Spectrum Brands (NYSE:SPB - Free Report) had its target price raised by Canaccord Genuity Group from $91.00 to $94.00 in a report issued on Monday morning,Benzinga reports. The brokerage currently has a hold rating on the stock.

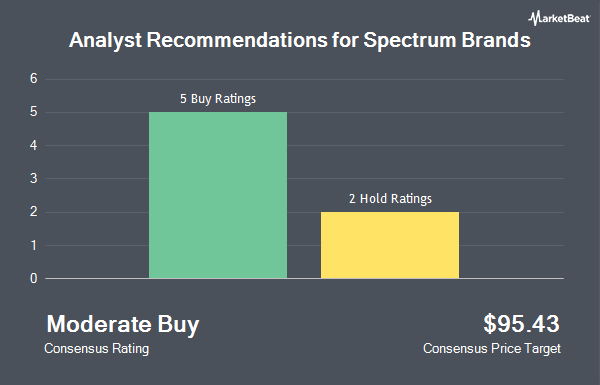

A number of other equities research analysts have also weighed in on the stock. UBS Group boosted their price objective on shares of Spectrum Brands from $111.00 to $120.00 and gave the stock a "buy" rating in a report on Friday, August 9th. Wells Fargo & Company upped their price target on shares of Spectrum Brands from $87.00 to $90.00 and gave the company an "equal weight" rating in a research report on Friday, August 9th. Finally, Deutsche Bank Aktiengesellschaft raised their price objective on Spectrum Brands from $91.00 to $94.00 and gave the company a "hold" rating in a research note on Friday, August 9th. Five analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Hold" and an average price target of $102.38.

View Our Latest Analysis on SPB

Spectrum Brands Price Performance

NYSE:SPB traded up $2.01 during midday trading on Monday, hitting $90.23. The company had a trading volume of 655,530 shares, compared to its average volume of 386,291. The company has a market capitalization of $2.53 billion, a PE ratio of 21.62, a P/E/G ratio of 0.25 and a beta of 1.23. The company has a quick ratio of 1.61, a current ratio of 2.28 and a debt-to-equity ratio of 0.26. Spectrum Brands has a 52-week low of $65.27 and a 52-week high of $96.74. The stock's fifty day moving average price is $91.49 and its 200-day moving average price is $89.53.

Spectrum Brands (NYSE:SPB - Get Free Report) last announced its quarterly earnings data on Friday, November 15th. The company reported $0.97 EPS for the quarter, missing the consensus estimate of $1.13 by ($0.16). The firm had revenue of $773.70 million for the quarter, compared to the consensus estimate of $747.80 million. Spectrum Brands had a net margin of 4.21% and a return on equity of 6.11%. Spectrum Brands's revenue for the quarter was up 4.5% compared to the same quarter last year. During the same quarter last year, the company posted $1.36 earnings per share. As a group, research analysts expect that Spectrum Brands will post 6.12 earnings per share for the current year.

Spectrum Brands Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, December 17th. Investors of record on Tuesday, November 26th will be issued a dividend of $0.47 per share. This represents a $1.88 dividend on an annualized basis and a dividend yield of 2.08%. The ex-dividend date is Tuesday, November 26th. This is an increase from Spectrum Brands's previous quarterly dividend of $0.42. Spectrum Brands's dividend payout ratio is currently 41.18%.

Institutional Inflows and Outflows

Hedge funds have recently added to or reduced their stakes in the stock. M&T Bank Corp purchased a new stake in shares of Spectrum Brands in the 3rd quarter worth about $221,000. Barclays PLC raised its stake in Spectrum Brands by 71.4% in the third quarter. Barclays PLC now owns 35,407 shares of the company's stock worth $3,369,000 after buying an additional 14,746 shares in the last quarter. National Bank of Canada FI lifted its holdings in Spectrum Brands by 10,046.3% in the third quarter. National Bank of Canada FI now owns 44,441 shares of the company's stock worth $4,228,000 after buying an additional 44,003 shares during the period. Wellington Management Group LLP boosted its position in Spectrum Brands by 7.6% during the 3rd quarter. Wellington Management Group LLP now owns 513,025 shares of the company's stock valued at $48,809,000 after acquiring an additional 36,063 shares in the last quarter. Finally, State Street Corp grew its holdings in shares of Spectrum Brands by 1.3% during the 3rd quarter. State Street Corp now owns 590,222 shares of the company's stock worth $56,154,000 after acquiring an additional 7,783 shares during the period.

Spectrum Brands Company Profile

(

Get Free Report)

Spectrum Brands Holdings, Inc operates as a branded consumer products and home essentials company in North America, Europe, the Middle East, Africa, and Asia-Pacific regions. It operates through three segments: Home and Personal Care; Global Pet Care; and Home and Garden. The Home and Personal Care segment provides home appliances under the Black & Decker, Russell Hobbs, George Foreman, PowerXL, Emeril Legasse, Copper Chef, Toastmaster, Juiceman, Farberware, and Breadman brands; and personal care products under the Remington brand.

Recommended Stories

Before you consider Spectrum Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spectrum Brands wasn't on the list.

While Spectrum Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.