports. The brokerage set a "buy" rating and a $120.00 price target on the stock. Canaccord Genuity Group's price target would suggest a potential upside of 28.27% from the company's current price.

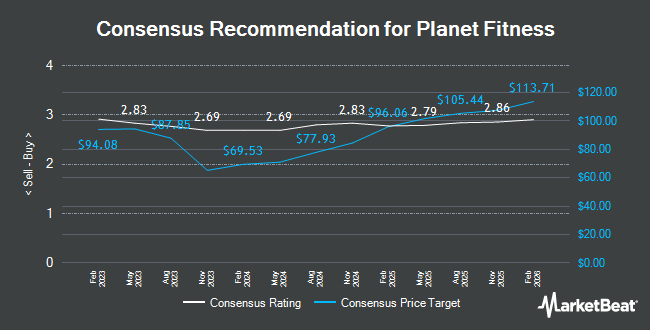

Several other equities research analysts also recently commented on the stock. Guggenheim reaffirmed a "buy" rating and set a $105.00 price objective on shares of Planet Fitness in a report on Thursday, February 27th. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $120.00 price objective on shares of Planet Fitness in a report on Monday, February 24th. Macquarie lowered their target price on shares of Planet Fitness from $99.00 to $95.00 and set a "neutral" rating on the stock in a report on Thursday, February 27th. DA Davidson reaffirmed a "neutral" rating and issued a $87.00 price target on shares of Planet Fitness in a report on Tuesday, January 21st. Finally, Roth Mkm reiterated a "buy" rating and issued a $115.00 price target (up from $110.00) on shares of Planet Fitness in a research report on Wednesday, February 26th. Five equities research analysts have rated the stock with a hold rating, thirteen have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $100.17.

Get Our Latest Stock Report on Planet Fitness

Planet Fitness Stock Performance

PLNT opened at $93.55 on Thursday. Planet Fitness has a fifty-two week low of $54.35 and a fifty-two week high of $110.00. The firm has a 50-day moving average of $101.29 and a 200 day moving average of $93.24. The firm has a market cap of $7.92 billion, a P/E ratio of 50.30, a PEG ratio of 2.45 and a beta of 1.54.

Planet Fitness (NYSE:PLNT - Get Free Report) last issued its quarterly earnings results on Tuesday, February 25th. The company reported $0.70 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.62 by $0.08. Planet Fitness had a net margin of 14.23% and a negative return on equity of 107.97%. The company had revenue of $340.50 million during the quarter, compared to analyst estimates of $324.57 million. During the same quarter last year, the business posted $0.60 EPS. Planet Fitness's quarterly revenue was up 19.4% compared to the same quarter last year. Equities research analysts predict that Planet Fitness will post 2.51 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Planet Fitness

Several hedge funds have recently added to or reduced their stakes in PLNT. Vanguard Group Inc. raised its holdings in shares of Planet Fitness by 0.5% during the 4th quarter. Vanguard Group Inc. now owns 8,035,765 shares of the company's stock valued at $794,496,000 after buying an additional 39,928 shares in the last quarter. T. Rowe Price Investment Management Inc. grew its position in Planet Fitness by 48.1% during the fourth quarter. T. Rowe Price Investment Management Inc. now owns 7,911,081 shares of the company's stock valued at $782,169,000 after acquiring an additional 2,570,826 shares during the last quarter. JPMorgan Chase & Co. raised its stake in shares of Planet Fitness by 1.0% during the fourth quarter. JPMorgan Chase & Co. now owns 3,609,196 shares of the company's stock worth $356,841,000 after acquiring an additional 36,803 shares in the last quarter. State Street Corp lifted its holdings in shares of Planet Fitness by 1.5% in the 3rd quarter. State Street Corp now owns 2,524,764 shares of the company's stock worth $205,061,000 after acquiring an additional 37,236 shares during the last quarter. Finally, Anomaly Capital Management LP boosted its stake in shares of Planet Fitness by 20.3% in the 4th quarter. Anomaly Capital Management LP now owns 1,772,593 shares of the company's stock valued at $175,256,000 after purchasing an additional 299,148 shares in the last quarter. Institutional investors own 95.53% of the company's stock.

Planet Fitness Company Profile

(

Get Free Report)

Planet Fitness, Inc, together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand. The company operates through three segments: Franchise, Corporate-Owned Stores, and Equipment. The company is involved in franchising business in the United States, Puerto Rico, Canada, Panama, Mexico, and Australia.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Planet Fitness, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Planet Fitness wasn't on the list.

While Planet Fitness currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.