ServiceNow (NYSE:NOW - Get Free Report) had its price target boosted by analysts at Canaccord Genuity Group from $1,200.00 to $1,275.00 in a report released on Thursday,Benzinga reports. The firm presently has a "buy" rating on the information technology services provider's stock. Canaccord Genuity Group's price objective suggests a potential upside of 26.03% from the company's current price.

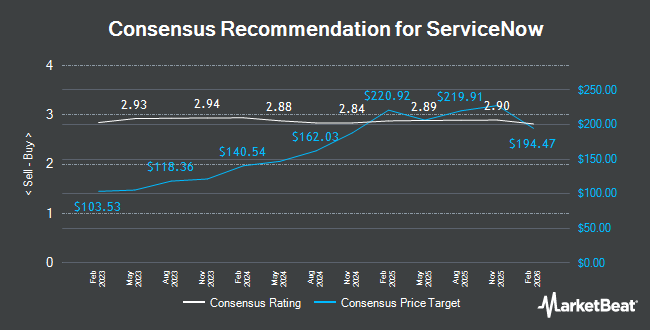

Several other equities research analysts also recently issued reports on the company. Needham & Company LLC increased their price objective on ServiceNow from $1,150.00 to $1,200.00 and gave the stock a "buy" rating in a research note on Thursday. Guggenheim restated a "sell" rating and set a $716.00 price target on shares of ServiceNow in a report on Wednesday, January 22nd. KeyCorp lowered shares of ServiceNow from an "overweight" rating to a "sector weight" rating in a research note on Friday, December 13th. Sanford C. Bernstein lifted their target price on shares of ServiceNow from $906.00 to $913.00 and gave the company an "outperform" rating in a research note on Thursday, October 24th. Finally, Evercore ISI upped their price target on shares of ServiceNow from $950.00 to $1,000.00 and gave the stock an "outperform" rating in a research note on Thursday, October 24th. One research analyst has rated the stock with a sell rating, three have given a hold rating, twenty-five have issued a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat, ServiceNow presently has an average rating of "Moderate Buy" and a consensus price target of $1,129.93.

View Our Latest Stock Report on ServiceNow

ServiceNow Trading Down 11.5 %

Shares of ServiceNow stock traded down $131.96 on Thursday, reaching $1,011.67. 6,155,740 shares of the company were exchanged, compared to its average volume of 1,613,548. ServiceNow has a fifty-two week low of $637.99 and a fifty-two week high of $1,198.09. The firm has a market capitalization of $208.40 billion, a price-to-earnings ratio of 157.34, a price-to-earnings-growth ratio of 5.11 and a beta of 0.99. The company has a current ratio of 1.13, a quick ratio of 1.13 and a debt-to-equity ratio of 0.16. The stock has a fifty day moving average price of $1,085.21 and a 200-day moving average price of $952.30.

ServiceNow (NYSE:NOW - Get Free Report) last announced its earnings results on Wednesday, January 29th. The information technology services provider reported $1.93 EPS for the quarter, missing the consensus estimate of $3.67 by ($1.74). ServiceNow had a return on equity of 16.03% and a net margin of 12.77%. On average, analysts expect that ServiceNow will post 7.06 EPS for the current year.

ServiceNow declared that its board has approved a stock repurchase plan on Wednesday, January 29th that permits the company to repurchase $3.00 billion in shares. This repurchase authorization permits the information technology services provider to buy up to 1.3% of its shares through open market purchases. Shares repurchase plans are often an indication that the company's leadership believes its stock is undervalued.

Insider Transactions at ServiceNow

In other news, insider Jacqueline P. Canney sold 66 shares of ServiceNow stock in a transaction dated Wednesday, November 13th. The shares were sold at an average price of $1,048.29, for a total transaction of $69,187.14. Following the sale, the insider now directly owns 3,027 shares in the company, valued at approximately $3,173,173.83. The trade was a 2.13 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, General Counsel Russell S. Elmer sold 81 shares of the stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $1,016.54, for a total transaction of $82,339.74. Following the completion of the transaction, the general counsel now directly owns 6,843 shares of the company's stock, valued at $6,956,183.22. This trade represents a 1.17 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 20,731 shares of company stock valued at $21,016,751. 0.25% of the stock is owned by corporate insiders.

Institutional Trading of ServiceNow

Several institutional investors have recently bought and sold shares of NOW. Polymer Capital Management HK LTD lifted its holdings in shares of ServiceNow by 57.0% during the third quarter. Polymer Capital Management HK LTD now owns 2,701 shares of the information technology services provider's stock valued at $2,416,000 after acquiring an additional 981 shares during the period. Union Bancaire Privee UBP SA bought a new position in ServiceNow during the 4th quarter valued at about $48,802,000. Avidian Wealth Enterprises LLC boosted its position in ServiceNow by 39.4% in the third quarter. Avidian Wealth Enterprises LLC now owns 488 shares of the information technology services provider's stock valued at $436,000 after buying an additional 138 shares in the last quarter. Venturi Wealth Management LLC grew its stake in ServiceNow by 36.4% during the third quarter. Venturi Wealth Management LLC now owns 2,868 shares of the information technology services provider's stock worth $2,565,000 after buying an additional 765 shares during the last quarter. Finally, Cardano Risk Management B.V. acquired a new stake in shares of ServiceNow during the fourth quarter worth approximately $105,090,000. Institutional investors and hedge funds own 87.18% of the company's stock.

ServiceNow Company Profile

(

Get Free Report)

ServiceNow, Inc provides end to-end intelligent workflow automation platform solutions for digital businesses in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally. The company operates the Now platform for end-to-end digital transformation, artificial intelligence, machine learning, robotic process automation, process mining, performance analytics, and collaboration and development tools.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ServiceNow, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ServiceNow wasn't on the list.

While ServiceNow currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report