Klaviyo (NYSE:KVYO - Get Free Report) had its target price hoisted by stock analysts at Canaccord Genuity Group from $32.00 to $40.00 in a research report issued to clients and investors on Thursday,Benzinga reports. The brokerage presently has a "buy" rating on the stock. Canaccord Genuity Group's target price points to a potential upside of 16.08% from the stock's previous close.

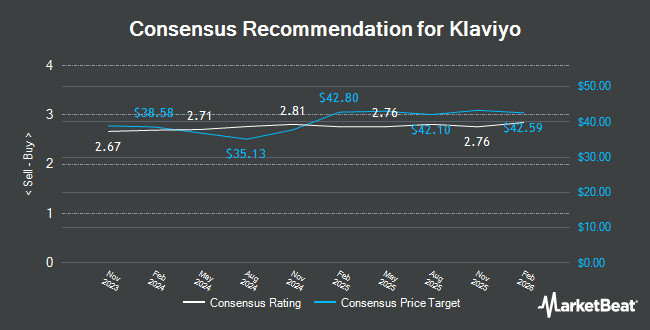

A number of other analysts have also commented on the company. Barclays boosted their price target on Klaviyo from $32.00 to $41.00 and gave the company an "overweight" rating in a report on Friday, October 11th. Piper Sandler lifted their price target on shares of Klaviyo from $34.00 to $45.00 and gave the company an "overweight" rating in a research note on Friday, October 18th. Needham & Company LLC reiterated a "buy" rating and set a $40.00 target price on shares of Klaviyo in a report on Wednesday, September 4th. Cantor Fitzgerald raised their price target on Klaviyo from $33.00 to $47.00 and gave the company an "overweight" rating in a research note on Thursday. Finally, Benchmark dropped their target price on shares of Klaviyo from $42.00 to $40.00 and set a "buy" rating on the stock in a report on Thursday. Three research analysts have rated the stock with a hold rating and fifteen have issued a buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $38.65.

View Our Latest Analysis on Klaviyo

Klaviyo Price Performance

Shares of NYSE KVYO traded down $5.90 during midday trading on Thursday, hitting $34.46. The stock had a trading volume of 4,680,996 shares, compared to its average volume of 1,148,000. Klaviyo has a fifty-two week low of $21.26 and a fifty-two week high of $41.00. The firm has a market cap of $9.19 billion, a P/E ratio of -24.44 and a beta of 1.13. The company's 50-day simple moving average is $35.12 and its 200 day simple moving average is $28.55.

Klaviyo (NYSE:KVYO - Get Free Report) last announced its quarterly earnings results on Wednesday, August 7th. The company reported $0.15 earnings per share for the quarter, beating analysts' consensus estimates of $0.10 by $0.05. Klaviyo had a negative net margin of 42.15% and a negative return on equity of 32.19%. The business had revenue of $222.21 million for the quarter, compared to the consensus estimate of $212.34 million. During the same period last year, the company posted $0.09 EPS. Klaviyo's revenue for the quarter was up 35.0% on a year-over-year basis. Equities analysts expect that Klaviyo will post -0.01 EPS for the current fiscal year.

Insider Activity

In other news, CFO Amanda Whalen sold 60,000 shares of the business's stock in a transaction that occurred on Friday, August 9th. The stock was sold at an average price of $30.23, for a total transaction of $1,813,800.00. Following the completion of the sale, the chief financial officer now owns 435,993 shares in the company, valued at $13,180,068.39. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. In other Klaviyo news, CFO Amanda Whalen sold 60,000 shares of the company's stock in a transaction dated Friday, August 9th. The shares were sold at an average price of $30.23, for a total value of $1,813,800.00. Following the completion of the sale, the chief financial officer now directly owns 435,993 shares of the company's stock, valued at approximately $13,180,068.39. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, major shareholder Summit Partners L. P sold 1,300 shares of the stock in a transaction dated Friday, August 30th. The shares were sold at an average price of $31.64, for a total transaction of $41,132.00. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 871,477 shares of company stock worth $27,610,861. Company insiders own 53.24% of the company's stock.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently bought and sold shares of KVYO. nVerses Capital LLC purchased a new stake in shares of Klaviyo during the 3rd quarter valued at $53,000. EntryPoint Capital LLC purchased a new stake in Klaviyo during the first quarter worth about $71,000. Dark Forest Capital Management LP raised its position in Klaviyo by 13.7% in the second quarter. Dark Forest Capital Management LP now owns 23,689 shares of the company's stock worth $590,000 after acquiring an additional 2,851 shares during the period. Victory Capital Management Inc. purchased a new position in Klaviyo in the third quarter valued at about $208,000. Finally, Arizona State Retirement System boosted its stake in Klaviyo by 67.1% in the second quarter. Arizona State Retirement System now owns 16,221 shares of the company's stock valued at $404,000 after acquiring an additional 6,512 shares during the last quarter. Hedge funds and other institutional investors own 45.43% of the company's stock.

Klaviyo Company Profile

(

Get Free Report)

Klaviyo, Inc, a technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa. The company offers Klaviyo, a cloud-native platform for data store, segmentation engine, campaigns and flows, and messaging infrastructure.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Klaviyo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Klaviyo wasn't on the list.

While Klaviyo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.